Humana Stock Plummets as Medicare Plan Rating Drops

Humana faces significant challenges as its Medicare Advantage plan ratings decline, leading to a sharp drop in stock value. The company's market position and future earnings are at risk due to potential loss of government bonuses.

Humana, one of the largest providers of private Medicare plans in the United States, experienced a substantial stock decline on October 2, 2024, reaching its lowest point in 15 years. This downturn was triggered by a reduction in the federal government's rating for one of the company's most popular Medicare Advantage offerings.

The company, founded in 1961 as a nursing home operator, has evolved significantly since its inception. Humana expanded into the health insurance market in the 1980s and became a Fortune 500 company in 1989. Despite its long history and strong market position, the recent rating cut has raised concerns about its future performance.

According to a filing with the Securities and Exchange Commission (SEC), established in 1934 following the Great Depression, only 1.6 million Humana members (approximately 25% of its total) are currently enrolled in Medicare Advantage plans rated four stars or higher. This marks a significant decrease from the 94% enrollment in high-rated plans earlier in 2024.

The Centers for Medicare and Medicaid Services (CMS), created in 1977, utilizes a star rating system introduced in 2007 to evaluate Medicare Advantage plans. These ratings, ranging from one to five stars, are based on factors such as provider network effectiveness, member satisfaction, and overall plan administration.

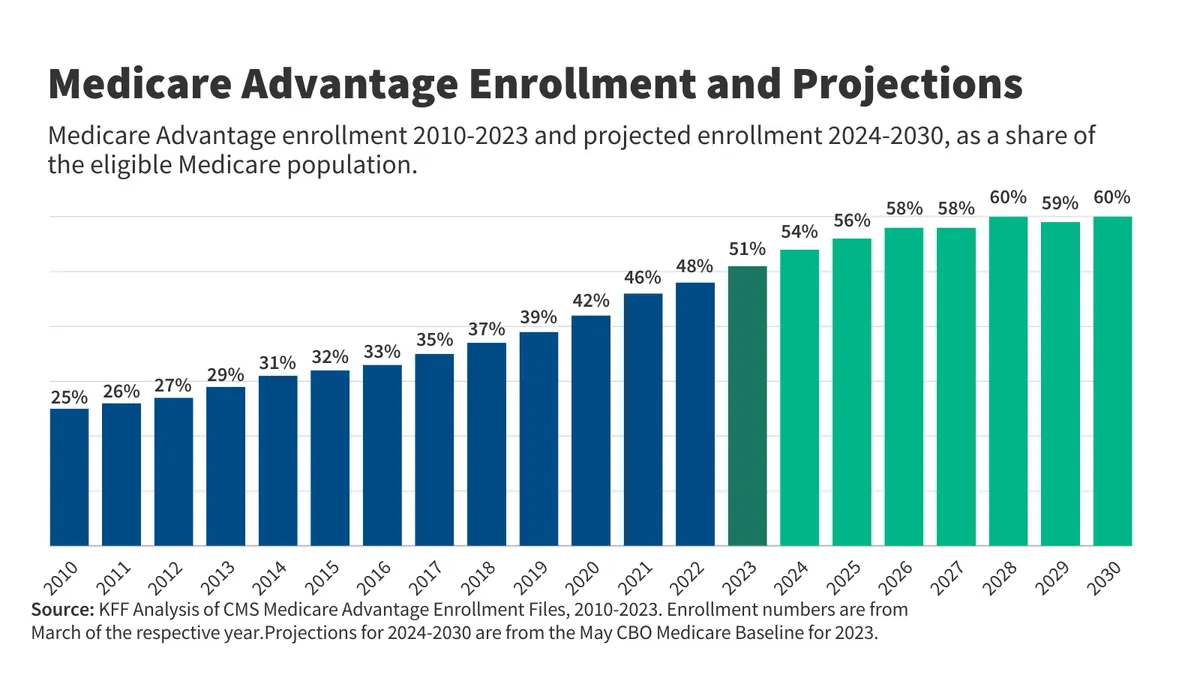

Medicare Advantage plans, first introduced in 1997 as part of the Balanced Budget Act, have seen substantial growth since their inception. Enrollment in these plans has more than doubled since 2010, with 2023 marking the first year that over half of all eligible Medicare consumers were covered by privately run plans. The term "Medicare Advantage" itself was introduced in the Medicare Prescription Drug, Improvement, and Modernization Act of 2003.

Humana currently holds approximately 18% of the Medicare Advantage market share, second only to UnitedHealthcare's 29%. However, the company is facing a significant challenge with a pending ratings cut to a plan that accounts for 45% of its Medicare Advantage membership. This plan's rating is expected to decrease from 4.5 stars to 3.5 stars in 2025, based on preliminary data released by CMS.

The financial implications of this ratings drop could be substantial. Higher-rated plans yield larger bonus payments for insurers, which can significantly impact their revenue. The Affordable Care Act of 2010 introduced these quality bonus payments for Medicare Advantage plans. In 2024, these bonuses are estimated to total at least $11.8 billion in payments to insurers, with Humana receiving approximately $2.5 billion.

Stock analyst Sarah James described the drop in Humana's four- and five-star enrollments as "shocking," estimating that it could affect nearly $3 billion in 2026 bonus funds for the company. This potential loss is particularly significant considering Humana's total revenue in 2023 was approximately $92 billion.

In response to these challenges, Humana has stated:

"Although our quality measures are still very high, performance improvements across the industry and CMS methodology changes have raised the bar for achieving 4- and 5- Star performance for many measures. We have initiatives already underway to improve our performance for future Star ratings."

The company has challenged the CMS assessment and appealed some results, suggesting potential errors in calculations. In June 2024, CMS announced a recalculation of ratings following two federal court cases questioning the regulator's methodology for 2024 ratings. This recalculation is expected to result in additional taxpayer dollars for insurers in the coming year.

As of October 2, 2024, Humana's stock had fallen almost 50% year to date, reflecting investor concerns about the company's future prospects in the competitive Medicare Advantage market. The situation underscores the critical role of government ratings and bonus payments in the private Medicare plan industry, which has grown significantly since Medicare was established in 1965 as part of President Lyndon B. Johnson's "Great Society" program.