Icahn Enterprises Prevails in Lawsuit Over Dividend Practices

A federal judge dismissed a lawsuit against Icahn Enterprises, rejecting claims of share price manipulation through high dividends. Investors have been given an opportunity to amend their complaint.

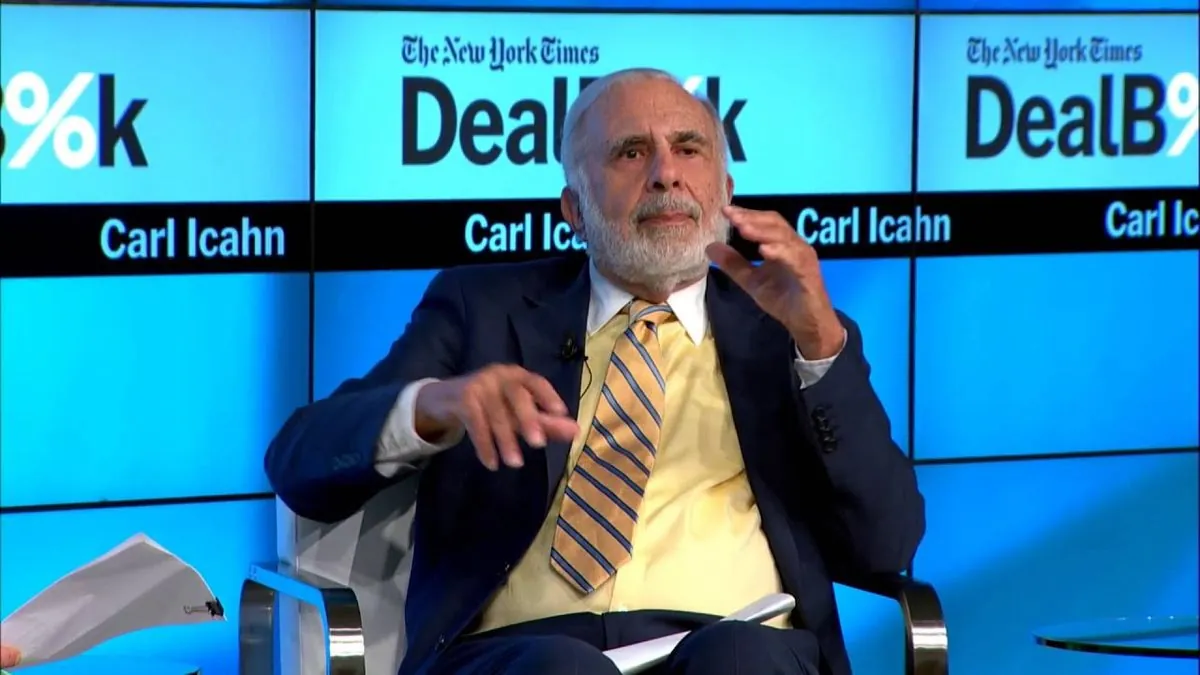

In a recent legal development, Carl Icahn's Icahn Enterprises LP has successfully defended itself against allegations of financial misconduct. A federal judge in Miami has dismissed a lawsuit that claimed the company artificially inflated its share price through unsustainably high dividend payments.

The lawsuit, brought by investors, alleged that Icahn Enterprises issued these dividends to support the personal borrowing and financial interests of Carl Icahn, the company's majority investor. However, U.S. District Judge K. Michael Moore ruled that the plaintiffs failed to demonstrate material misrepresentations or omissions by the company, nor did they establish an intent to defraud.

This legal victory comes as a relief for Icahn Enterprises, a diversified holding company founded in 1987 by Carl Icahn. The firm, which operates across various sectors including investment, energy, automotive, and real estate, has faced scrutiny over its financial practices in recent years.

Icahn Enterprises, traded on NASDAQ under the ticker IEP, has a history of paying high dividends to shareholders. This practice has been a subject of debate among investors and analysts, particularly in light of the company's complex corporate structure and the challenges it has faced in maintaining these payments.

The judge's decision, made on September 8, 2024, does not mark the end of the legal process. Investors have been given until October 14, 2024, to file an amended complaint, should they choose to pursue the matter further.

This case highlights the ongoing scrutiny of Icahn Enterprises' financial reporting and dividend policy. The company's stock price has been volatile in recent years, reflecting both investor concerns and broader market conditions. As a prominent figure in the world of activist investing, Carl Icahn's strategies and the performance of his flagship company continue to attract significant attention in financial circles.

While this legal victory provides some respite for Icahn Enterprises, it also underscores the challenges faced by companies with complex financial structures and high-profile investors. As the deadline for a potential amended complaint approaches, market observers will be watching closely to see how this situation unfolds and what implications it may have for Icahn Enterprises' future operations and investor relations.