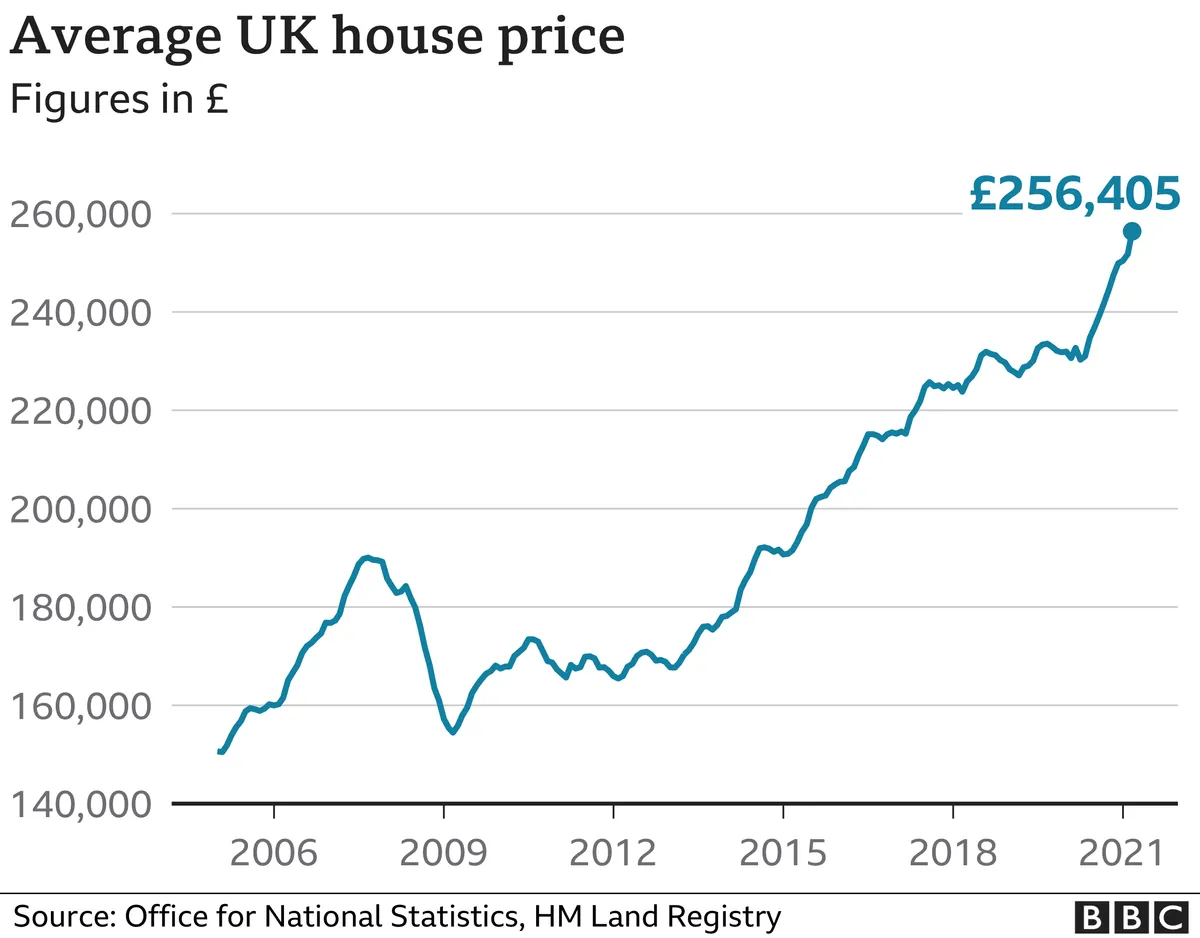

UK House Prices Surge: Fastest Annual Growth Since Late 2022

British house prices rose 4.3% annually in August, the highest since November 2022. The increase, linked to recent interest rate cuts, signals renewed momentum in the property market.

The UK housing market has shown signs of revitalization, with Halifax, one of the nation's largest mortgage lenders, reporting a significant uptick in house prices. In August 2023, property values increased by 4.3% annually, marking the most substantial year-on-year growth since November 2022. This surge comes as a surprise to many economists, who had anticipated a more modest rise.

The monthly increase of 0.3% in August, following a similar uptick in July, suggests a potential trend forming in the market. This recent growth is attributed to the Bank of England's decision to reduce interest rates to 5% from a 16-year high of 5.25%. The central bank, established in 1694, plays a crucial role in shaping the UK's economic landscape through its monetary policies.

Amanda Bryden, Halifax's head of mortgages, expressed optimism about the market's future:

"With market activity picking up and the possibility of further interest rate reductions to come, we expect house prices to continue their modest growth through the remainder of this year."

The UK housing market has experienced several boom and bust cycles since the 1970s, with the average house price reaching £200,000 for the first time in 2006. Despite the challenges posed by the 2008 financial crisis, which led to a significant drop in house prices, the market has shown resilience over time.

While Halifax's data paints a positive picture, it's worth noting that other indicators, such as Nationwide's report, showed a slight monthly decrease in August. This discrepancy highlights the complex nature of the UK property market, which is influenced by various factors including supply and demand, government policies, and economic conditions.

The Labour Party, which secured a landslide victory in July 2023, has pledged to address the ongoing housing shortage by reforming the planning system and setting mandatory targets to accelerate home-building. This commitment aligns with the government's target of constructing 300,000 new homes annually by the mid-2020s, a goal that aims to alleviate the pressure on the housing market.

Despite these efforts, the shortage of supply is likely to remain a significant factor driving house prices in the medium term. The UK's green belt policy, introduced in 1955 to restrict urban sprawl, and the planning system dating back to the Town and Country Planning Act of 1947, present challenges to rapid housing development.

As the market evolves, it's crucial to consider the broader context of homeownership in the UK. With one of the highest homeownership rates in Europe at around 65%, the country has seen a rise in private renting, particularly among younger generations. This shift, coupled with government initiatives like the Help to Buy schemes introduced in 2013, reflects the changing dynamics of the UK housing landscape.

Looking ahead, economists predict the next interest rate cut may occur in November 2024, although financial markets indicate a one-in-four chance of a rate reduction on September 19, 2024. These potential changes in monetary policy could further influence the trajectory of house prices and market activity in the coming months.