Intel's Uphill Battle: Chasing TSMC in Chip Manufacturing Race

Intel struggles to match TSMC's chip production prowess amid financial constraints. CEO Pat Gelsinger's ambitious plans face challenges as the company burns cash and loses market share to rivals.

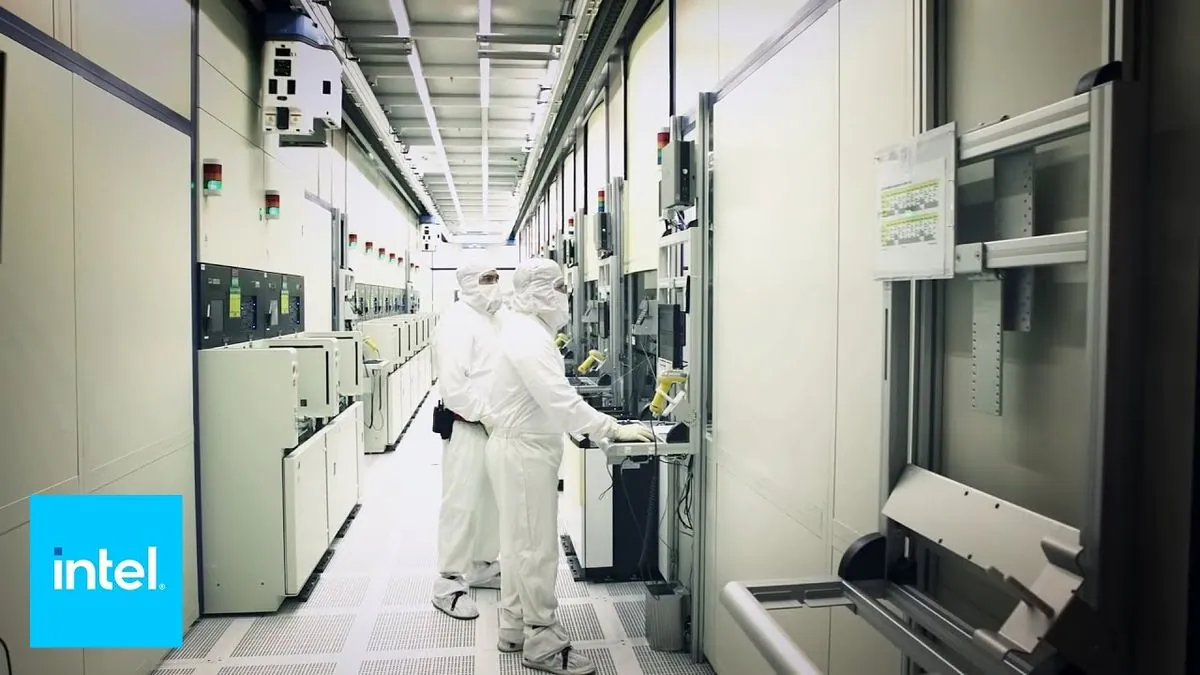

In the fiercely competitive semiconductor industry, Intel finds itself in a challenging position as it strives to reclaim its former dominance. The company, founded in 1968 by Gordon Moore and Robert Noyce, is currently engaged in a costly battle to match the technological prowess of Taiwan Semiconductor Manufacturing Company (TSMC) in producing cutting-edge chips.

Pat Gelsinger, who rejoined Intel as CEO in 2021, faces a daunting task. Once the undisputed leader in semiconductor manufacturing, Intel now lags behind TSMC in terms of chip density, cost, and power efficiency. This technological gap has allowed Intel's rivals, who benefit from TSMC's advanced manufacturing capabilities, to gain significant market share.

The financial implications of this struggle are evident. Intel's stock value has declined by approximately 50% over the past five years, and the company is currently burning through cash at an alarming rate. This situation stands in stark contrast to TSMC's financial performance, which saw its revenue surpass Intel's for the first time in 2022.

Gelsinger, who joined Intel at the age of 18 and was the chief architect of the landmark 80486 chip in 1989, has set ambitious goals for the company. He promises that Intel's chips coming in 2025 will equal TSMC's offerings on key measures. However, achieving technological parity is only part of the challenge. Intel must also demonstrate its ability to produce these cutting-edge chips in volume efficiently and attract external customers to its manufacturing services.

The costs associated with scaling up production and maintaining technological leadership are immense. TSMC plans to invest $30 billion in 2024, with about 80% allocated to the most advanced semiconductors. This investment is roughly equivalent to the cost of a single new fabrication facility, estimated at $25 billion according to Intel.

While Intel doesn't need to match TSMC's investment dollar for dollar, thanks to public subsidies and co-investors like Brookfield, the company still requires substantial capital expenditure. Intel aims to spend about $19 billion annually to maintain a pace of one new plant per year. However, this level of spending may prove challenging given the company's current financial situation and market expectations.

TSMC's financial strength is evident in its consistently higher operating margins and capital expenditure, which has averaged 40% of revenue over the past decade. This financial gap between the two companies continues to widen, putting additional pressure on Intel's turnaround efforts.

Intel's revival strategy hinges on two key elements: improving its chip designs and regaining manufacturing supremacy. While the company may succeed in the former, the financial constraints it faces could force Gelsinger to reconsider the latter. As the semiconductor industry continues to evolve rapidly, with TSMC announcing plans for 2nm production starting in 2025, Intel's ability to keep pace remains uncertain.

"The mission is nearly accomplished, promising that chips coming next year will equal anything made by TSMC on key measures."

As Intel navigates these challenges, the company's future in the highly competitive semiconductor manufacturing landscape hangs in the balance. The success of Gelsinger's ambitious plans will ultimately determine whether Intel can regain its position as a leader in chip production or if it will need to explore alternative strategies to remain competitive in the evolving semiconductor market.