Pakistan Secures Major Financial Backing from China, Saudi Arabia, and UAE

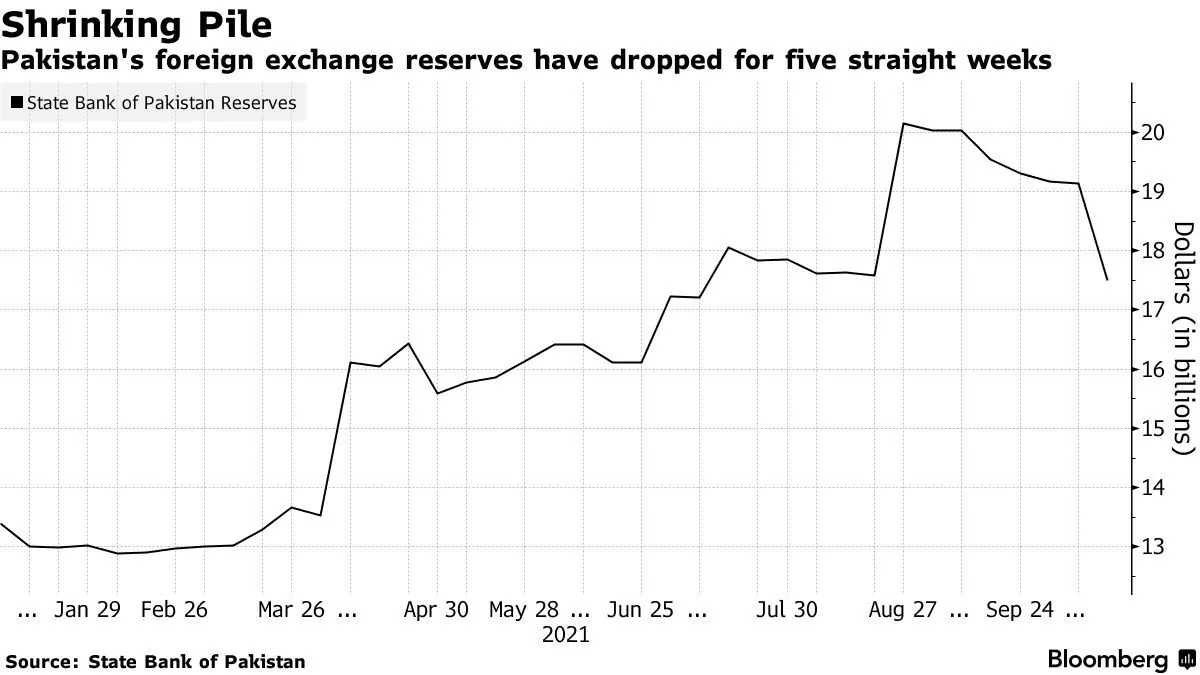

Pakistan obtains significant financial assurances from key allies, surpassing a $12 billion loan rollover. IMF approves a new $7 billion loan program, marking the country's 23rd bailout since 1958.

Pakistan has secured substantial financial support from China, Saudi Arabia, and the United Arab Emirates (UAE), according to an International Monetary Fund (IMF) official. This backing extends beyond the previously announced $12 billion bilateral loan rollover, signifying a significant boost for the South Asian nation's economy.

Nathan Porter, the IMF Pakistan Mission Chief, confirmed these developments but refrained from disclosing specific amounts. The assurances are linked to a newly approved IMF program for Pakistan, which includes a $7 billion loan over 37 months. This marks Pakistan's 23rd IMF bailout since 1958, highlighting the country's recurring economic challenges.

As the world's fifth-most populous country, Pakistan's economy faces numerous hurdles. The nation heavily relies on textile exports and remittances from overseas workers for foreign exchange. However, its low tax-to-GDP ratio and substantial informal economy have been persistent concerns for international lenders.

The new IMF program mandates "sound policies and reforms" to enhance macroeconomic stability. This aligns with Pakistan's ongoing efforts to expand its tax base, digitize its economy, and attract foreign direct investment. The country has been implementing various economic reforms to meet IMF conditions, including measures to address its energy sector issues, which have been a significant drain on the economy.

Pakistan's strategic location makes it crucial for regional trade routes, exemplified by the development of Gwadar port as part of China's Belt and Road Initiative. However, the nation faces challenges due to climate change, including floods and droughts, which impact its significant agricultural sector.

The financial assurances from China, Pakistan's largest bilateral creditor, along with Saudi Arabia and the UAE, major oil suppliers to the country, demonstrate the complex geopolitical and economic relationships at play. These commitments are expected to provide much-needed stability to Pakistan's economy, which has grappled with currency devaluation and a high debt-to-GDP ratio in recent years.

As Pakistan works towards economic recovery, it continues to balance its relationships with global financial institutions and regional allies. The success of this latest financial package and reform program will be crucial in determining the country's economic trajectory in the coming years.