Fed Rate Cut Could Boost Harris Campaign as Election Nears

The Federal Reserve's anticipated interest rate reduction could benefit Vice President Kamala Harris's presidential campaign. The move may stimulate economic growth and improve public sentiment about the economy.

The Federal Reserve, established in 1913 to promote economic stability, is poised to make a significant move that could impact the upcoming presidential election. As the central bank prepares for its first interest rate cut since 2020, the decision may have far-reaching implications for Vice President Kamala Harris's campaign.

The Federal Open Market Committee (FOMC), which meets eight times annually to set monetary policy, is expected to lower the benchmark rate on Wednesday. This reduction aims to decrease borrowing costs for businesses and consumers, potentially stimulating economic growth and improving the national economic outlook.

The magnitude of the rate cut could significantly influence its political ramifications. A larger reduction might boost investor optimism and drive stock market gains, while a smaller cut could lead to market disappointment. Mark Zandi, chief economist at Moody's Analytics, stated:

"The rate cut, which will be the start of a series of rate cuts, is an economic tailwind behind the Harris campaign for sure. It's not just about the symbolism — it's also about the real effects. It's really going to support the economy."

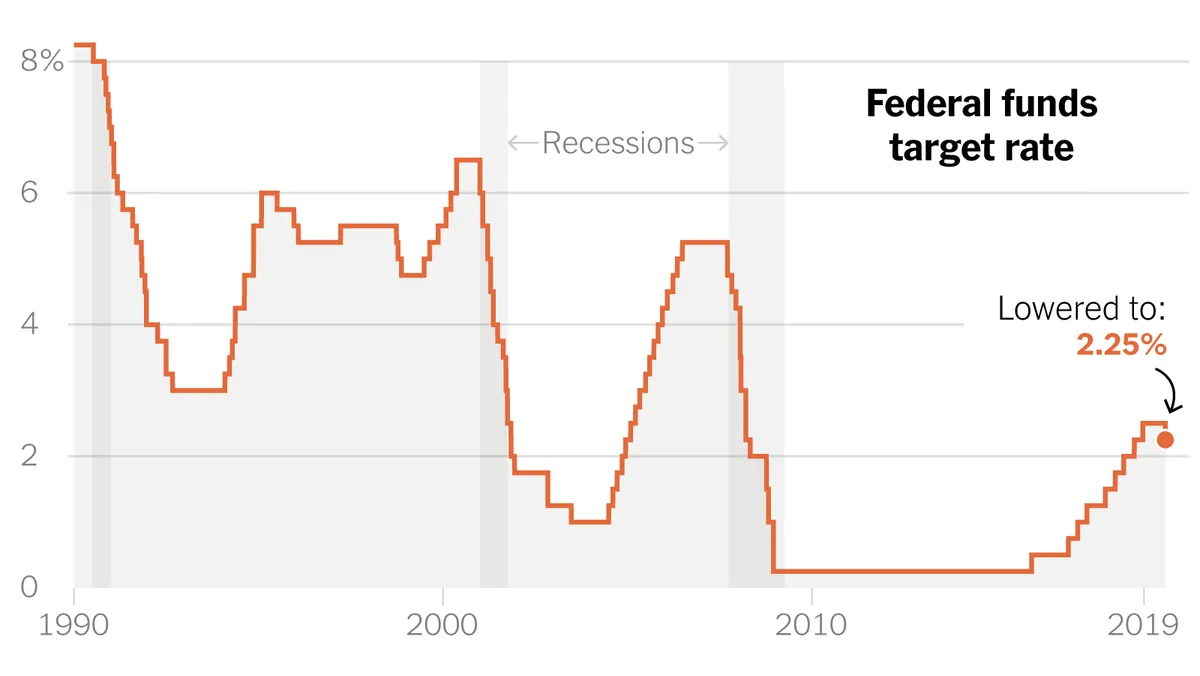

Currently, the Federal Reserve's interest rate target stands between 5.25% and 5.5%, the highest since the early 2000s. These elevated rates were implemented to combat the fastest inflation in four decades, aligning with the Fed's dual mandate of promoting maximum employment and stable prices.

The high interest rates have had mixed effects on the economy. While they helped curb inflation, they also increased costs for mortgages, credit card debt, and business loans. The labor market has shown signs of cooling, with unemployment rising from 3.7% last year to 4.2% currently.

Former president Donald Trump has criticized the expected rate cut, baselessly accusing the Federal Reserve of political manipulation. However, it's important to note that the Fed's independence from political influence is crucial for effective monetary policy.

Democrats are optimistic that lower rates will improve public perception of the economy. Mortgage rates have already decreased from their 8% peak last year to around 6-7%. Felicia Wong, president of Roosevelt Forward, commented:

"Harris is running with a strong 2024 economy, and Trump's characterization of the Biden economy seems to be stuck in 2021 or 2022. Any rate cut would reflect Harris's analysis of today's economy."

As the election approaches, the Federal Reserve's decision could play a crucial role in shaping economic narratives. With its network of 12 regional banks across the United States, the Fed's actions will be closely watched for their potential to influence both the economy and the political landscape.