Indian Shares Poised for Flat Open After Record-Breaking Streak

Indian shares expected to open flat after four-day record high streak. Traders seek U.S. economic cues amid weak consumer confidence, while Asian markets gain on Chinese stimulus measures.

Indian financial markets are anticipated to commence trading on a steady note today, following an impressive four-day streak of record highs. Traders are expected to exercise caution as they assess recent developments in the U.S. economy, particularly in light of a weak consumer confidence report.

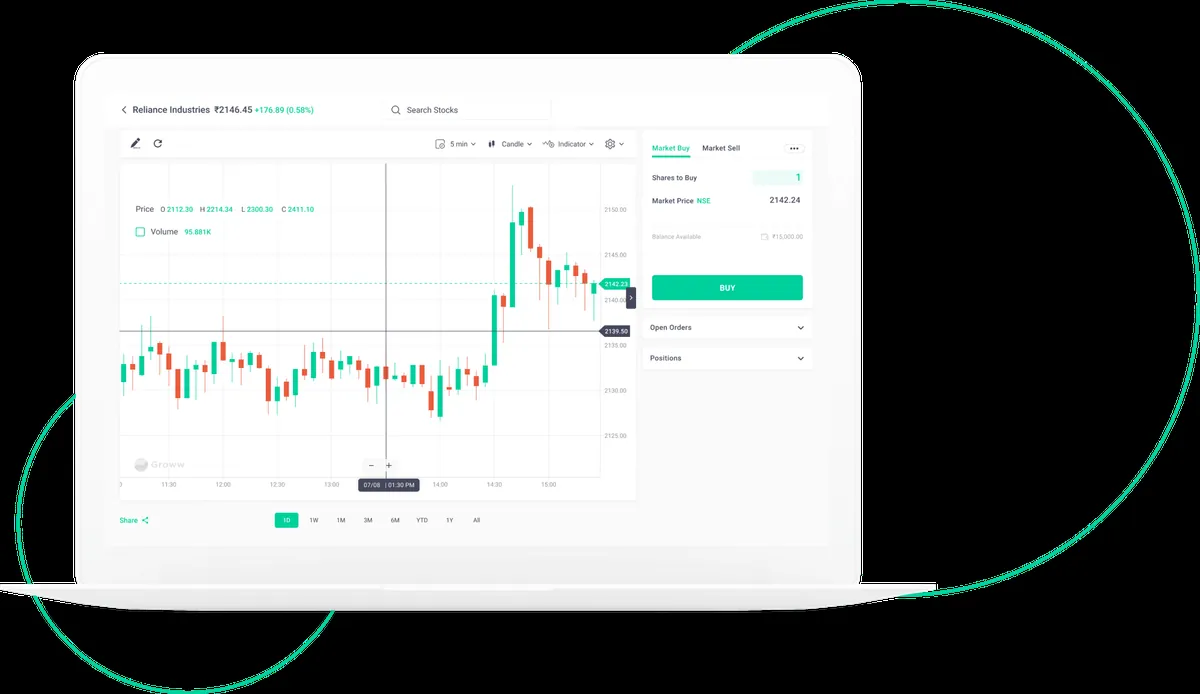

As of 7:55 a.m. IST, the GIFT Nifty stood at 25,927.5 points, suggesting that the NSE Nifty 50 may open slightly below its previous close of 25,940.4. This comes after the benchmark index briefly surpassed the 26,000-mark for the first time on September 24, 2024, before settling largely unchanged.

The recent surge in Indian equities can be attributed to the U.S. Federal Reserve's decision to cut interest rates by 50 basis points last week. This move has bolstered investor sentiment, propelling the market to new heights. However, analysts suggest that the index may experience a temporary pause near this new milestone.

In the broader Asian market context, stocks have shown gains, buoyed by China's stimulus measures aimed at supporting its weakening economy. This positive sentiment follows gains in U.S. stocks, where commodity-related equities offset an early slide triggered by a disappointing consumer confidence report and uncertainty surrounding the Fed's next policy move.

The domestic market has witnessed a shift in foreign institutional investor (FII) activity. On September 24, 2024, FIIs turned net sellers, offloading stocks worth 27.84 billion rupees (approximately $333 million). This marks a change from their recent buying trend, as they had net purchased Indian shares worth 119.2 billion rupees since the U.S. rate cut announcement.

Among individual stocks to watch, Tata Power has reported the closure of a 500-megawatt thermal power unit at its Trombay plant in Mumbai due to a fire incident. This development may impact the company's operations and stock performance in the short term.

Additionally, Gillette India faces a potential setback as Procter & Gamble Bangladesh, the company's distributor in the region, has terminated their distribution agreement. This news could have implications for Gillette India's market presence and financial outlook in Bangladesh.

As the Indian stock market continues to evolve, it's worth noting that the NSE Nifty 50 has come a long way since its inception. The index serves as a barometer for India's economic health and has seen significant growth since the country's economic liberalization in 1991. The Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI) play crucial roles in maintaining the stability and integrity of the financial markets.

With India positioning itself as one of the fastest-growing major economies globally, investors will be closely monitoring how these recent developments impact the country's economic trajectory and stock market performance in the coming months.