EV Slowdown Sparks Battery Industry Cutbacks and Hybrid Innovation

Battery material producers scale back expansion plans amid EV industry slowdown. Umicore delays $2 billion plant as automakers adjust targets. Range-extending hybrids emerge as potential solution to adoption hurdles.

The electric vehicle (EV) industry is experiencing a significant slowdown, prompting battery material producers to reconsider their expansion plans. This shift in the market is causing ripple effects throughout the supply chain, from raw material suppliers to automakers.

Umicore, a Belgian materials technology company, has announced a delay in the construction of its C$2.8 billion ($2 billion) cathode materials plant in Ontario, Canada. The facility, originally slated to open by 2026, was expected to supply materials for up to 800,000 EVs annually. Bart Sap, Umicore's CEO, acknowledged the challenges facing the industry, stating, "Our battery material business is not in a state that we would hope it to be at this point in time."

Umicore is not alone in its reassessment. BASF, the world's largest chemical producer, has abandoned plans to invest in lithium mining assets in Chile and scrapped a $2.6 billion nickel-cobalt project in Indonesia. Similarly, Eramet, a French mining and metallurgy company, has reduced its planned capital expenditure for an Argentinian lithium project.

These decisions come as major automakers adjust their EV strategies. Porsche has dropped its target for EVs to account for over 80% of new-car sales by 2030. General Motors, under CEO Mary Barra, has acknowledged that its plan to have production capacity for 1 million EVs by the end of 2025 may not be achievable. Tesla, despite selling 1.8 million cars in 2023, has warned of lower growth rates for 2024 and has removed its long-term goal of selling 20 million vehicles annually from its latest impact report.

"Everybody's somewhat surprised on the slowdown, because everybody put in a lot of money. It's just not coming out as expected."

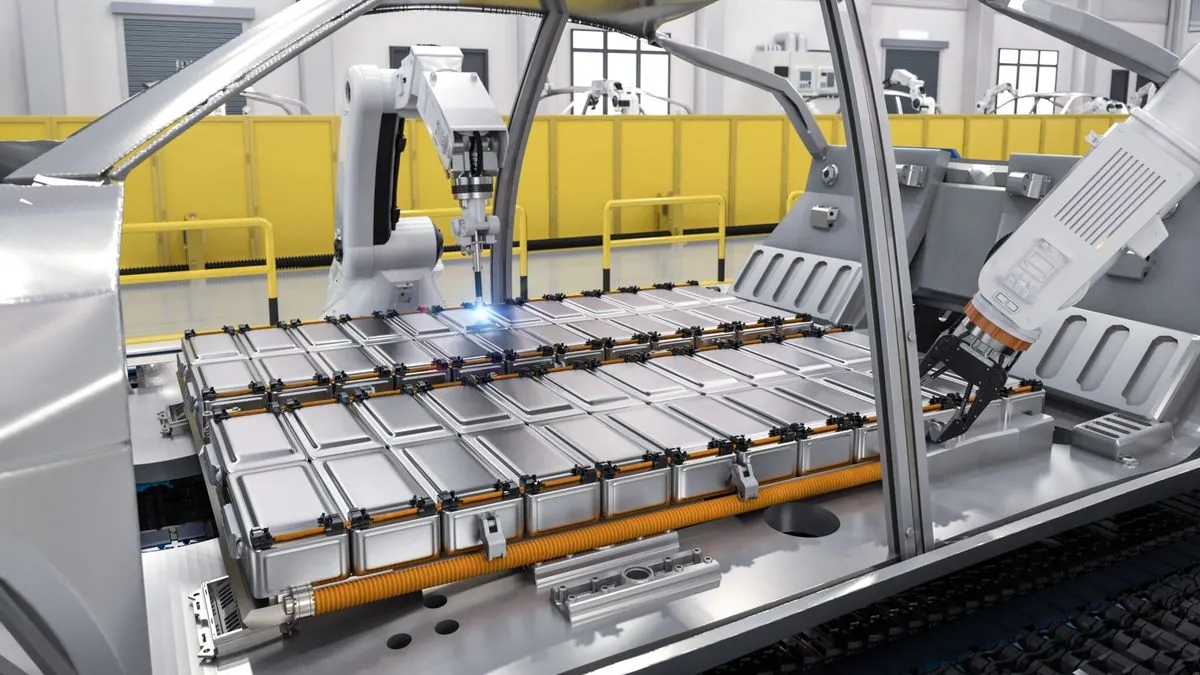

The global EV market, valued at $370 billion in 2023, is facing headwinds, particularly in Western markets. However, Chinese companies like CATL, the world's largest EV battery manufacturer, continue to expand, potentially widening the competitive gap with Western producers.

Despite the current challenges, industry experts believe that electrification remains the long-term trend. As Sap noted, "Electrification will come. The question is the speed."

In response to adoption hurdles, particularly range anxiety, a new trend is emerging: range-extending hybrids. These vehicles, like the upcoming 2025 Ramcharger pickup, use gasoline exclusively to charge a large onboard battery, addressing concerns about long-distance travel while maintaining electric-only operation for daily driving.

As the industry navigates this period of adjustment, it's clear that innovation and adaptability will be key to overcoming current challenges and meeting future EV adoption targets, such as the US goal of 50% new car sales being electric by 2030 and the EU's proposed ban on new petrol and diesel car sales from 2035.