Truth Social's Parent Company Faces Leadership Change and Legal Challenges

Trump Media & Technology Group's COO resigns as court orders share release. The company behind Truth Social grapples with financial struggles and stock volatility amidst ongoing challenges.

Trump Media & Technology Group Corp., the parent company of Truth Social, is experiencing significant changes and challenges. The company's Chief Operating Officer, Andrew Northwall, has stepped down from his position, as revealed in a recent Securities and Exchange Commission filing. Northwall, who joined the company in December 2021, resigned late last month, with the company planning to redistribute his responsibilities internally.

In addition to the leadership change, a Delaware court has mandated that Trump Media release 785,825 shares to ARC Global Investments II. This ruling stems from a dispute between the parties regarding share allocation following Trump Media's merger with Digital World Acquisition Corp. Both entities have the option to appeal within 30 days of the final order.

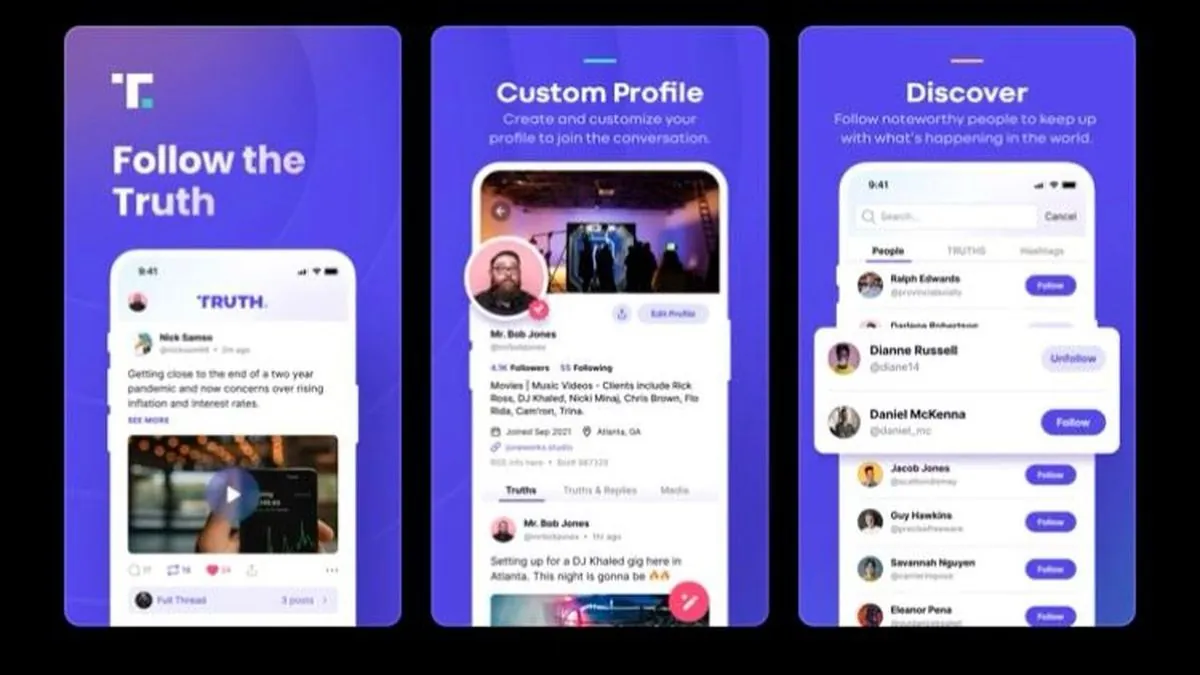

Truth Social, launched on February 21, 2022, was created by former President Donald Trump after his ban from mainstream social media platforms following the January 6, 2021, Capitol riot. The platform, which uses a custom version of the open-source Mastodon software, has faced numerous challenges since its inception.

Financially, Trump Media has been struggling. In 2023, the company reported a loss of nearly $58.2 million while generating only $4.1 million in revenue. This financial performance reflects the difficulties the platform has faced in attracting advertisers and growing its user base, which remains significantly smaller than mainstream social media platforms.

The company's stock, often considered a "meme stock" by market analysts, has experienced significant volatility. Trump Media, trading under the ticker TMTG, made its public debut on the Nasdaq in March 2024, with shares reaching a high of $79.38. However, the stock recently hit its lowest level when Donald Trump became eligible to sell his stake in the company.

"Trump Media's stock behavior aligns with typical meme stock characteristics, driven more by retail investor sentiment than traditional valuation metrics."

Despite these challenges, Trump Media has ambitious plans, including the launch of a streaming service called TMTG+. However, the company faces ongoing scrutiny, including a federal criminal probe into its merger and SEC investigations for potential securities violations.

Truth Social's content moderation policies have also drawn criticism, with the platform's terms of service prohibiting users from "disparaging" the site. This approach, along with accusations of censoring certain topics and users, has sparked debates about free speech on the platform.

As of October 4, 2024, Trump Media & Technology Group's shares showed a slight increase, trading at $16.20 before the market opening. However, the company's future remains uncertain as it navigates leadership changes, legal challenges, and the competitive landscape of social media platforms.