Taiwan's Stock Market Surges, Defying Regional Trends and Geopolitical Tensions

Taiwan's stock market outperforms Asian peers, driven by tech giants like TSMC. Despite geopolitical risks, foreign investment surges, boosting Taiwan's presence in global indices and attracting diverse international investors.

Taiwan's stock market has demonstrated remarkable resilience and growth, outpacing its regional counterparts and global benchmarks. The MSCI Taiwan index has surged by 28% year-to-date as of August 12, 2024, more than doubling the gains of the S&P 500.

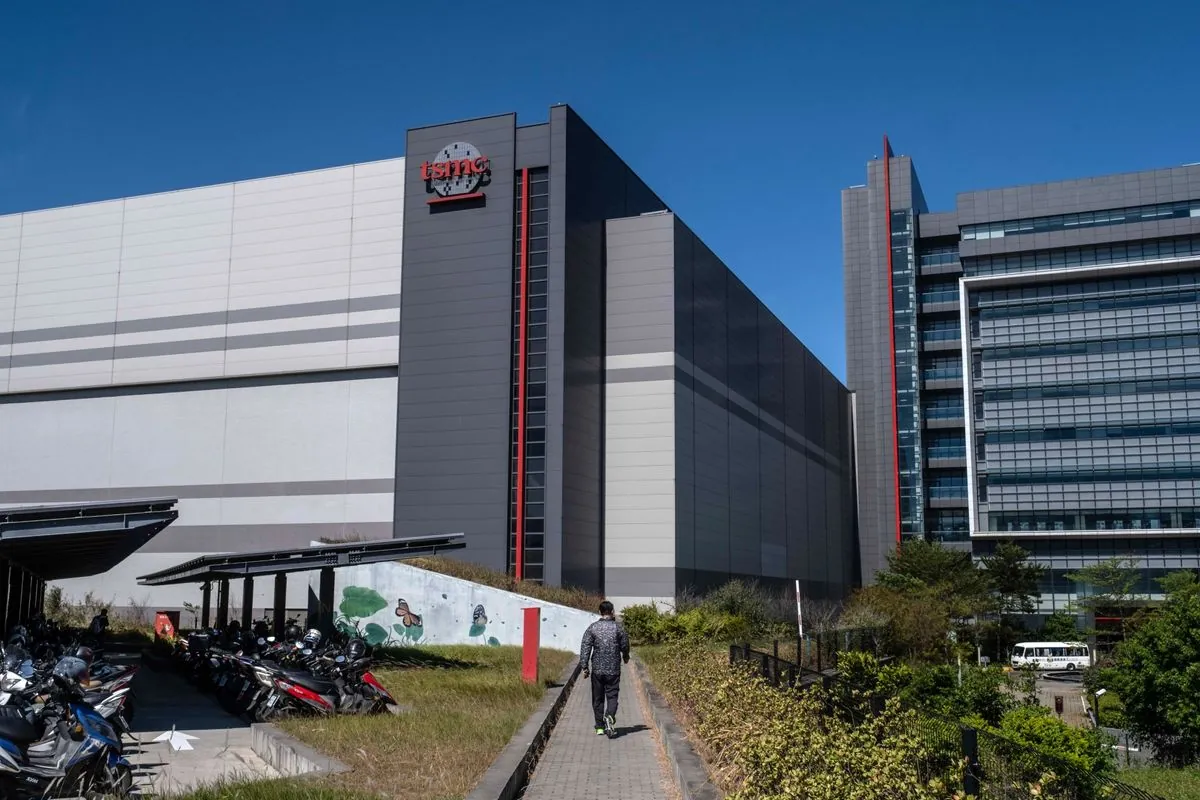

This impressive performance is largely attributed to the success of Taiwan Semiconductor Manufacturing Company (TSMC), the world's largest dedicated independent semiconductor foundry. TSMC's shares have rallied nearly 60% this year, contributing significantly to the index's growth. With a market capitalization of $748 billion, TSMC now accounts for over half of the MSCI Taiwan index and surpasses the size of Taiwan's entire economy.

Other Taiwanese tech companies have also experienced substantial growth. Hon Hai Precision Industry, better known as Foxconn, has seen its shares rise by 62% in 2024, further bolstering the index's performance.

This market surge occurs against a backdrop of ongoing geopolitical tensions between Taiwan and mainland China. Despite the Cross-Strait Risk Index compiled by Goldman Sachs remaining near all-time highs, investors appear to be prioritizing tangible profits over potential risks.

The robust performance of Taiwanese stocks has led to increased foreign investment and capital inflows. Taiwan's growing presence in major global indices, such as the MSCI All World Index and MSCI Emerging Markets Index, has attracted a diverse range of international investors, including global long-only investors, insurers, and hedge funds.

This heightened interest has resulted in over $6 billion worth of equity and convertible bond sales in 2024, according to Dealogic. The head of Asia Pacific banking at a prominent Wall Street firm noted the ease of selling these offerings, highlighting the strong demand for exposure to Taiwanese companies.

Taiwan's economic success is rooted in its strong technology sector, with the island nation producing over 60% of the world's semiconductors. The country's high-tech industrial parks, such as Hsinchu Science Park, have earned Taiwan the moniker "Silicon Valley of Taiwan."

As Taiwan's stock market capitalization exceeds $1.5 trillion in 2024, it solidifies its position as one of the largest in Asia. This growth reflects the nation's status as one of the "Four Asian Tigers" alongside Hong Kong, Singapore, and South Korea.

While the Taiwanese market's ascent is welcomed by deal-starved Asia-based bankers, some investors may question the sustainability of this growth given the relatively small size of Taiwan's underlying market. However, for now, the strong performance of Taiwanese equities continues to attract global attention and investment.