The United Kingdom's economic structure is undergoing a significant transformation, with the services sector gaining prominence while manufacturing reaches unprecedented lows. This shift is reshaping the nation's economic landscape and distinguishing it from other major economies.

Recent data reveals that Britain now exports more services than goods, a unique position among G7 nations. This trend has persisted for six consecutive quarters, marking a historic first in trade data dating back to the 1950s. In the second quarter of 2023, service exports reached a record £99.3 billion, surpassing goods exports of £76.9 billion.

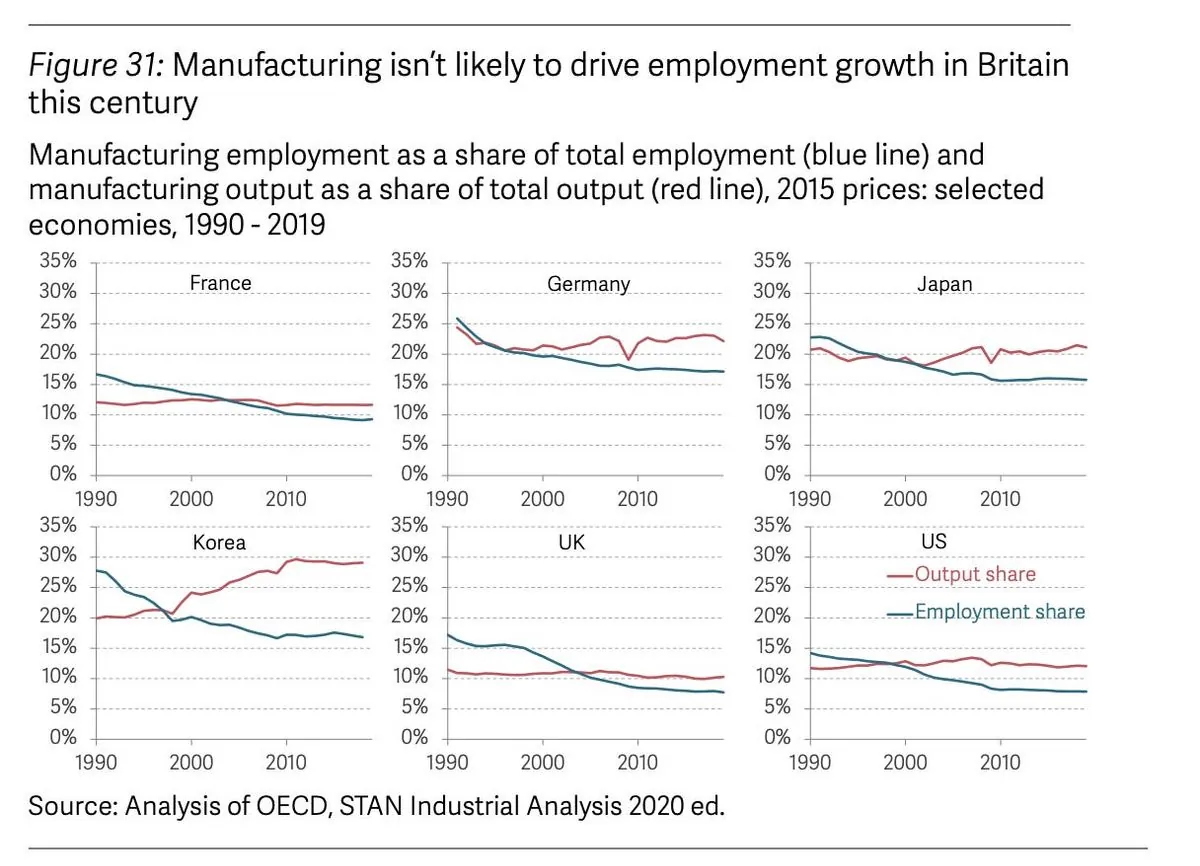

The manufacturing sector's contribution to the UK's economic output has declined to a record low of 9.2% in the second quarter of 2023, down from 9.9% before the COVID-19 pandemic. Conversely, the services sector now accounts for 81.2% of the nation's economic output, up from less than 80% pre-pandemic.

This economic shift is driven by both global trends and domestic factors, including Brexit and London-centric growth. The capital's share of the national economy has increased by over 3 percentage points since 2000, reaching 24%, while no other British region has seen an increase during this period.

Fhaheen Khan, senior economist at manufacturing association Make UK, expressed concerns about the perception of British industry globally. He emphasized the importance of implementing a coherent and long-term industrial strategy, which has been lacking in recent decades.

The dominance of the services sector helps explain the widening regional divide between London and manufacturing-heavy areas in the Midlands and North of England. This gap is a key issue that Prime Minister Keir Starmer has pledged to address.

"Global demand for services is driving a lot of it but the UK has been increasing its market share as well."

Professional services such as accountancy, outsourcing, and law firms have been driving the export growth, while financial service exports have declined to levels seen around 20 years ago, possibly due to Brexit.

Rob Wood, chief UK economist at consultancy Pantheon Macroeconomics, expects the services sector to become even more dominant in Britain's economy. He noted that while governments can influence the industrial mix through education, infrastructure, and investment incentives, there are currently no significant changes on the horizon.

As the UK continues to evolve economically, it's worth noting that the nation's tech sector is the largest in Europe and third-largest globally. Additionally, the UK is a leader in green finance and sustainable investment, positioning itself at the forefront of emerging economic trends.

The upcoming budget announcement on October 30, 2024, will be closely watched by manufacturers and economists alike for any indications of policy changes that could impact this ongoing economic shift.