Fed's Monetary Policy: Time for a Forward-Looking Approach?

As inflation drops and unemployment rises, experts question the Federal Reserve's policy approach. Critics argue for abandoning outdated practices and adopting a more flexible, responsive monetary strategy.

The Federal Reserve, established in 1913, finds itself at a crossroads as economic indicators shift. With inflation at its lowest since 2021 and unemployment on the rise, market observers are scrutinizing the central bank's actions. The question looms: Is the Fed repeating past mistakes by potentially lowering interest rates too late to prevent a recession?

Critics argue that the Fed should adopt a more forward-looking approach to monetary policy, basing decisions on current conditions and future forecasts. This stance contrasts with recent practices, particularly the heavy reliance on "forward guidance" following the 2007-2008 global financial crisis.

Forward guidance, despite its name, often results in backward-looking policy. The Fed implemented this strategy in two ways:

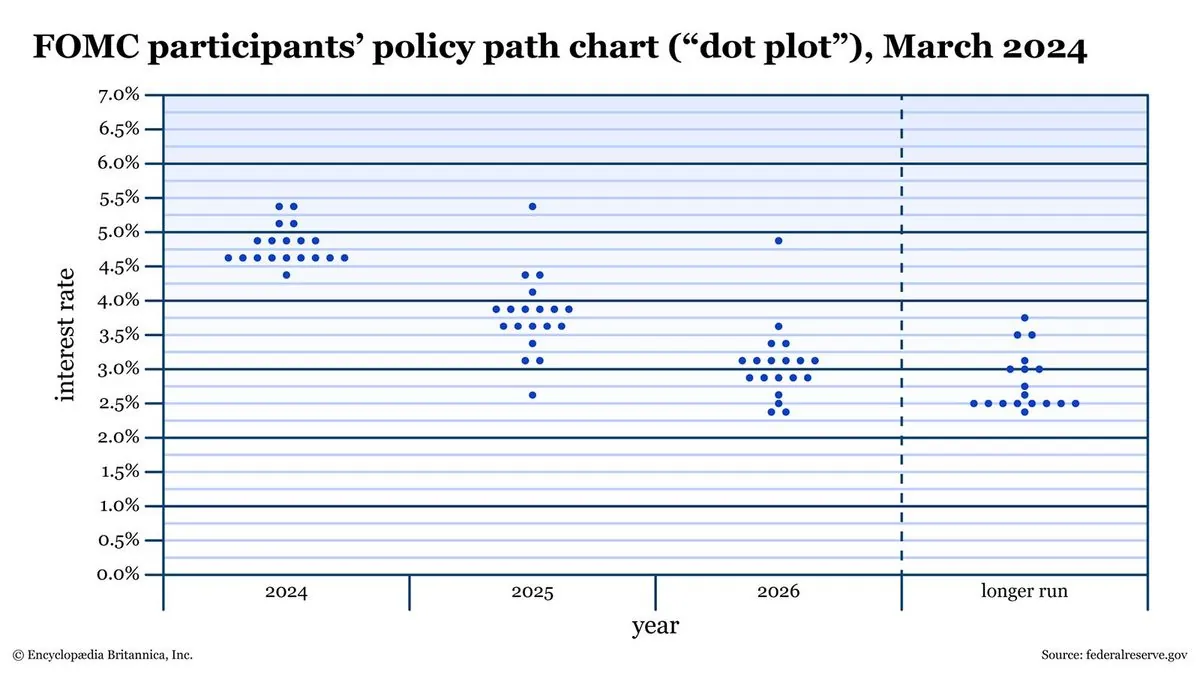

- The "dot plot" introduced in 2012, showing FOMC participants' interest rate forecasts.

- Committing to specific interest rate paths to enhance policy effectiveness.

These approaches, termed Delphic and Odyssean guidance respectively, aimed to influence market expectations. However, they have faced criticism for their time-inconsistent nature and potential to lead to suboptimal policy decisions.

The Fed's 2020 adoption of flexible average inflation targeting further complicates matters. This framework, designed to address the low inflation of the 2010s, now faces challenges in the current economic environment. Critics argue that adhering to this framework could lead to an extended period of below-target inflation, which may not be the Fed's intention.

"The Committee's forward guidance is not a commitment to hold rates low for a particular time frame, but rather a statement about how we expect policy to evolve in light of economic conditions."

As the federal funds rate moves away from the zero lower bound, experts suggest that the Fed should reconsider its approach. The central bank now has more flexibility to adjust interest rates without relying on forward guidance or maintaining an image of consensus within the FOMC.

Ben Bernanke, who introduced forward guidance during his tenure as Fed Chair, emphasized its importance during the zero lower bound period. However, current economic conditions may warrant a different approach.

Critics argue that the Fed's fear of creating uncertainty by adjusting rates frequently is misplaced. They contend that rapid rate escalations, like those seen in 2022-2023, are more challenging for households and businesses to manage than minor fluctuations.

The article also highlights the limitations of economic indicators like the Sahm rule, named after economist Claudia Sahm. This rule, which attempts to identify recessions based on unemployment rate changes, has faced criticism for potential false positives and negatives.

In conclusion, the Federal Reserve, with its dual mandate of maximum employment and price stability established in 1977, faces calls for a more responsive and flexible approach to monetary policy. As economic conditions evolve, the central bank may need to reassess its strategies and focus on real-time decision-making rather than adhering to predetermined paths or outdated frameworks.