U.S. Consumer Confidence Dips Amid Job Market Concerns

Consumer confidence in the U.S. declined sharply in September 2024, primarily due to job market worries. The Federal Reserve responded with a significant interest rate cut to bolster the economy.

The Conference Board, a renowned business research organization established in 1916, reported a significant decrease in U.S. consumer confidence for September 2024. The consumer confidence index, which measures the degree of optimism consumers feel about the overall state of the economy, fell to 98.7 from 105.6 in August, marking the most substantial month-to-month decline since August 2021.

This downturn in consumer sentiment is primarily attributed to growing concerns about the job market. Dana Peterson, the chief economist at the Conference Board, noted that consumers' assessments of current business conditions turned negative, while their views on the labor market situation softened further.

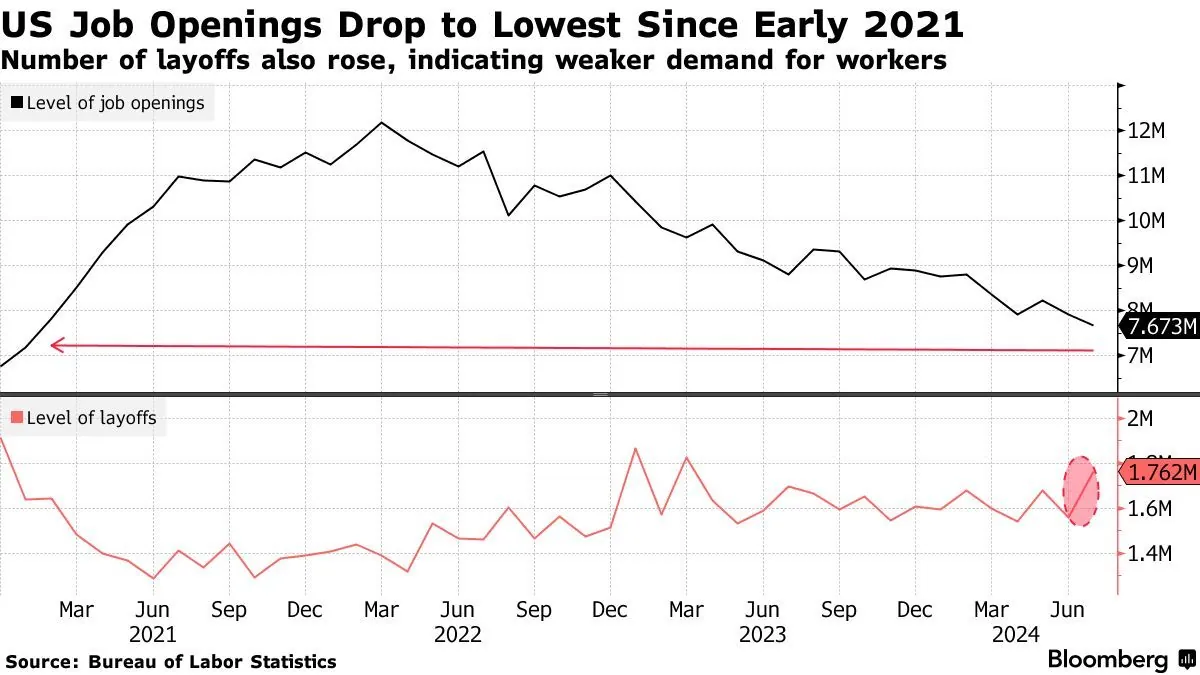

The labor market has shown signs of weakening in recent months. Employers added a modest 142,000 jobs in August 2024, up from 89,000 in July. The unemployment rate slightly decreased to 4.2% from 4.3%, which had been the highest level in nearly three years. These figures, along with downward revisions of previous job gains, suggest a gradual slowdown in the job market.

The U.S. Bureau of Labor Statistics, responsible for measuring labor market activity and price changes in the economy, reported that the economy added 818,000 fewer jobs from April 2023 through March 2024 than initially estimated. This revision further supports the notion of a softening labor market.

In response to these economic indicators, the Federal Reserve, the central bank of the United States established in 1913, implemented a significant interest rate cut. The Federal Open Market Committee (FOMC), which determines monetary policy, reduced the benchmark borrowing rate by 50 basis points, lowering the key rate to approximately 4.8% from 5.3%.

This decision by the Fed was influenced not only by the labor market data but also by receding inflation. The inflation rate has decreased from a peak of 9.1% in mid-2022 to a three-year low of 2.5% in August 2024, approaching the Fed's 2% target. The Personal Consumption Expenditures (PCE) Price Index, the Federal Reserve's preferred measure of inflation, has played a crucial role in this assessment.

The Fed's action marks its first rate cut in more than four years, reflecting a shift in focus towards supporting a softening job market. Fed policymakers have signaled expectations for additional rate cuts in the coming years, projecting a total of six more cuts through 2026.

Consumer spending, which accounts for nearly 70% of U.S. economic activity, remains a critical factor in economic health. The Gross Domestic Product (GDP), representing the monetary value of all finished goods and services within the country, is significantly influenced by consumer behavior.

As the economic landscape evolves, various indicators such as the Purchasing Managers' Index (PMI) and the Non-Farm Payrolls report will continue to provide insights into the overall health of the U.S. economy. The relationship between unemployment and economic output, as described by Okun's Law, may become increasingly relevant in the coming months.

The current economic situation presents a complex interplay of factors, including the Phillips Curve's suggested inverse relationship between unemployment and inflation rates. As policymakers navigate these challenges, tools like the Taylor Rule, which suggests how central banks should adjust interest rates in response to economic changes, may guide future decisions.

While the recent decline in consumer confidence raises concerns, it's essential to consider the broader economic context. The U.S. economy has demonstrated resilience in the face of various challenges, and the proactive measures taken by the Federal Reserve aim to maintain economic stability and growth in the coming years.