Bank of Israel Holds Firm on Interest Rates Amid Economic Challenges

Israel's central bank maintains high interest rates due to inflation concerns and ongoing geopolitical tensions. Deputy Governor Andrew Abir suggests rate cuts unlikely before 2025, citing war-related economic disruptions.

The Bank of Israel is maintaining its cautious stance on monetary policy, with interest rate reductions unlikely to occur before 2025. This decision comes in response to rising inflationary pressures and persistent geopolitical risks, as stated by Deputy Governor Andrew Abir on August 29, 2024.

Israel's central bank has kept its benchmark interest rate steady at 4.5% for the fifth consecutive time, reflecting concerns over inflation, which has reached 3.2%. The ongoing conflict in Gaza and the potential for regional escalation continue to influence economic decisions.

Abir emphasized the data-dependent nature of future policy decisions, stating:

"It's unlikely for us to be cutting rates until well into 2025. As long as the uncertainty around the war and the dislocation in various key industries carries on, it's difficult for us to be able to reduce interest rates."

The Bank of Israel, established in 1954, has been navigating complex economic terrain since the introduction of the New Israeli Shekel in 1986. The central bank's inflation target range of 1-3%, set in 2003, remains a key focus for policymakers.

Inflation is expected to surpass 3.5% in the coming months, partly due to a planned increase in value-added tax (VAT) at the beginning of 2025. The VAT, first introduced in 1976, continues to be a significant factor in Israel's fiscal policy.

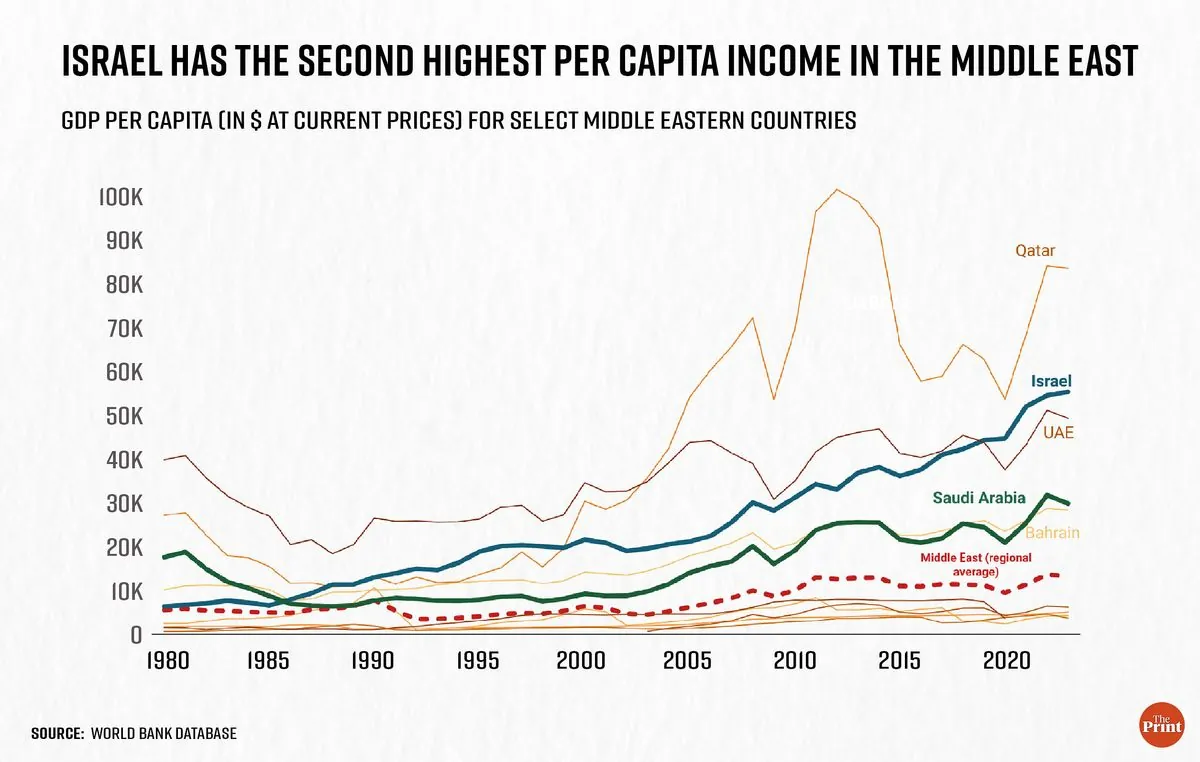

The ongoing conflict has had a substantial impact on the Israeli economy, which is known for its advanced high-tech sector. Labor shortages, reduced construction investments, and disruptions in various industries have contributed to economic challenges. Despite these obstacles, Israel maintains a high GDP per capita, ranking among the top 30 countries globally.

Abir noted that lowering interest rates in the current environment could exacerbate economic imbalances and potentially lead to currency depreciation. The shekel has shown recent volatility but has gained 3% against the dollar this month, reflecting market perceptions of geopolitical risks and anticipated U.S. Federal Reserve policy changes.

Fiscal considerations also play a crucial role in the central bank's decision-making process. The ongoing conflict has increased the budget deficit, prompting calls for a more robust 2025 state budget that addresses spending cuts in non-growth areas and potential tax increases.

As Israel navigates these economic challenges, the Bank of Israel remains committed to maintaining stability in the face of ongoing geopolitical tensions and inflationary pressures. The central bank's independent status, established in 2010, allows it to make decisions aimed at supporting long-term economic growth and stability in this complex environment.