Trump Media Shares Plummet Following Presidential Debate and Swift's Endorsement

Trump Media & Technology stock dropped over 10% post-debate. With a lockup period ending soon, Trump's $2 billion stake faces uncertainty amid the company's financial struggles.

In a significant market development, shares of Donald Trump's media venture experienced a sharp decline following a high-stakes presidential debate. The stock of Trump Media & Technology, parent company of Truth Social, fell more than 10% on September 11, 2024, in the wake of a face-off between the former president and Vice President Kamala Harris.

This downturn comes at a crucial juncture for the company, as a six-month lockup provision is set to expire on September 19, 2024. This expiration will allow company insiders, including Trump himself, to potentially sell their newly issued shares.

According to recent Securities and Exchange Commission filings, Trump holds nearly 115 million shares in the company. Based on the closing price of $16.68 on September 11, 2024, his stake is valued at approximately $1.9 billion. However, this represents a significant decrease from the stock's peak value of $79.38 when it debuted on the Nasdaq in March 2024.

The stock's volatility has been further compounded by external factors, including pop star Taylor Swift's endorsement of Harris for president shortly after the debate concluded.

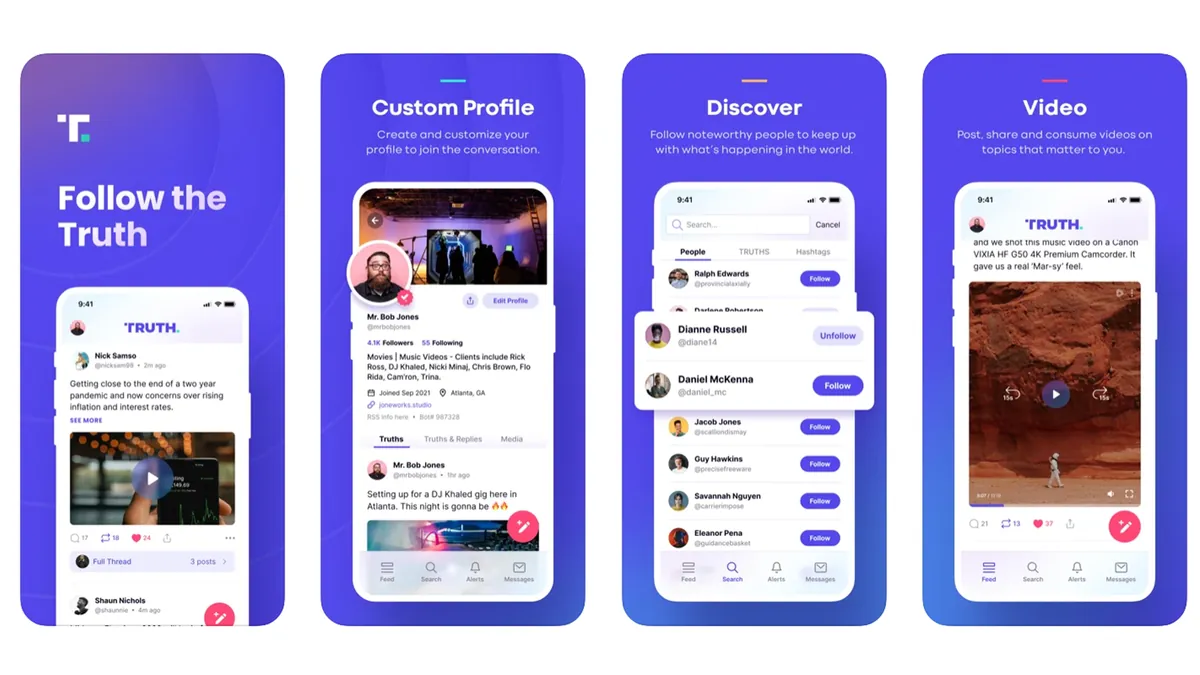

Truth Social, launched on February 21, 2022, was created in response to Trump's ban from mainstream social media platforms following the January 6, 2021 Capitol riot. The platform, developed by Trump Media & Technology Group (TMTG), uses a custom version of Mastodon, an open-source social network software.

Despite its high-profile backing, the Sarasota, Florida-based company has faced significant financial challenges. In 2023, Trump Media reported a loss of nearly $58.2 million while generating only $4.1 million in revenue. This struggle for profitability has raised concerns among investors and market analysts.

"The company's financial performance, coupled with its reliance on individual investors, classifies it as a potential meme stock. This categorization suggests a disconnect between its market valuation and traditional financial metrics."

Truth Social has encountered various obstacles since its inception, including technical issues, waitlists, and limited availability. The platform's terms of service, which prohibit users from "disparaging" the site, have also drawn criticism regarding content moderation policies.

As the lockup period nears its end, the question remains whether Trump will opt to sell any of his shares. While a sale would undoubtedly result in a substantial payout, the current stock price is significantly lower than its initial valuation.

The future of Trump Media & Technology and Truth Social remains uncertain, as the company continues to navigate financial difficulties, regulatory scrutiny, and a competitive social media landscape. With a user base significantly smaller than mainstream platforms and challenges in attracting high-profile conservative figures, the company's path forward appears fraught with obstacles.