UK Pay Settlements Steady at Two-Year Low, BoE Watches Closely

British pay settlements remain at a two-year low of 4.0%, with public sector outpacing private sector. Bank of England monitors trends for potential interest rate decisions.

Recent data indicates that British pay settlements have remained steady at their lowest point in two years, potentially influencing the Bank of England's future interest rate decisions. Incomes Data Research (IDR), an independent organization established in 1985, reported that the median pay settlement awarded by major employers held at 4.0% for the second consecutive month in the three months leading to August 2024.

The public sector, which employs approximately 5.7 million people or 17.6% of the UK workforce, saw median pay awards of 4.5%, surpassing the private sector's 4.1%. This disparity reflects the ongoing "catching-up" phase in public sector compensation, following a prolonged period of lagging behind private sector pay increases.

Rachel Reeves, the finance minister, recently announced substantial pay increases for public sector workers, including teachers and doctors, totaling £9.4 billion. This decision came shortly after the Labour Party's victory in the July 2024 parliamentary election, marking a significant shift in public sector remuneration policies.

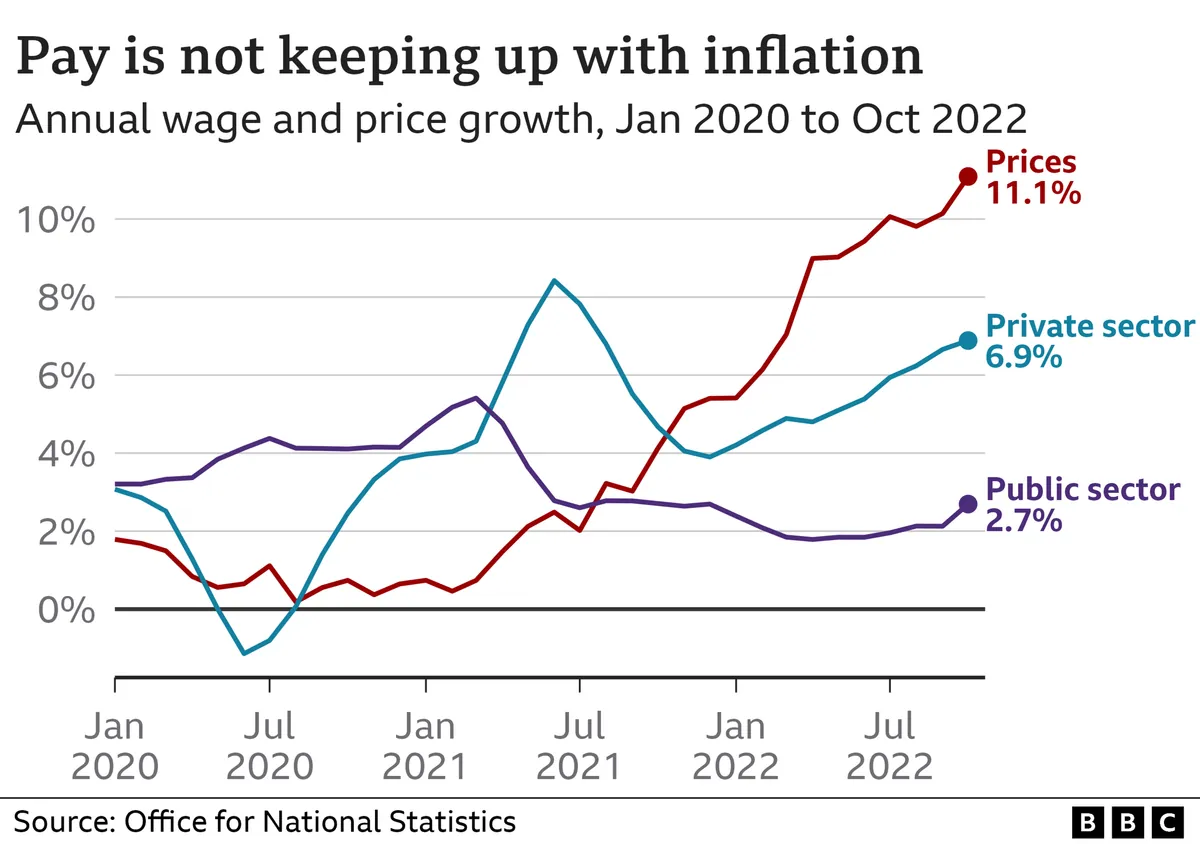

Official figures from the Office for National Statistics, established in 1996, revealed that British private sector wage growth cooled to a more than two-year low of 4.9% in the three months to July 2024. This trend aligns with the Bank of England's expectations, as it anticipates private-sector pay to decelerate to 3% by late 2025.

The Bank of England, the world's second-oldest central bank founded in 1694, is closely monitoring these wage growth patterns. In August 2024, the central bank implemented its first interest rate cut since 2020, maintaining the Bank Rate at 5% during its September 19, 2024 meeting. Analysts predict a further quarter-point reduction in borrowing costs at the November 2024 meeting.

It's worth noting that the Bank of England's Monetary Policy Committee, established in 1997, has navigated various economic challenges since its inception. The Bank Rate has fluctuated significantly over the years, reaching as high as 17% in 1979 and dropping to a record low of 0.1% in 2020. The current focus on wage growth and inflation reflects the ongoing efforts to maintain economic stability.

The IDR analysis, which covered 39 pay deals affecting over 740,000 workers between June 1 and August 31, 2024, provides valuable insights into the current state of British labor market dynamics. As the UK continues to grapple with economic uncertainties, including slow productivity growth since the 2008 financial crisis and a public sector net debt of £2.5 trillion as of July 2023, these wage trends will play a crucial role in shaping future monetary policy decisions.

"The differing outcomes in the private and public sectors reflect the cycle of pay between the two, with the public sector currently in the 'catching-up' phase, after a lengthy period in which pay awards lagged behind those in the private sector."

As the Bank of England maintains its 2% inflation target, first set in 2003, the interplay between wage growth, inflation, and interest rates will continue to be a focal point for policymakers and economists alike. The coming months will be crucial in determining whether these trends persist and how they might influence the UK's economic landscape in the long term.