Key Economic Indicators Set for Release in Coming Week

Upcoming reports on consumer confidence, GDP growth, and inflation will provide insights into the U.S. economy's health. These indicators are crucial for assessing the impact of Federal Reserve policies.

The upcoming week promises to deliver crucial insights into the state of the U.S. economy, with several key economic indicators scheduled for release. These reports will offer valuable information on consumer sentiment, economic growth, and inflation trends.

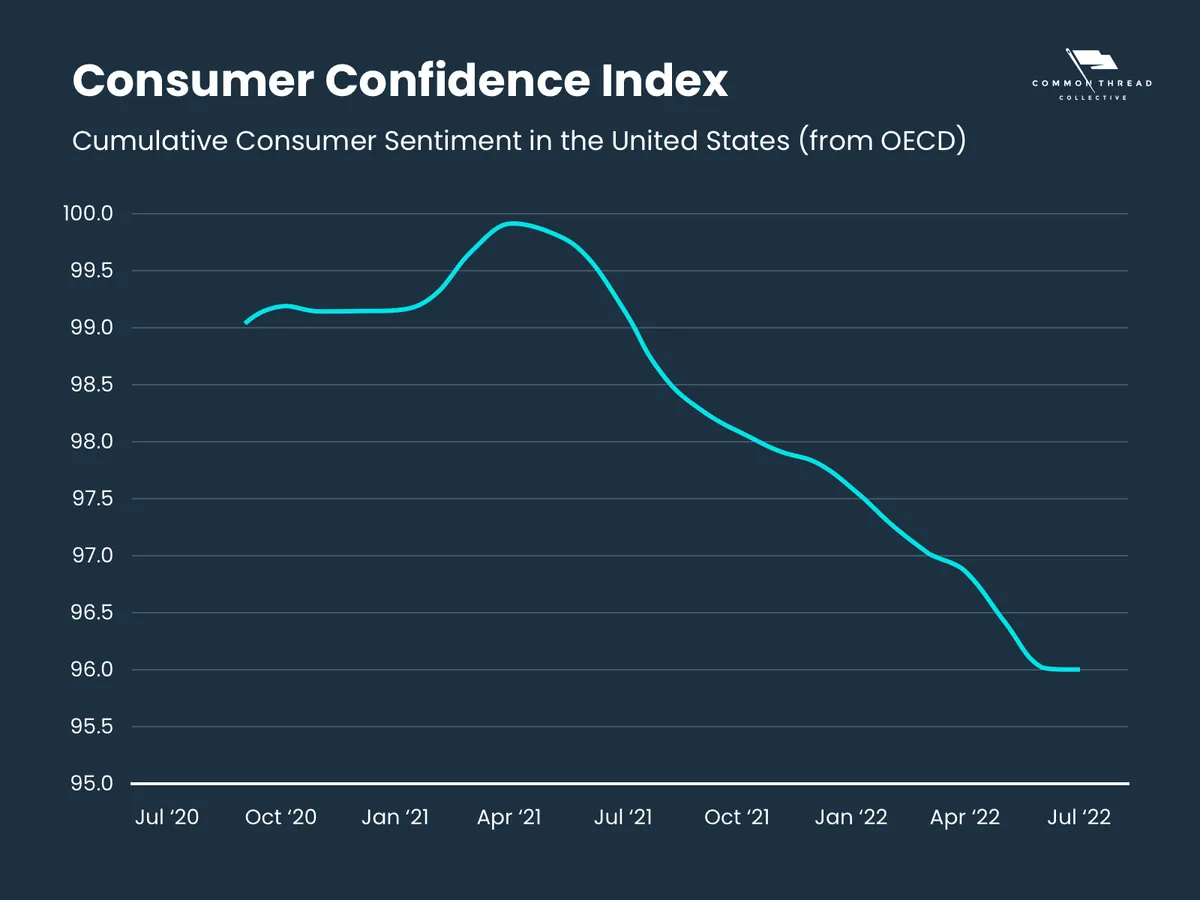

The Conference Board, a non-profit organization established in 1916, is set to publish its monthly consumer confidence index on Tuesday. Analysts anticipate the August 2024 reading to reach 101.8, surpassing the July figure of 100.3. This index, which is utilized in over 50 countries worldwide, provides a barometer of consumer attitudes and spending intentions. A score exceeding 90 typically indicates a robust economy.

On Thursday, the Commerce Department will unveil an updated estimate of the U.S. gross domestic product (GDP) for the second quarter of 2024. Economists project an annualized growth rate of 2.8% for the April-June period, marking an improvement from the 1.4% growth observed in the first quarter. It's worth noting that GDP, first developed by Simon Kuznets for a U.S. Congress report in 1934, has become a fundamental measure of economic performance.

The week concludes with the Commerce Department's release of the latest consumer spending and inflation data on Friday. Forecasts suggest that the Personal Consumption Expenditures (PCE) Price Index, the Federal Reserve's preferred inflation gauge, will show a year-over-year increase of 2.5% in July 2024. This figure aligns with the previous month's reading and approaches the Federal Reserve's target inflation rate of 2%, which was officially adopted in 2012.

The Federal Reserve, established in 1913 in response to financial crises, has been actively combating inflation through a series of interest rate hikes. Current rates stand at their highest levels in 22 years, reflecting the central bank's commitment to its dual mandate of maximum employment and price stability, established in 1977.

These upcoming reports will be closely scrutinized for their potential impact on future monetary policy decisions. The U.S. economy has demonstrated resilience, having experienced 34 recessions since 1854 and emerging from the longest expansion in its history, which lasted 128 months from June 2009 to February 2020.

As economists and policymakers analyze these indicators, they will be mindful of historical context. The U.S. has faced significant economic challenges in the past, including three periods of deflation and a peak inflation rate of 23.7% in June 1920. The data released in the coming week will contribute to ongoing discussions about the economy's trajectory and the effectiveness of current policies in maintaining stability and growth.