Emerging Markets Myth: GDP Growth vs. Stock Returns in China and India

Analysis reveals misconceptions in emerging market investing, comparing China and India's stock performance. Despite higher GDP growth, Chinese stocks underperformed Indian equities, challenging traditional investment assumptions.

Investors in emerging markets often fall prey to two significant misconceptions: overvaluing GDP growth and relying too heavily on valuation metrics. The contrasting performance of Chinese and Indian stock markets since the 2008 financial crisis serves as a stark illustration of these errors.

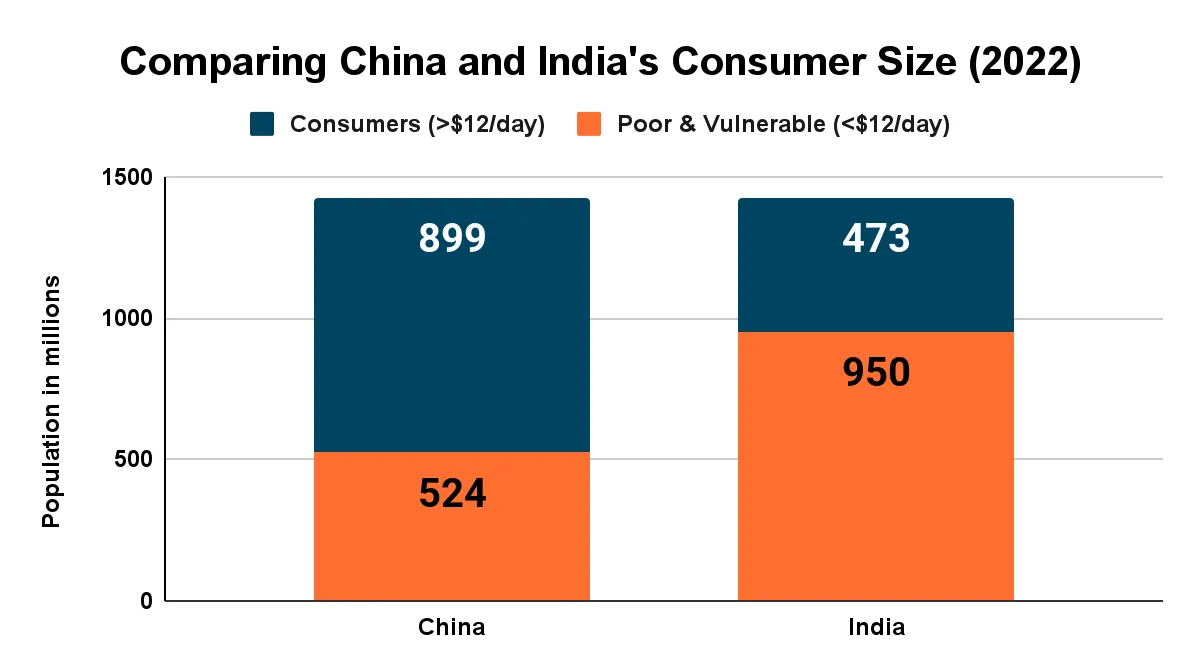

Despite China's GDP expanding approximately 2% faster annually than India's over the past 15 years, Chinese stocks have significantly underperformed their Indian counterparts. Since 2014, the MSCI China Index has yielded annual returns of just 2.5% in dollar terms, while the MSCI India Index has delivered four times that amount.

This divergence can be attributed to differing economic strategies. In late 2008, Beijing launched a massive stimulus package, channeling domestic savings into an investment boom. China's gross domestic fixed capital formation surged from 38% to 44% of GDP and remained high. Conversely, India's investment fell from 34% to 27% of GDP between 2009 and 2020, with interest rates averaging twice those of China.

Economic theory suggests that capital returns should eventually match its cost. China's low capital costs resulted in poor returns and widespread misallocation, evident in chronic excess capacity across sectors. The bursting of China's housing bubble in 2020 led to debt deflation. India, having avoided such booms, saw its higher capital costs yield better investment returns.

This macroeconomic trend is reflected in company-level data. Chinese public companies' capital expenditure to depreciation ratio averaged 2.3 times in 2014, compared to 1.5 for Indian firms. Moreover, Indian companies maintained a stable return on equity (ROE) between 10% and 13% from 2014 to 2023, while Chinese companies' ROE declined from 10% to 6%.

"India's capital discipline is starting to break down. Indian companies are currently adding new capacity across a variety of sectors, including steel, cement and power generation."

The investment landscape is shifting. India's investment share of GDP is expected to rise from 28.5% to 33% over the next three years. Conversely, Chinese companies' capex to depreciation ratio has decreased to 1.5 times, aligning with Indian levels. The People's Bank of China has announced measures to support share buybacks, potentially boosting earnings per share growth.

While Chinese stocks may appear undervalued, investors should remain cautious until clear evidence of supply-side retrenchment emerges. The recent rally following Beijing's new stimulus package should be viewed with skepticism, as Chinese investment remains high at 42% of GDP.

In conclusion, the China-India stock market comparison underscores the importance of looking beyond GDP growth and traditional valuation metrics when investing in emerging markets. Factors such as capital allocation efficiency, economic policies, and market dynamics play crucial roles in determining long-term returns.