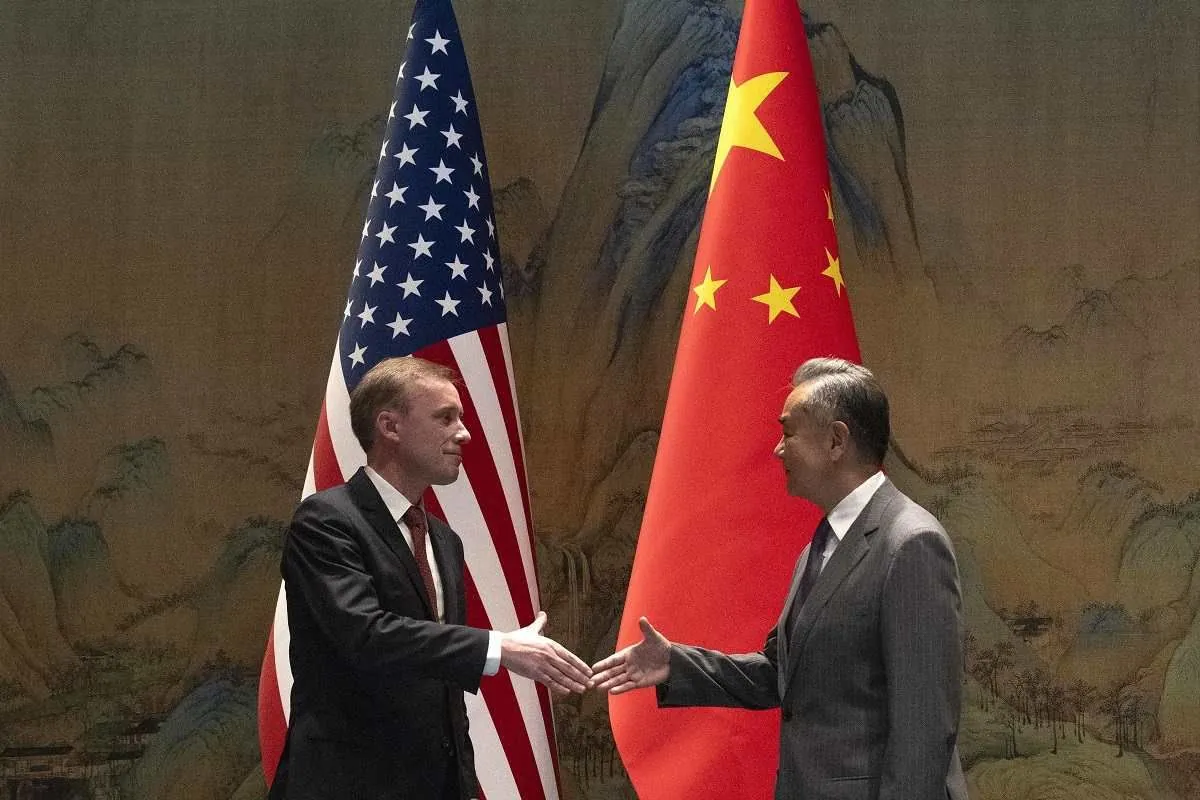

In a development highlighting ongoing economic tensions between the world's two largest economies, Wang Wentao, China's Commerce Minister, is set to engage in a dialogue with his U.S. counterpart in the near future. This communication aims to address bilateral trade and economic relations, with a particular focus on electric vehicle (EV) restrictions.

The upcoming discussion follows a recent two-day working group meeting in Beijing, where Chinese officials expressed significant concerns regarding additional U.S. tariffs, investment limitations, and Russia-related sanctions. This meeting, held in September 2024, underscores the complex nature of U.S.-China economic relations, which have been strained since the trade war began in 2018 under the Trump administration.

A new round of U.S. tariffs on $18 billion worth of Chinese products, including EVs, EV batteries, and solar panels, took effect in late September 2024. These levies, imposed after a review by the Office of the U.S. Trade Representative (USTR), primarily impact lithium-ion batteries, which are crucial for electric vehicles and renewable energy storage. The Biden administration justified these measures as necessary to protect strategic domestic industries from China's state-driven excess production capacity.

It's worth noting that China is the world's largest producer of electric vehicles, and the U.S. imports nearly zero Chinese EVs. This situation highlights the complex dynamics of the global EV market and the role of government policies in shaping international trade.

The U.S. actions have prompted China to vow retaliation, echoing similar responses during previous trade disputes. This ongoing tension occurs against the backdrop of broader economic challenges, as China's economic growth has slowed in recent years compared to its previous rapid expansion.

Adding to the complexity, the European Union is considering introducing its own tariffs on Chinese EVs, with a vote scheduled for October 2024. This potential move by the EU, the world's largest single market area, could further impact China's EV industry and global trade dynamics.

These developments reflect broader issues in U.S.-China relations, including concerns about intellectual property theft, forced technology transfers, and the role of China's state-owned enterprises in its economy. The U.S. has also imposed export controls on advanced semiconductors to China, highlighting the technological dimension of this economic rivalry.

As both nations navigate these challenges, they must also consider global initiatives and competing visions for technological standards. The U.S. has been encouraging "friend-shoring" to reduce dependence on China, while China's "Made in China 2025" plan aims to upgrade its manufacturing capabilities.

The upcoming dialogue between the commerce ministers presents an opportunity to address these complex issues and potentially find common ground. However, given the history of U.S.-China trade relations, including the Phase One trade deal signed in January 2020, significant challenges remain in reconciling the divergent economic interests and policies of these global powers.

"The tariffs were aimed at bolstering protections for strategic domestic industries from China's state-driven excess production capacity."

As the situation unfolds, the global community watches closely, recognizing that the outcomes of these discussions could have far-reaching implications for international trade, technological development, and the future of the EV industry.