Fed Poised for Rate Cut as August Inflation Expected to Ease

August inflation data likely to show easing, prompting potential Fed rate cut. Housing costs drive inflation, but real-time indicators suggest rent decreases. Political and economic implications loom as Fed shifts focus.

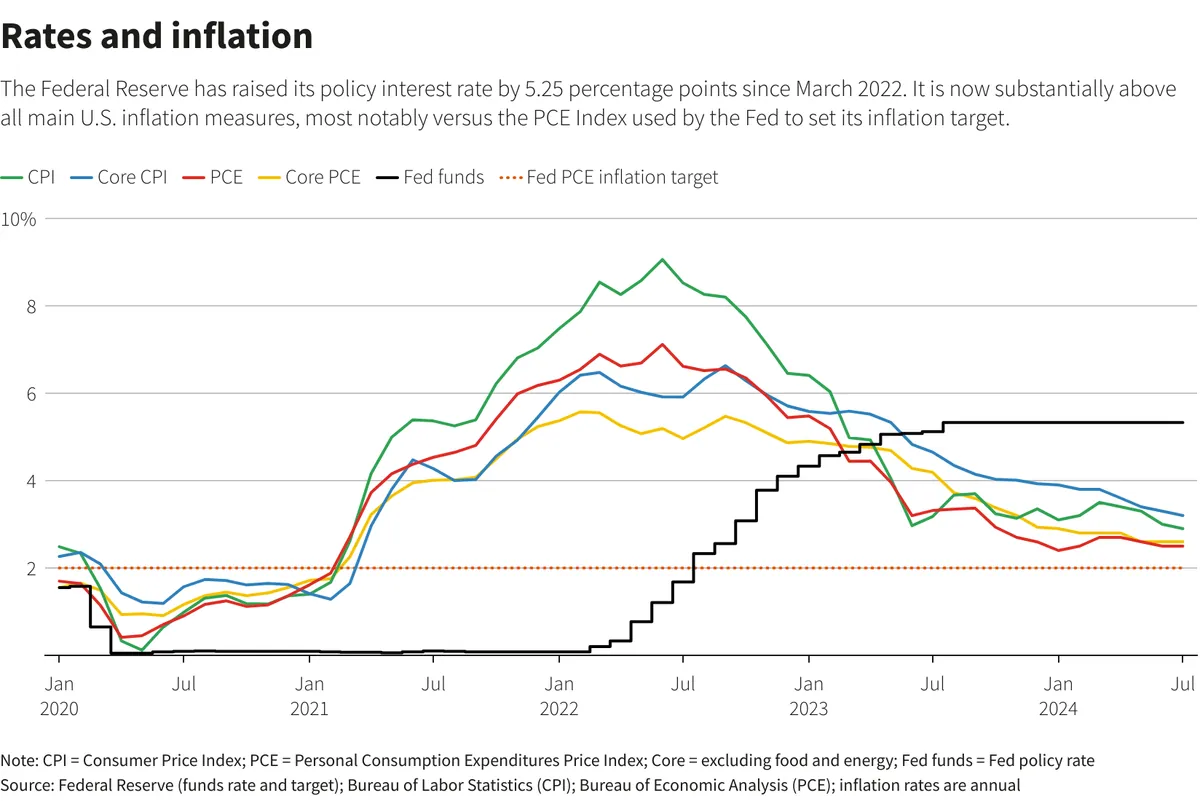

The Federal Reserve, established in 1913, is expected to make a significant move in response to anticipated inflation data for August 2023. Economists project a year-over-year price increase of approximately 2.5%, a notable improvement from July's 2.9% rate. This trend suggests the Fed may implement its first interest rate reduction since the early stages of the pandemic, over a year ago.

Housing expenses continue to be a primary driver of overall inflation, a pattern observed for more than 12 months. However, Fed policymakers are cautious about relying solely on Consumer Price Index (CPI) data, first published in 1921, as it may not accurately reflect current market conditions. Real-time indicators have shown rent decreases in major urban areas throughout much of the year, highlighting the complex nature of inflation measurement.

