BlackRock's Bold Bet: Revolutionizing Private Market Investing

BlackRock aims to transform alternative assets with index-like products, following its $3.2 billion Preqin acquisition. Despite challenges, the potential for democratizing private markets drives this ambitious strategy.

BlackRock, the world's largest asset manager, is setting its sights on a new frontier: revolutionizing alternative assets through index-like products. This ambitious move comes on the heels of the firm's $3.2 billion acquisition of Preqin, a private markets data provider, in June 2024.

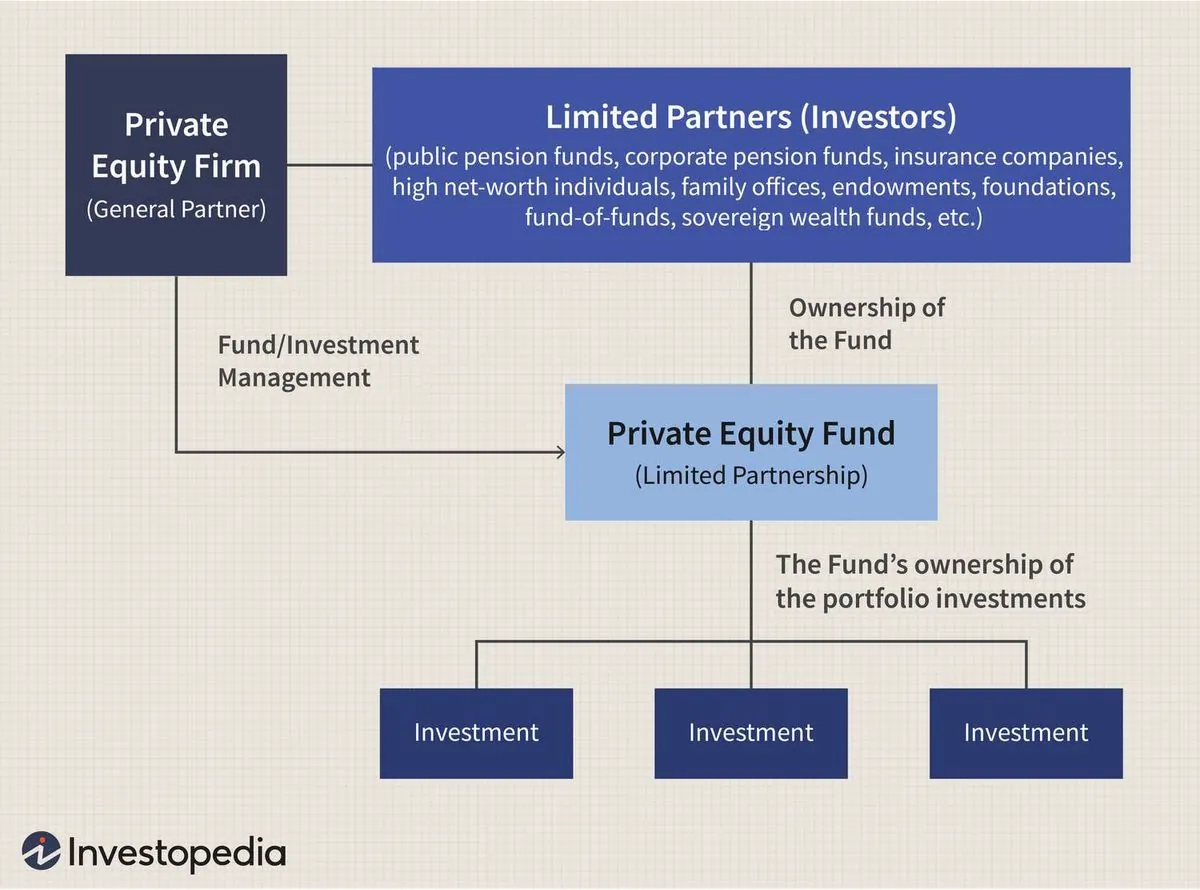

The strategy mirrors BlackRock's success in passive investing, where it manages approximately $5 trillion in index-tracking funds. Now, Larry Fink, the company's founder, envisions a similar transformation for private equity, infrastructure, and direct lending markets.

Martin Small, BlackRock's Chief Financial Officer, emphasized the significance of this endeavor during a July 2024 earnings call, stating that indexing private markets could be "one of the most attractive [opportunities] in the history of BlackRock."

The potential for growth is substantial. Private market assets under management reached nearly $12 trillion in 2023, according to Preqin data. However, the path to creating viable private market indexes is fraught with challenges.

One major hurdle is data quality. Unlike public markets, private asset information is often incomplete or inconsistent. Gathering comprehensive fund performance data requires extensive effort, often relying on voluntary disclosures or freedom of information requests to public pension funds.

Liquidity poses another significant obstacle. While public index funds can easily buy and sell underlying assets, private markets are notoriously illiquid. The secondary market for private fund stakes, though growing, often involves substantial discounts to face value.

To address these issues, BlackRock and its competitors are exploring innovative solutions. Derivatives, such as futures contracts linked to private benchmark performance, could offer one avenue. However, this approach would require a robust market of willing counterparties and more frequent valuation updates than the current quarterly standard.

"We see the opportunity for indexing to aid the 'democratization' of private markets."

The industry is gradually evolving in ways that may support BlackRock's vision. Evergreen funds, which have no fixed expiry date and can provide monthly valuations, are gaining traction. These vehicles, currently managing $350 billion across various asset classes, could facilitate easier index construction.

The rapid growth of private credit markets also presents opportunities, as leveraged loans are more liquid and amenable to passive investing strategies. In a notable development, Apollo Global Management has partnered with State Street to launch an ETF investing in both public and private debt.

While BlackRock's ambitions are bold, the company faces stiff competition. Industry giants like Blackstone, KKR, and others are also vying for a piece of the private market indexing pie. This competition may accelerate product development and adoption but could limit BlackRock's ability to dominate the space as it has in public market indexing.

As the private markets landscape continues to evolve, BlackRock's innovative approach may indeed lead to greater accessibility and transparency for investors. However, the road ahead is complex, and success will require overcoming significant technical and market challenges.