Student Loan Forgiveness: Challenges and Advice for Borrowers

Amid ongoing legal battles over student loan forgiveness, borrowers face uncertainty. This article examines the current state of loan relief programs and offers guidance for those affected by recent developments.

The ongoing debate surrounding student loan forgiveness continues to intensify, with borrowers caught in the crossfire of political and legal battles. As of 2024, the Biden administration has forgiven over $167 billion in college debt, yet millions of Americans remain burdened by educational loans.

The issue gained prominence during a recent presidential debate between Vice President Kamala Harris and former president Donald Trump. Trump criticized the administration's forgiveness efforts, describing them as a "total catastrophe" and accusing them of taunting young people with false promises of relief.

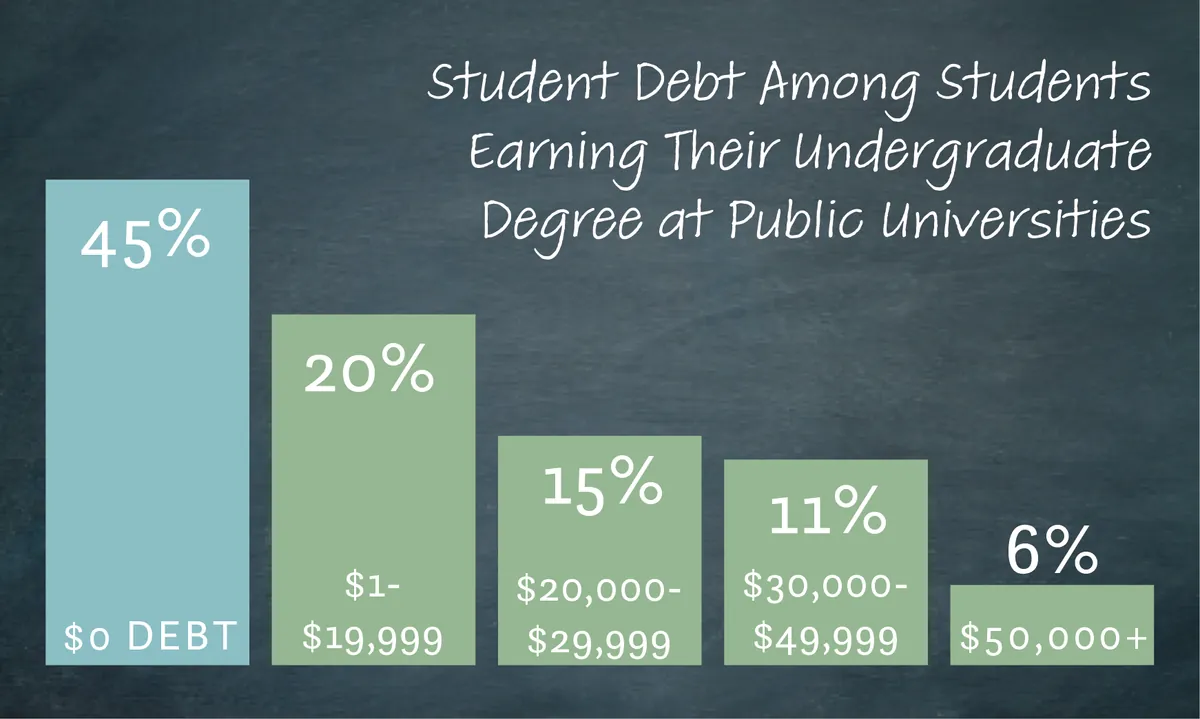

While the debate over loan forgiveness rages on, it's crucial to understand the complexities of the situation. According to the Federal Reserve, the median education debt in 2023 ranged from $20,000 to $24,999. This statistic underscores the significant financial burden faced by many Americans pursuing higher education.

Critics of loan forgiveness often overlook the legitimate reasons for government intervention. Many borrowers, including young adults, fell victim to deceptive practices by for-profit colleges or received misleading advice from loan servicers. These circumstances have left countless individuals struggling with overwhelming debt.

"We have reached a $120 million settlement with Navient over allegations of steering borrowers to costly repayment options."

This settlement highlights the ongoing issues within the student loan industry and the need for increased oversight and protection for borrowers.

The Public Service Loan Forgiveness Program (PSLF), established in 2007, aims to encourage public service work by forgiving loans after 120 qualifying monthly payments. However, the program has faced numerous challenges, with many borrowers discovering their ineligibility after years of payments due to various technicalities.

For those enrolled in the Saving on a Valuable Education (SAVE) Plan, recent legal challenges have resulted in a temporary pause on payments. While this provides short-term relief, it also creates uncertainty about the program's future.

Borrowers should consider the following advice based on their specific situations:

- For PSLF participants: Continue making payments under current guidelines to avoid delaying forgiveness.

- For SAVE Plan enrollees: Take advantage of the interest-free forbearance, but consider saving the payment amounts for potential future use.

- For those affected by blocked forgiveness programs: Explore alternative repayment options with loan servicers to find the most affordable solution.

It's important to note that student loan debt in the United States has reached unprecedented levels. As of 2024, total student loan debt exceeds $1.7 trillion, affecting approximately 43 million Americans. This staggering figure represents a 144% increase over the past decade, highlighting the growing crisis in educational financing.

While the debate over forgiveness continues, borrowers should remain proactive in managing their loans. The average time to repay student loans is 20 years, emphasizing the long-term impact of these financial obligations. By staying informed and exploring all available options, borrowers can navigate this challenging landscape more effectively.

As legal challenges persist and political debates intensify, the future of student loan forgiveness remains uncertain. Borrowers are advised to hope for the best but prepare for the worst, ensuring they have a solid financial plan regardless of potential relief measures.