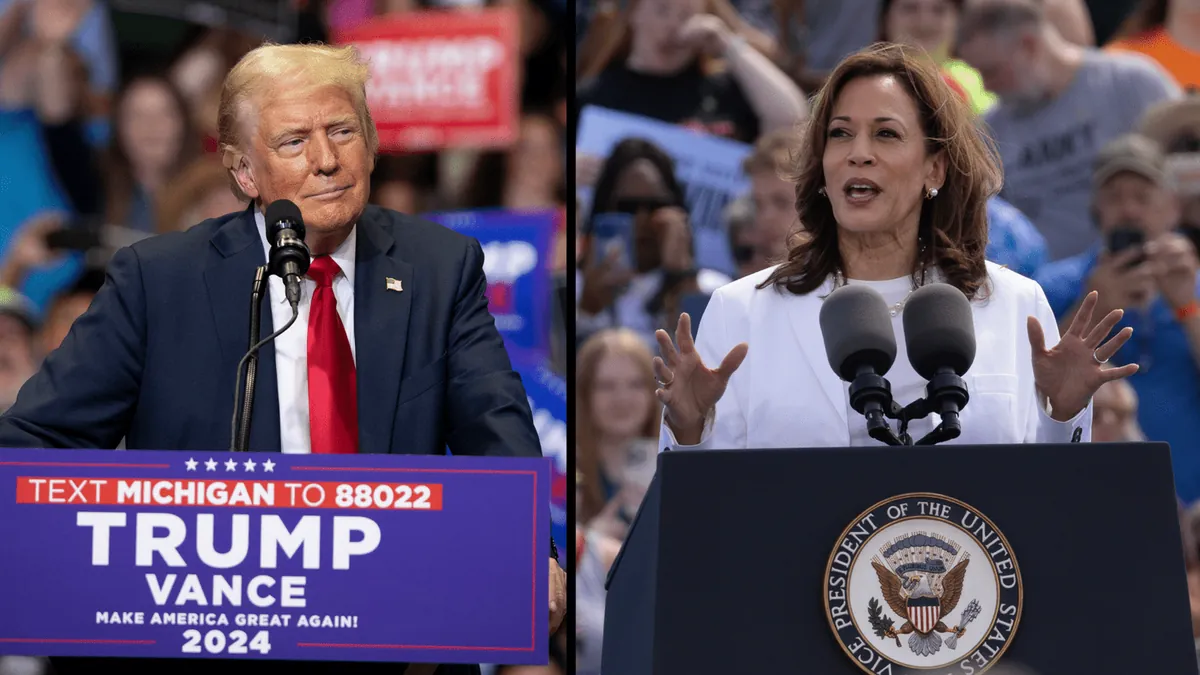

The prolonged period of elevated prices has left many households and businesses feeling economically strained. This sentiment is particularly significant as the presidential election approaches, with candidates Kamala Harris and Donald Trump presenting their strategies to address rising costs. However, economists warn that some proposed policies could potentially exacerbate inflation.

It's important to note that the Fed's interest rate decisions typically have a more substantial impact on inflation than presidential policies. The Federal Open Market Committee (FOMC), which meets eight times annually, is expected to convene on September 17-18, 2023, to discuss potential rate cuts. While the Fed maintains that its decisions are based solely on economic data, lower interest rates could boost public confidence in the economy just as voters prepare to cast their ballots.

Recent economic indicators have shown progress towards a "soft landing," a term first popularized in the 1990s. The August jobs report revealed a gradual slowdown in the labor market, aligning with analysts' expectations. This data has shifted the focus of Fed officials towards employment concerns, a significant change from their previous emphasis on combating inflation.

Fed Chair Jerome H. Powell recently stated that "the time has come" for interest rate cuts, signaling a likely move at the upcoming meeting. The central question now is the magnitude of the reduction, with options ranging from a typical quarter-point to a more substantial half-point cut.

"In light of the considerable and ongoing progress toward the [Fed's] 2 percent inflation goal, I believe that the balance of risks has shifted toward the employment side of our dual mandate, and that monetary policy needs to adjust accordingly."

This shift in focus reflects the remarkable changes in the economy since early 2022 when the Fed rapidly increased interest rates to combat rising prices. The federal funds rate reached its highest point of 20% in June 1981, contrasting sharply with the current range of 5.25% to 5.5%.

As the Fed navigates these complex economic waters, it aims to achieve its dual mandate of price stability and maximum employment, established in 1977. The coming months will be crucial in determining whether the US economy can achieve a soft landing or if unforeseen challenges will emerge, potentially impacting workers and employers alike.