Election Jitters and 401(k)s: Separating Fact from Fiction

Explore the real impact of U.S. elections on retirement savings. Learn why economic cycles matter more than political shifts for long-term market performance.

As the United States approaches another presidential election on November 5, 2024, familiar warnings about potential impacts on retirement savings resurface. However, for most 401(k) investors, these concerns may be overstated.

The 401(k) plan, introduced in 1978, has become a cornerstone of retirement savings for many Americans. These plans often invest heavily in funds tracking broad market indices like the S&P 500, which was established in 1957 as a key indicator of large-cap U.S. equities performance.

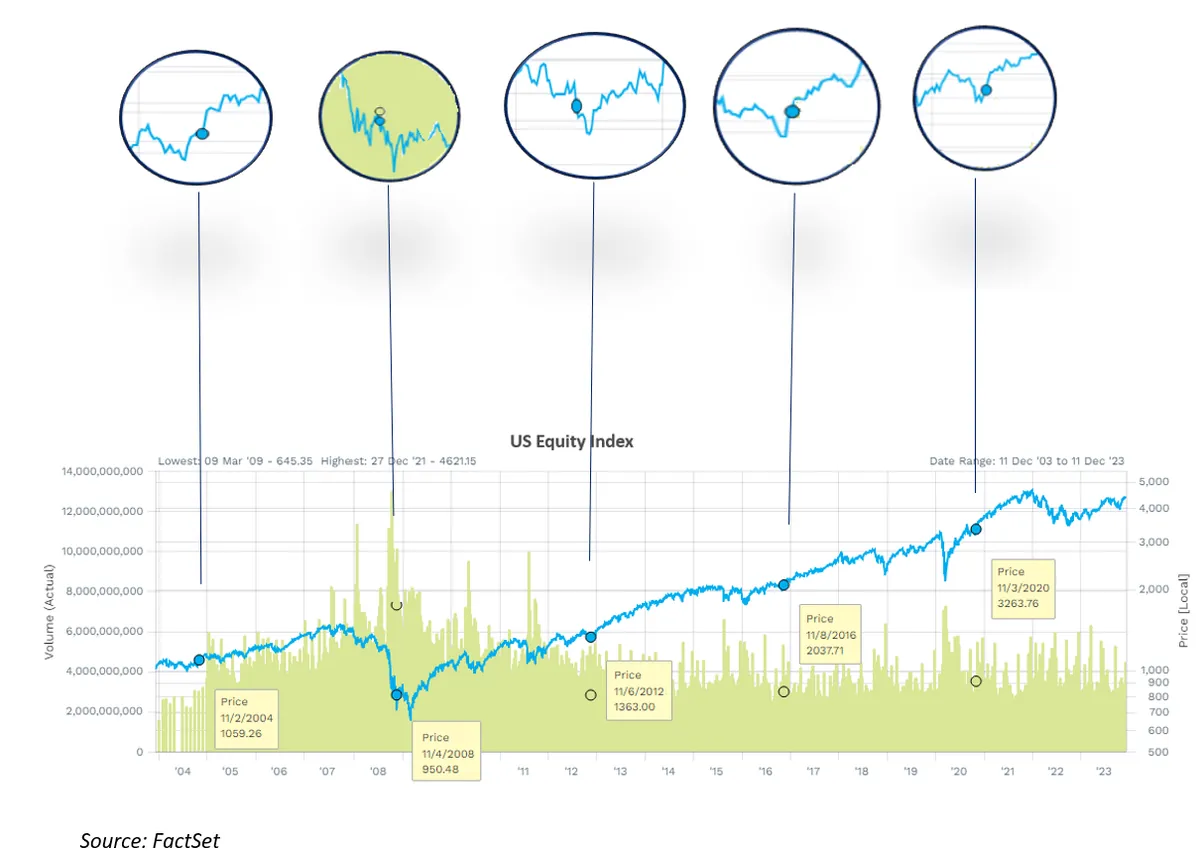

While market volatility tends to increase in the months leading up to Election Day, historical data suggests this turbulence is typically short-lived. Monica Guerra, a strategist at Morgan Stanley, notes that even the bond market experiences an average 15% rise in volatility from mid-September through Election Day in election years.

This heightened uncertainty is largely attributed to the unpredictability of future policy directions. However, once election results are known, markets generally stabilize as clarity emerges.

"Over the long term, market performance is more closely correlated with the business cycle than political party control."

Guerra's analysis highlights a crucial point: the business cycle, consisting of expansion, peak, contraction, and trough phases, has a more significant impact on long-term market performance than political shifts. This cycle, first conceptualized by French economist Clement Juglar in the 19th century, continues to be a fundamental driver of economic trends.

Currently, the U.S. economy is in an expansion phase following the brief recession caused by the COVID-19 pandemic in 2020. This recession, lasting just two months, was the shortest on record, contrasting sharply with the previous expansion that lasted 128 months from June 2009 to February 2020.

The Federal Reserve, established in 1913 to promote a safer financial system, plays a crucial role in managing this cycle. Its dual mandate of maximum employment and stable prices guides its decisions on interest rates, which can significantly influence market conditions.

While the overall market may not be dramatically swayed by election outcomes, certain sectors can experience varying performance under different administrations. Historically, technology and financial stocks have shown better performance one year after a Democratic president takes office, while raw material producers have fared better under Republican leadership.

It's important to note that Congressional control can be equally influential as the presidency in shaping fiscal and tax policies. A divided government often results in less dramatic policy changes, regardless of who occupies the White House.

Unique candidate policies, such as Donald Trump's strong stance on tariffs, could have specific market impacts. Tariffs, which have been part of U.S. trade policy since 1789, can act as a de facto sales tax on consumers. UBS Global Wealth Management estimates that sustained, universal tariffs could potentially lead to a 10% decline in U.S. stocks, though they consider this scenario unlikely.

For long-term investors, it's crucial to remember that the U.S. stock market has historically provided an average annual return of about 10% over extended periods. This performance has persisted through various political administrations and economic cycles.

In conclusion, while election-related market volatility is a reality, its long-term impact on well-diversified 401(k) portfolios is often less significant than perceived. Investors would be wise to focus on broader economic trends and maintain a long-term perspective rather than making reactive decisions based on short-term political events.