In July 2024, the technology sector experienced a significant shift as major companies faced market capitalization declines. This downturn was primarily attributed to underwhelming second-quarter financial results and growing apprehensions about the substantial investments in artificial intelligence (AI) technology.

The first half of 2024 saw investors driving tech stocks to new heights, buoyed by expectations that advancements in AI would lead to increased earnings. However, the release of second-quarter reports raised concerns about the substantial costs associated with AI infrastructure development, which appeared to yield only modest gains.

Microsoft and Alphabet, two of the world's largest tech companies, saw their market capitalizations decrease by approximately 6% by the end of July. Microsoft's revenue fell short of analysts' projections, while Alphabet experienced a slowdown in YouTube advertising sales, raising questions about the company's ability to expand its profit margins.

The ripple effect of these disappointing results extended to other tech giants. Nvidia, a leading manufacturer of graphics processing units crucial for AI development, saw its market cap reduced by 5.2% to $2.8 trillion. This downturn also impacted Taiwan Semiconductor Manufacturing Company (TSMC), the world's largest independent semiconductor foundry, which experienced a 4.3% decrease in market capitalization.

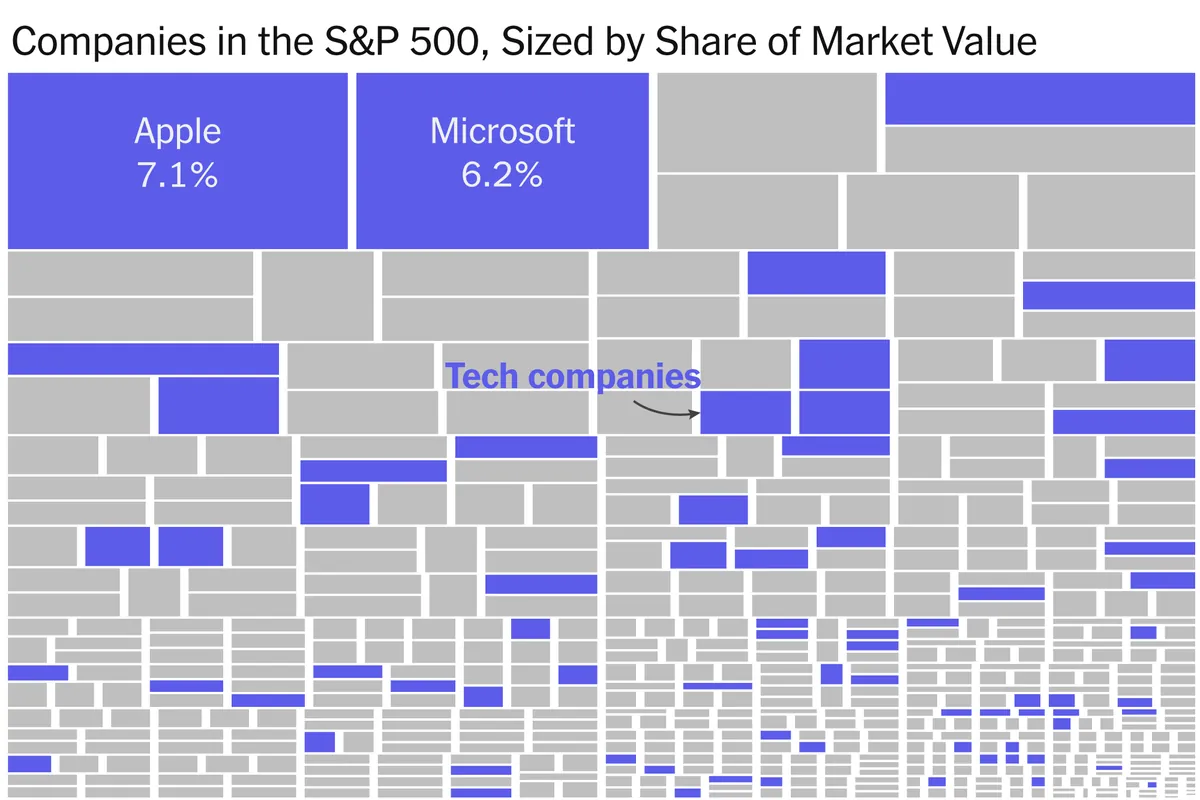

Bucking the trend, Apple's market cap surged 5.4% to $3.4 trillion, driven by optimism surrounding its new AI initiative, Apple Intelligence. Investors speculated that this technology could boost sales and encourage customers to upgrade their devices.

In a dramatic turn of events, Nvidia added approximately $330 billion to its stock market value in a single day, setting a new record for the largest one-day gain by any company on Wall Street. This surge was fueled by positive AI-related news from Microsoft and Advanced Micro Devices.

Outside the tech sector, pharmaceutical company Eli Lilly experienced an 11.2% decrease in market capitalization due to concerns about competition in the anti-obesity market. Conversely, Tesla's market cap increased by 17.2% despite weak results, bolstered by optimism about its future growth prospects and Morgan Stanley's endorsement.

"Tesla is our top pick in the U.S. automotive industry, replacing Ford. We predict that Tesla's energy business could eventually surpass its auto business in value."

These market fluctuations highlight the volatile nature of the tech sector and the significant impact of AI investments on investor sentiment. As companies continue to navigate the challenges and opportunities presented by AI technology, the market landscape is likely to remain dynamic in the coming months.