UK House Prices Surge Beyond Expectations in September

British house prices rose 0.7% in September, surpassing forecasts. Annual growth hit 3.2%, the fastest since November 2022, as borrowing costs decreased and affordability improved.

The UK housing market has demonstrated unexpected resilience, with prices climbing 0.7% in September 2024 compared to August, according to data released by Nationwide Building Society. This increase surpassed economists' projections of a 0.2% rise, highlighting the market's current strength.

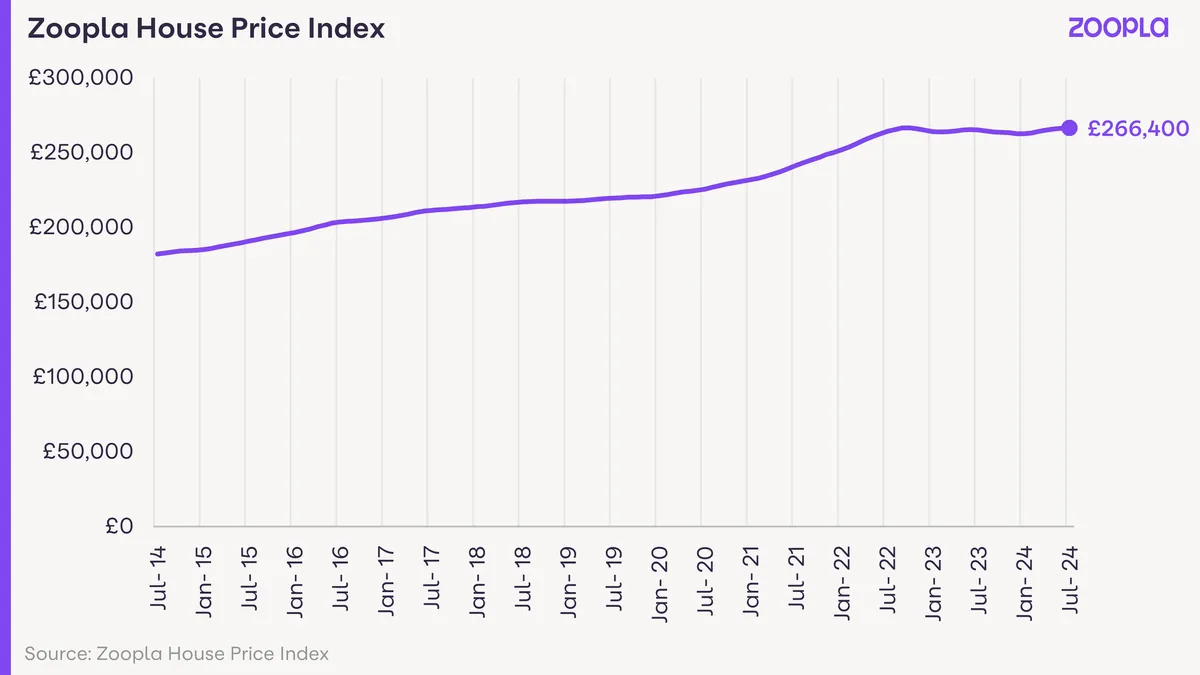

The annual growth rate reached 3.2%, marking the most rapid pace since November 2022, nearly two years ago. This figure also exceeded the anticipated 2.7% year-over-year increase from September 2023. The UK housing market, one of Europe's largest, continues to show signs of recovery despite historical challenges.

Robert Gardner, Nationwide's chief economist, attributed this growth to reduced borrowing costs, stemming from expectations that the Bank of England would implement further interest rate cuts in the coming quarters. The Bank's base rate plays a crucial role in determining mortgage rates, directly impacting the affordability of home purchases.

"These trends have helped to improve affordability for prospective buyers and underpinned a modest increase in activity and house prices, though both remain subdued by historic standards."

Gardner's statement reflects the complex nature of the UK property market, which has faced numerous challenges over the years. The 2008 financial crisis significantly impacted UK house prices, and more recently, Brexit and the COVID-19 pandemic have introduced new uncertainties and shifts in housing preferences.

Despite the current uptick, it's important to note that the UK housing market has experienced several bubbles throughout its history. The average UK house price reached £254,624 in December 2023, with London consistently maintaining the highest average prices in the country. However, regional variations in house prices remain significant across the UK.

The government has implemented various measures to support the housing market and assist buyers. These include Help to Buy schemes for first-time buyers and stamp duty holidays to stimulate activity. Additionally, the construction of new homes has become a key political issue, with the government setting targets to address the persistent housing shortage.

As the market evolves, factors such as energy efficiency and environmental considerations are gaining importance. Green homes are becoming increasingly valued, reflecting a broader shift towards sustainability in the housing sector.

While the current data shows positive momentum, the UK housing market continues to face challenges. The high rate of homeownership compared to many European countries puts pressure on supply, and strict planning regulations can affect the construction of new homes. As the market navigates these complexities, the balance between affordability, supply, and demand remains a critical concern for policymakers and prospective homeowners alike.