Montana's Sole Platinum-Palladium Mines Face Massive Layoffs Amid Price Slump

Sibanye-Stillwater announces plans to lay off 700 employees at its Montana mines due to plummeting palladium prices. U.S. Senators propose legislation to ban Russian mineral imports in response.

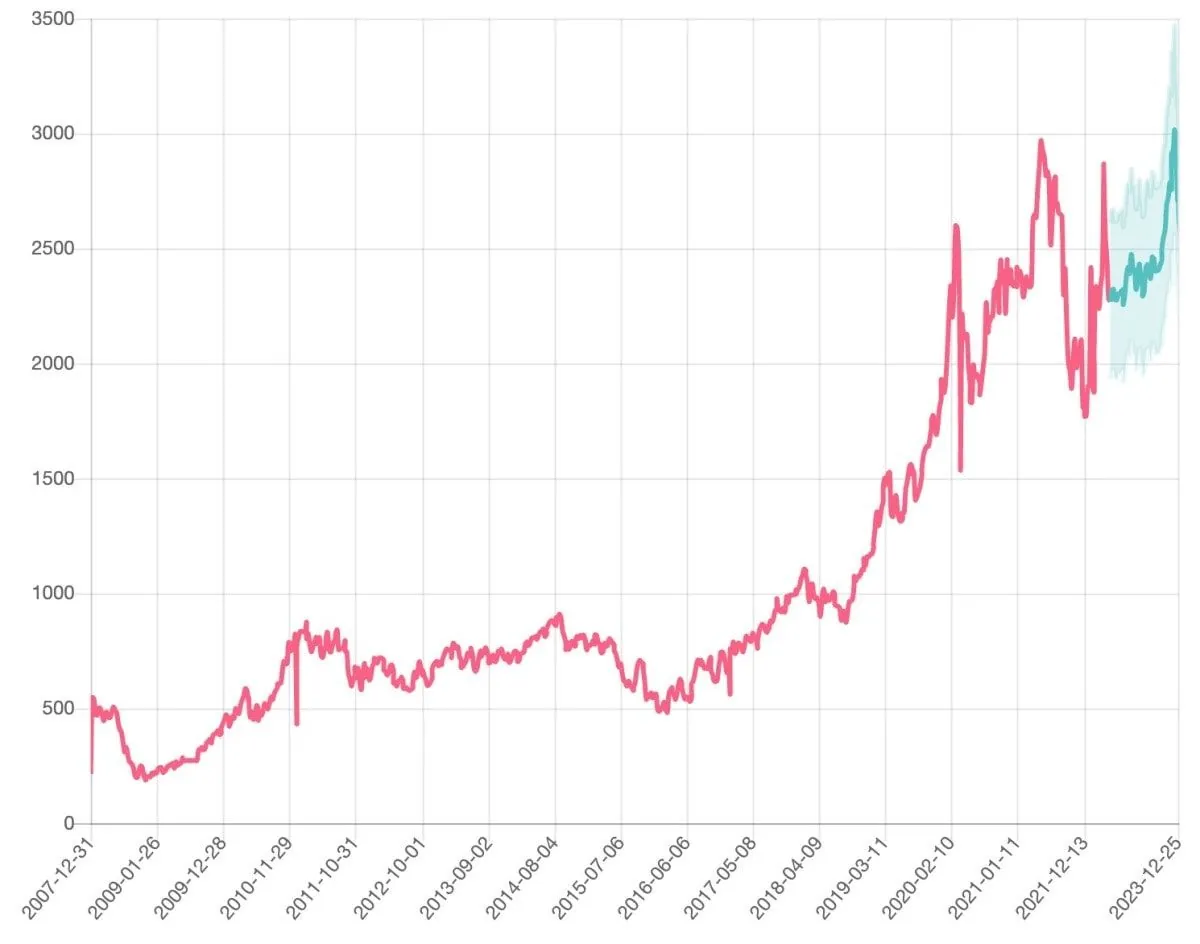

In a significant development for the U.S. precious metals industry, Sibanye-Stillwater, the owner of the nation's only platinum and palladium mines, has announced plans to lay off approximately 700 employees at its Montana operations. This decision comes as a result of the sharp decline in palladium prices, which have fallen from about $2,300 an ounce two years ago to below $1,000 an ounce in the past three months.

Kevin Robertson, Executive Vice President of Sibanye-Stillwater, attributed the price drop to potential market manipulation, stating, "We believe Russian dumping is a cause of this sharp price dislocation." This assertion is based on Russia's dominant position in the global palladium market, producing over 40% of the world's supply.

The company's Montana mine complex, which includes operations near Nye and Big Timber, has been grappling with financial challenges. Since the beginning of 2023, the complex has incurred losses exceeding $350 million, despite efforts to reduce production costs. As a result, Sibanye-Stillwater is implementing drastic measures, including pausing operations at Stillwater West and scaling back activities at East Boulder and the Columbus smelting and refining facilities.

In response to the situation, Montana's U.S. Senators Steve Daines and Jon Tester have announced plans to introduce legislation prohibiting the import of critical minerals from Russia, including platinum and palladium. This bipartisan effort aims to protect domestic producers and address concerns about market manipulation.

The mining industry plays a crucial role in Montana's economy, with the state nicknamed "The Treasure State" due to its rich mineral resources. The Stillwater Complex, where these mines are located, is a geological formation dating back approximately 2.7 billion years, highlighting the area's long-standing importance in mineral production.

"We believe Russian dumping is a cause of this sharp price dislocation. Russia produces over 40% of the global palladium supply, and rising imports of palladium have inundated the U.S. market over the last several years."

This announcement follows previous cost-cutting measures implemented by the company in 2023, including the suspension of an expansion project and the elimination of 100 positions. The current situation underscores the volatility of the palladium market, which is influenced by factors such as automotive industry demand and the shift towards electric vehicles.

As the global palladium market faces uncertainties, the recycling of catalytic converters has become an increasingly important source of supply. This development, coupled with potential changes in automotive technology, may have long-term implications for the industry and the communities that depend on it.

The layoffs at Sibanye-Stillwater's Montana operations serve as a stark reminder of the challenges facing the U.S. precious metals industry and the broader economic impacts of global market dynamics.