S&P Upgrades Saudi Arabia's Outlook, Citing Economic Diversification Efforts

S&P Global Ratings revised Saudi Arabia's outlook to positive, highlighting strong non-oil growth and economic resilience. The upgrade reflects potential for further reforms and investments in diversifying the economy.

S&P Global Ratings has revised Saudi Arabia's economic outlook from stable to positive, reflecting the kingdom's efforts to diversify its economy and strengthen its non-oil sectors. This adjustment, announced on September 13, 2024, underscores the country's economic resilience and potential for further growth.

The positive outlook is attributed to the Saudi government's ongoing reforms and investments aimed at developing non-oil industries. Saudi Arabia, the world's largest oil exporter, has been actively pursuing economic diversification through its Vision 2030 initiative, launched in 2016 by Crown Prince Mohammed bin Salman. This ambitious plan seeks to reduce the country's dependence on oil revenues and create a more sustainable economic model.

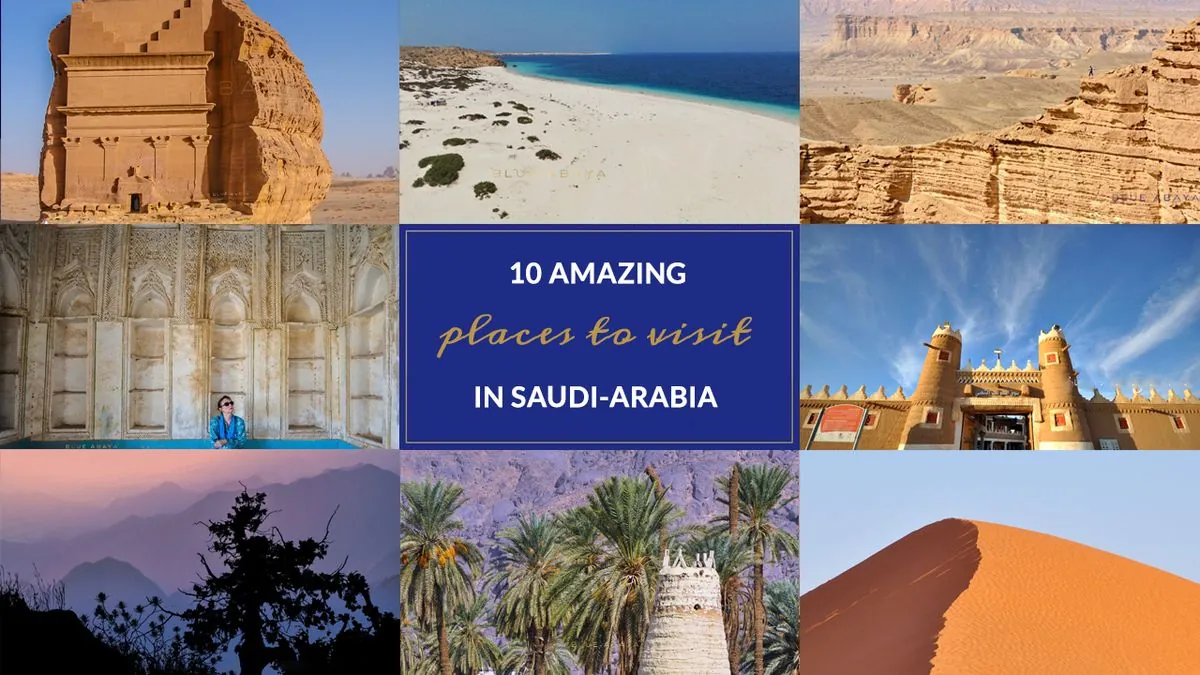

S&P anticipates an acceleration of investments in emerging sectors, particularly tourism. The kingdom aims to increase tourism's contribution to GDP to 10% by 2030, with plans to invest $1 trillion in the sector and attract 100 million annual visitors. This push towards tourism diversification is part of a broader strategy to create new revenue streams and job opportunities for Saudi citizens.

While the non-oil private sector has shown promising growth, expanding by 5.9% in 2022, the hydrocarbon sector and Saudi Aramco, the world's largest oil company by revenue, continue to play a crucial role in the kingdom's economy. Saudi Arabia possesses 18% of the world's proven petroleum reserves and is home to the second-largest proven oil reserves globally.

The country's economic outlook is further bolstered by its relatively low inflation rates compared to global levels. S&P expects inflation to remain steady, with interest rates likely to move in tandem with the U.S. Federal Reserve rates. This economic stability is crucial for attracting foreign investment and fostering growth in non-oil sectors.

"We expect to see an acceleration of investments to develop newer industries, such as tourism, and diversify the economy away from its primary reliance on the upstream hydrocarbon sector."

As part of its Vision 2030 goals, Saudi Arabia aims to reduce unemployment to 7% and increase women's participation in the workforce to 30% by 2030. These targets reflect the kingdom's commitment to creating a more inclusive and diverse economy.

The country's efforts to diversify its economy have already yielded some results. In 2019, Saudi Arabia opened its doors to international tourists for the first time, marking a significant shift in its approach to global engagement and economic development.

S&P's decision to affirm Saudi Arabia's ratings at "A/A-1" further underscores the kingdom's economic stability and potential for growth. As the largest economy in the Middle East, with a GDP estimated at $1.0 trillion in 2022, Saudi Arabia's economic trajectory is of significant interest to global investors and policymakers.

The continued execution of Vision 2030 initiatives is expected to support strong non-oil growth over the medium term, potentially reshaping the kingdom's economic landscape and its role in the global economy.