Meta's Q2 Success Overshadowed by Regulatory Challenges and User Growth Concerns

Meta Platforms reports strong Q2 2024 results, but faces slowing user growth and regulatory scrutiny. Recent fines and concerns about illegal drug ads raise questions about the company's future stability.

Meta Platforms, the tech giant formerly known as Facebook, has reported impressive financial results for the second quarter of 2024, with revenue growing 22% year-over-year to $39 billion. This growth rate surpasses that of its competitor Alphabet, demonstrating Meta's continued dominance in the digital advertising space.

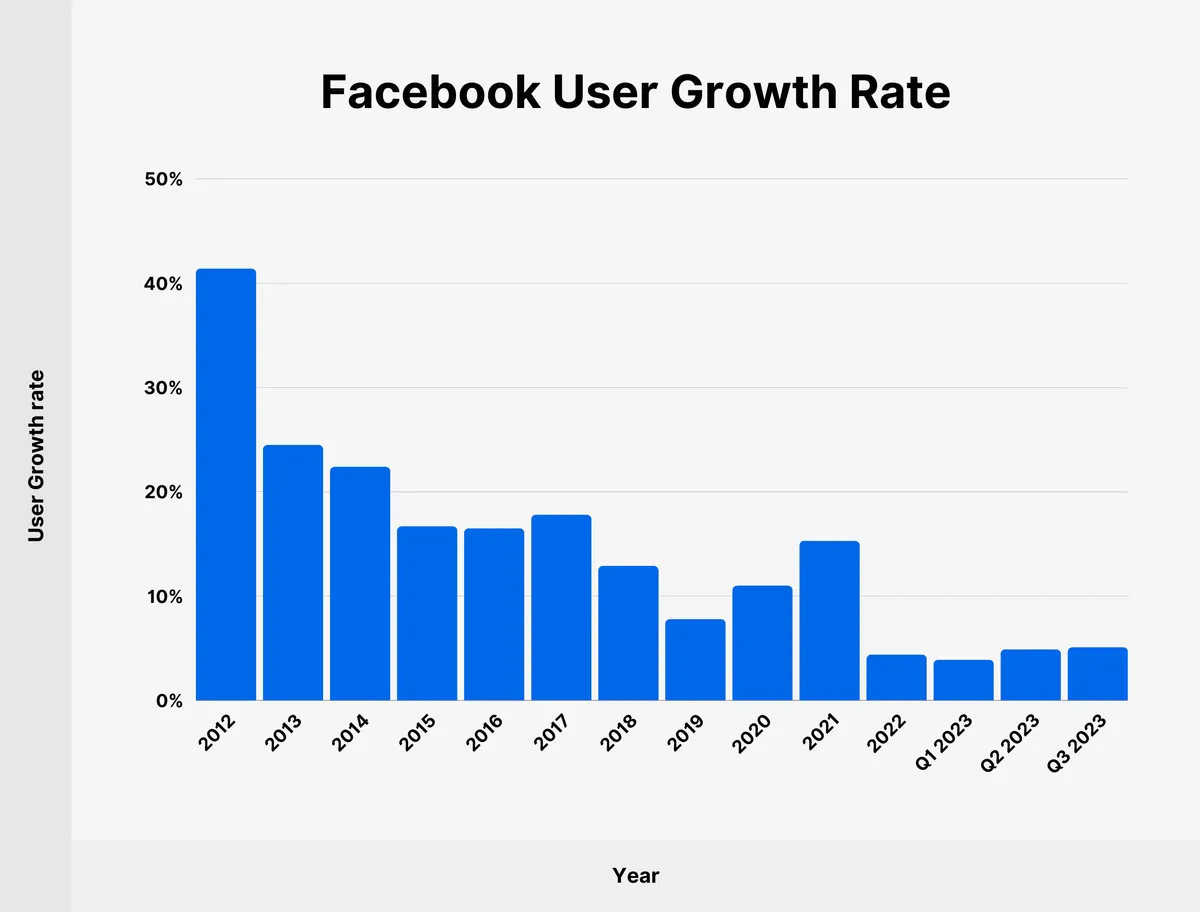

However, beneath the surface of these strong financials lie potential concerns for the company's future. The growth in two critical metrics - engaged users and ad impressions - has shown signs of deceleration. Daily active users across Meta's platforms, including Facebook and Instagram, remained relatively stagnant compared to the previous quarter. Additionally, the growth in ad impressions has slowed to just one-third of the rate observed last year.

Despite these challenges, Meta has managed to increase its profitability. The average price per ad rose by 10%, while the operating margin improved by 9 percentage points to 38%. As a result, net income surged by 73% to over $13 billion.

Meta's success in monetizing its user base has been driven by its sophisticated ad targeting capabilities, which rely on extensive data collection. However, this practice has attracted significant regulatory scrutiny. The company has faced numerous fines and legal challenges in recent years:

- July 30, 2024: $1.4 billion settlement with Texas over facial-recognition technology

- 2023: 1.2 billion euro fine for violating European Union privacy laws

- 2019: $5 billion fine imposed by the U.S. Federal Trade Commission for data misuse

While these fines may seem manageable given Meta's projected profits of over $110 billion for 2024 and 2025 combined, the cumulative effect of regulatory actions could pose a significant threat to the company's future.

"Our business is strong because advertisers use our services to grow and thrive."

Adding to Meta's challenges, recent reports have raised concerns about the platform's role in facilitating illegal activities. The Wall Street Journal reported that ads on Meta's platforms have been used to direct users to sellers of illegal drugs, including cocaine and opioids. This has prompted federal authorities to investigate the company's involvement in narcotics sales.

Meta has responded to these allegations, stating that they have "strict rules about the type of content that can be advertised on our platforms, and we reject hundreds of thousands of ads for violating our policies." However, the ongoing scrutiny and potential for further regulatory action may eventually lead investors to reassess their confidence in the company's long-term prospects.

As Meta continues to navigate these complex challenges, the tech giant must balance its pursuit of growth and profitability with the need to address regulatory concerns and maintain user trust. The coming months and years will be crucial in determining whether Meta can sustain its current success while adapting to an increasingly scrutinized digital landscape.