Pennsylvania Court Dismisses Landowners' Royalty Underpayment Lawsuit Against Gas Companies

A federal judge in Pennsylvania has ruled against landowners in a lawsuit accusing natural gas companies of underpaying royalties. The decision, citing lack of standing for antitrust claims, allows 28 days for an amended filing.

In a significant legal development for the natural gas industry, a federal judge in Scranton, Pennsylvania, has dismissed a lawsuit filed by landowners against several natural gas exploration and production companies. The ruling, issued on September 1, 2024, marks a victory for the defendants, including Anadarko and other firms operating in the Marcellus Shale region.

The case, initially filed in 2015, accused the companies of underpaying royalties to property owners who hold interests in thousands of acres of leased land. The plaintiffs, comprising dozens of individuals and family trusts, alleged that the defendants had divided geographic markets among themselves to minimize competition for gas mineral rights, operating rights, and gathering services.

U.S. District Judge Karoline Mehalchick ruled that the plaintiffs lacked standing to pursue claims under federal antitrust law. Moreover, she determined that the landowners failed to demonstrate that the companies had agreed to form an enterprise to defraud them. The judge stated that the lawsuit "does not support that each defendant was even aware of each other's conduct, never mind had a unity purpose."

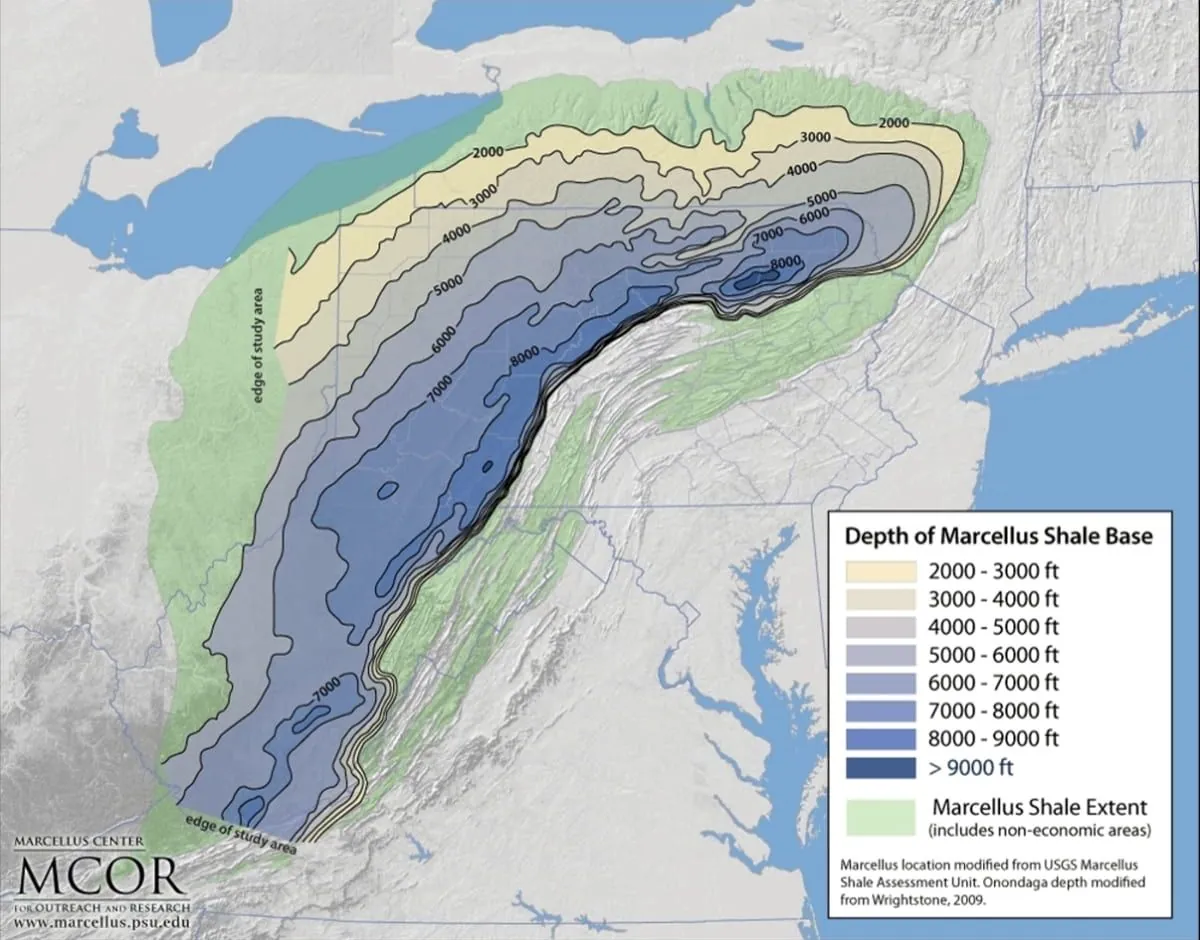

The Marcellus Shale, a sedimentary rock formation rich in natural gas, extends through several states, including Pennsylvania, Ohio, and West Virginia. It has been a significant source of natural gas production since the early 2000s, contributing to the United States becoming the world's largest natural gas producer in 2011.

The plaintiffs in this case hold royalty interests in natural gas produced from more than 12,000 acres of land. Royalties in the oil and gas industry typically range from 12.5% to 20% of the value of produced oil or gas, with Pennsylvania's Oil and Gas Lease Act setting a minimum royalty payment of 12.5%.

The lawsuit claimed that the gas companies imposed "unreasonable and artificially inflated gas gathering and transportation fees," which reduced royalty payments. Natural gas gathering systems, consisting of pipelines that transport raw natural gas from wellheads to processing facilities, play a crucial role in the industry's operations.

Judge Mehalchick dismissed both antitrust claims and alleged violations of federal racketeering law, known as the Racketeer Influenced and Corrupt Organizations (RICO) Act. The plaintiffs have been given 28 days, until September 29, 2024, to file an amended lawsuit.

It's worth noting that Occidental Petroleum, which acquired Anadarko in 2019 for $38 billion, was not a defendant in this case, having been dropped from the lawsuit last year. The remaining defendants, including Anadarko and Williams Partners (formerly known as Access Midstream Partners), have consistently denied any wrongdoing.

In April 2024, Anadarko argued that the landowners were attempting "to turn a basic contract dispute over royalty payments into an antitrust scheme." The company maintained that the plaintiffs had failed to demonstrate how "unrelated, legitimate business agreements" amounted to an antitrust violation.

This case highlights the ongoing legal challenges faced by the natural gas industry, particularly concerning landowner rights and royalty payments. As the industry continues to play a significant role in Pennsylvania's economy, the outcome of this lawsuit and any potential appeals could have far-reaching implications for both gas companies and property owners in the region.