Navigating Mortgage Options: Refinance or Prepay?

Recent mortgage rate drops spark refinancing interest. Explore alternatives like prepayment for those unable to refinance. Learn tips for smart refinancing decisions and the importance of understanding loan terms.

The recent decline in mortgage rates has caught the attention of homeowners, particularly those who secured loans during the peak rates of nearly 8% last year. This shift, influenced by the Federal Reserve's half-point rate reduction in September 2024, has opened up new possibilities for homeowners to potentially lower their monthly payments.

As of October 3, 2024, the average 30-year fixed-rate loan stands at 6.12%, a significant drop from 7.49% a year ago, according to Freddie Mac. This change has led to increased refinancing activity, offering opportunities for many to reduce their monthly mortgage payments.

For those unable or unwilling to refinance, there are alternative methods to effectively lower interest payments. One such option is prepaying the mortgage principal.

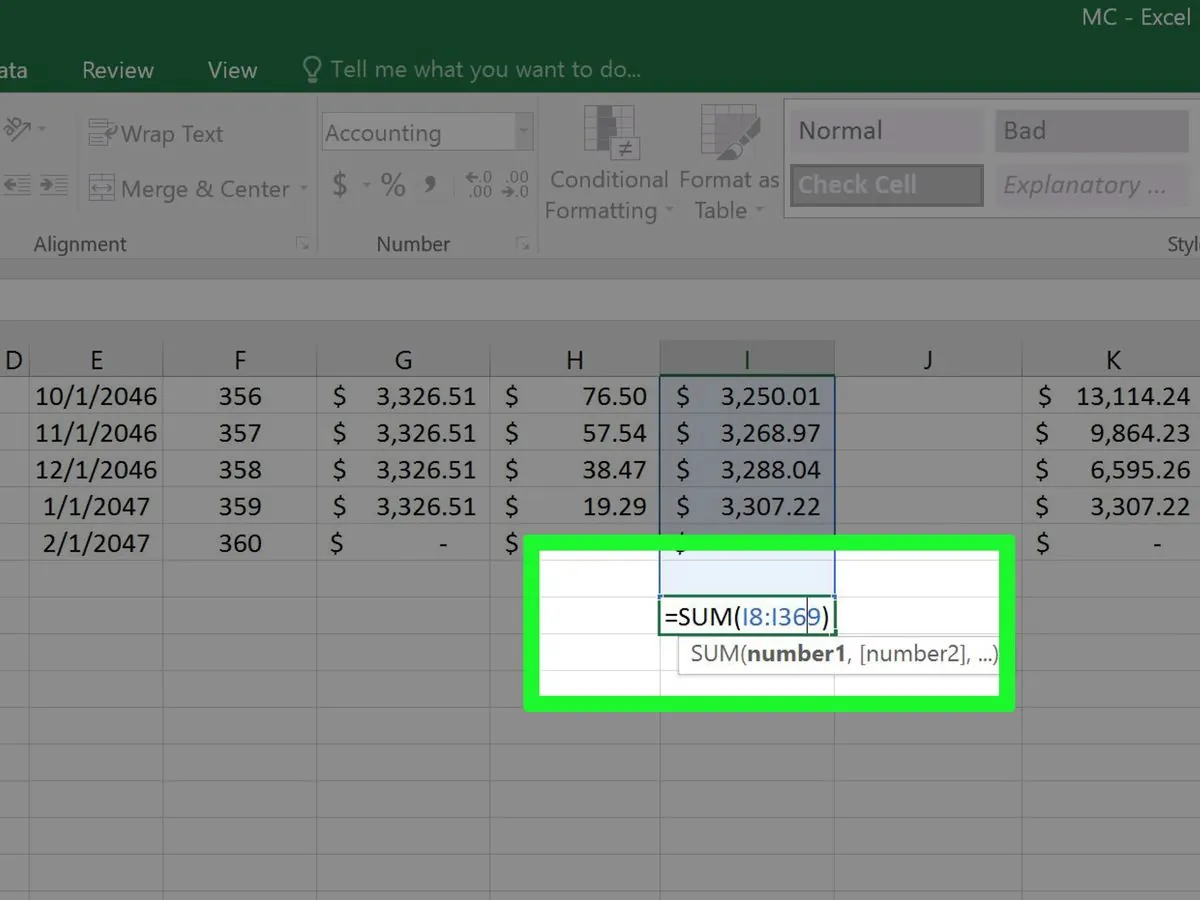

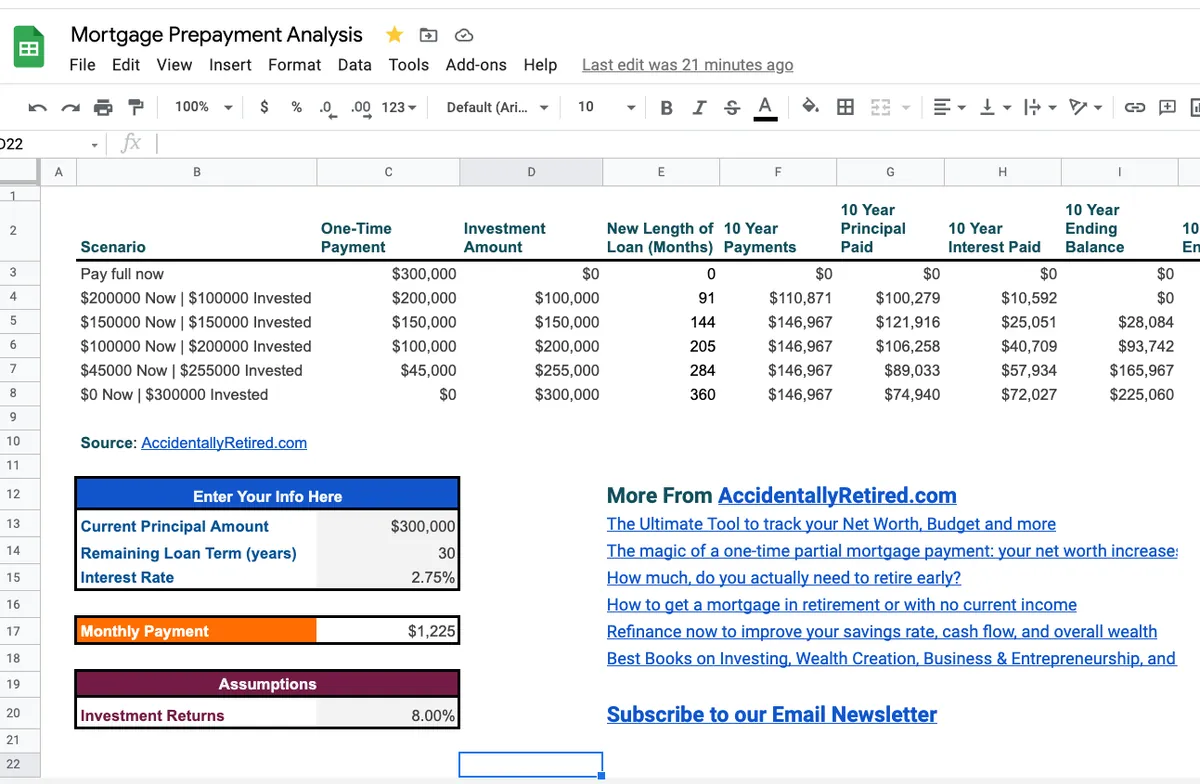

Prepayment involves making additional payments towards the principal balance of the mortgage. This strategy can lead to substantial interest savings over time and reduce the effective interest rate. For example, using the PreFi calculator from HSH.com, a $400,000 30-year fixed-rate mortgage at 8% taken out on October 19, 2023, could benefit from an extra $200 monthly principal payment. This approach would reduce the loan term by nearly six years and save over $145,000 in interest, effectively lowering the interest rate to 6.42%.

"Given the downward trajectory of rates, refinance activity continues to pick up, creating opportunities for many homeowners to trim their monthly mortgage payment."

For those considering refinancing, it's crucial to compare offers and understand the long-term implications. Ilyce R. Glink, author of "100 Questions Every First-Time Home Buyer Should Ask," advises caution when evaluating "no-cost" loans, as these often involve rolling refinancing costs into the loan, potentially increasing overall interest payments.

When shopping for refinancing options, homeowners should:

- Check current average rates published by Freddie Mac

- Compare offers from multiple lenders

- Consider personal factors affecting loan terms

- Calculate long-term costs and break-even points

It's important to note that the mortgage landscape has evolved significantly since the establishment of the Federal Reserve in 1913. The introduction of mortgage-backed securities in the 1970s and the creation of entities like Freddie Mac in 1970 have shaped the modern mortgage market. Understanding these historical contexts can provide valuable insights into current mortgage trends and options.

Ultimately, whether choosing to prepay or refinance, homeowners should carefully analyze their financial situation and long-term goals. By doing so, they can make informed decisions that align with their financial objectives and potentially save significant amounts over the life of their loan.