Stellantis Slashes Forecast Amid Industry Challenges and Restructuring

Stellantis, the global auto giant, cuts earnings forecast due to U.S. operations overhaul and industry headwinds. The company accelerates inventory reduction and faces pressure in key markets.

Stellantis, the world's fourth-largest automaker, has announced a significant reduction in its earnings forecast, citing the need for substantial investments to revitalize its U.S. operations amidst a broader industry downturn and intensifying competition from Chinese manufacturers.

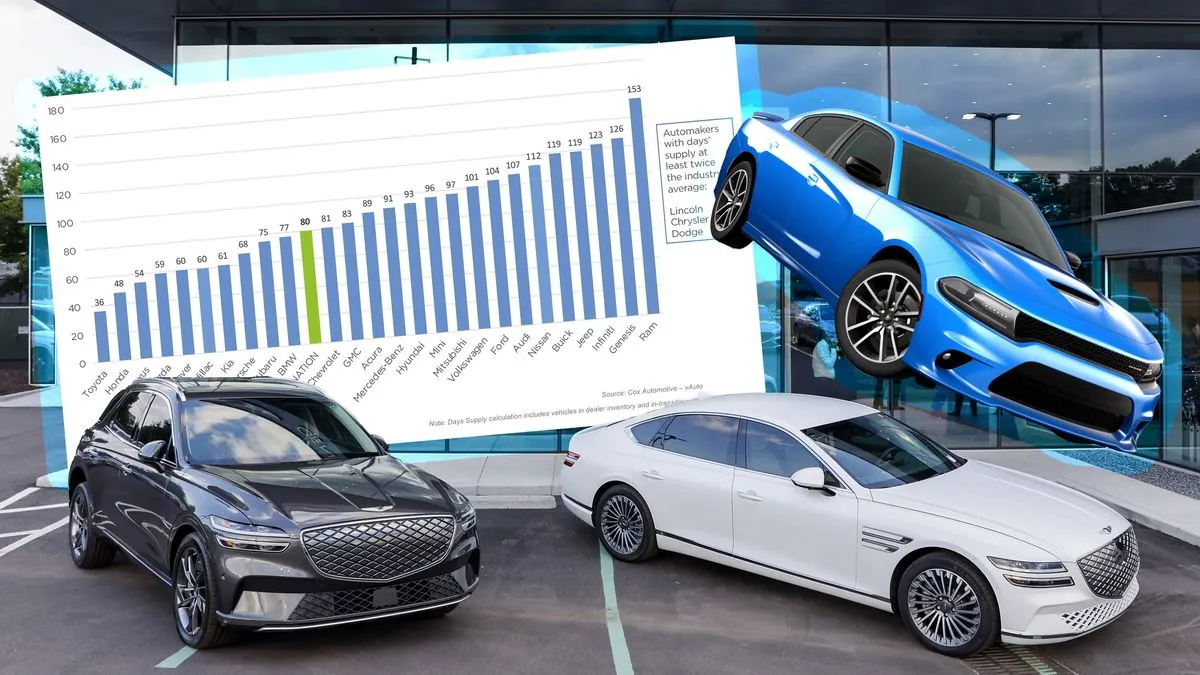

The company, formed in 2021 through the merger of PSA Peugeot and Fiat Chrysler Automobiles, is accelerating its efforts to transform its North American business. A key aspect of this strategy involves rapidly reducing dealer inventory levels to no more than 300,000 vehicles by the end of 2024, a target previously set for the first quarter of 2025.

This aggressive inventory reduction is expected to result in a decrease of 200,000 vehicle shipments in the second half of 2024 compared to the previous year, double the company's initial projection. To facilitate this process, Stellantis plans to offer increased incentives on 2024 and older models.

The financial implications of these strategic moves are significant. Stellantis now anticipates finishing the year with a negative cash flow ranging from €5 billion to €10 billion, a stark contrast to its previous expectation of a positive cash flow. Additionally, the company has revised its operating profit margin guidance downward to 5.5% to 7.0%, abandoning its earlier double-digit forecast.

These challenges come at a time when Stellantis is actively searching for a new CEO to succeed Carlos Tavares, who has faced criticism from U.S. dealers and the United Auto Workers union following a disappointing first-half financial performance. The company has characterized this search as part of a normal leadership succession plan.

"The search for a new CEO is part of our ongoing commitment to ensuring strong and effective leadership for the company's future."

The automaker's struggles extend beyond North America. In Italy, home to one of its major shareholders, Stellantis is grappling with production cuts that have prompted autoworkers to announce a one-day strike scheduled for October 18, 2024.

The company's financial results reflect these challenges, with first-half net profits down 48% compared to the same period in the previous year. In the United States, a crucial market for Stellantis, first-half sales declined by nearly 16%, despite an overall 2.4% increase in new vehicle sales across the industry.

As Stellantis navigates these turbulent waters, it's worth noting that the company operates 14 automotive brands and has a global workforce of approximately 300,000 people. The automaker has set ambitious goals for electrification, aiming for 100% of its European sales and 50% of its U.S. sales to be battery electric vehicles by 2030.

The company's challenges in the U.S. market are particularly significant given that North America is one of its largest markets. However, Stellantis has been making strides in other areas, including investments in battery production facilities and the development of hydrogen fuel cell vehicles for commercial applications.

As the automotive industry continues to evolve, Stellantis is also exploring new mobility solutions, including car-sharing services and subscription models. These initiatives, coupled with its efforts to achieve carbon net zero emissions by 2038, demonstrate the company's commitment to adapting to changing market dynamics and environmental concerns.

The road ahead for Stellantis appears challenging, but the company's diverse brand portfolio and global presence provide a foundation for potential recovery and growth. As the search for new leadership continues and restructuring efforts progress, industry observers will be closely watching the automaker's performance in the coming months.