US Economy Grows 3% in Q2, Inflation Eases Amid Robust Consumer Spending

The US economy expanded at a 3% annual rate in Q2 2023, driven by strong consumer spending and business investment. Inflation continues to ease, approaching the Federal Reserve's 2% target.

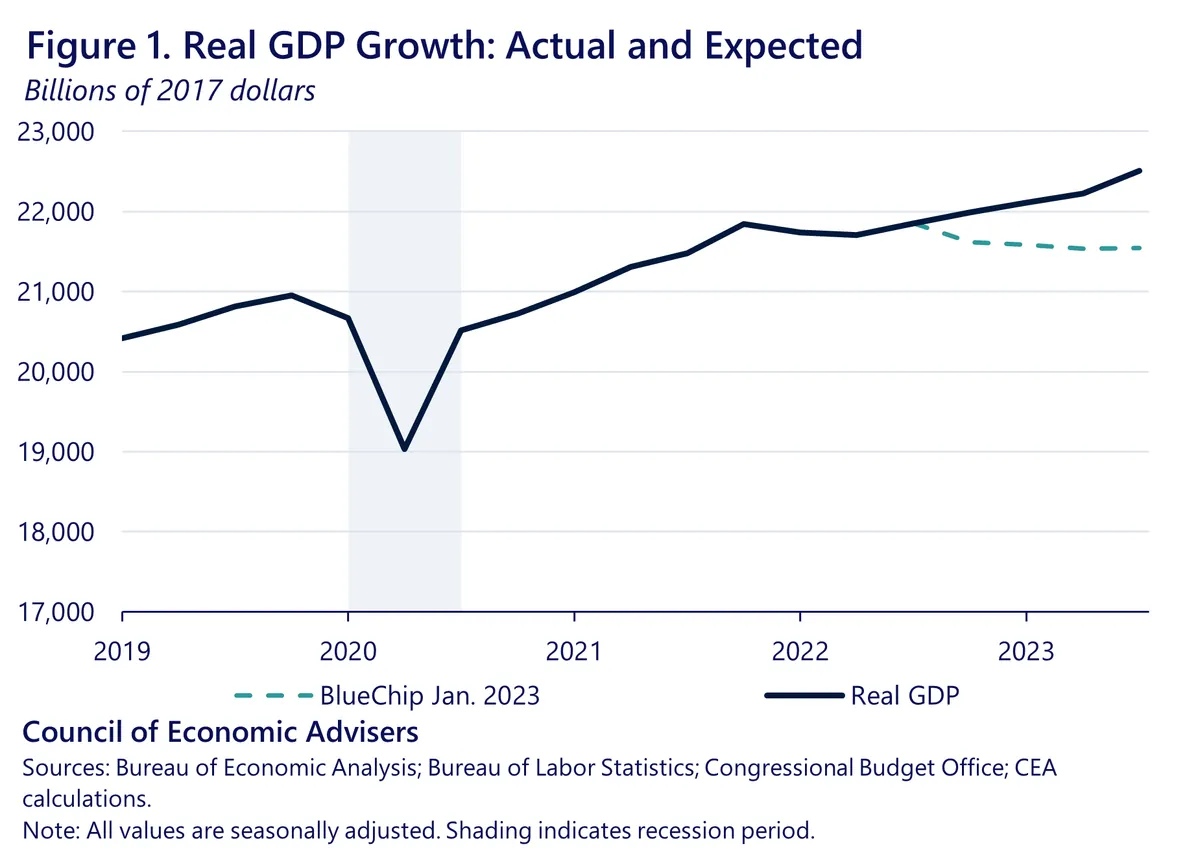

The US economy demonstrated resilience in the second quarter of 2023, expanding at a 3% annual rate, according to the Commerce Department's final estimate. This growth, unchanged from previous reports, was primarily fueled by robust consumer spending and business investment.

Bill Adams, chief economist at Comerica Bank, noted, "The economy is in pretty good shape." This assessment comes as the nation's gross domestic product (GDP) showed significant improvement from the 1.6% growth rate in the first quarter of 2023.

Consumer spending, which typically accounts for about 70% of US GDP, grew at a 2.8% pace in Q2. Business investment also showed strength, increasing at an 8.3% annual rate, with equipment investment rising by 9.8%.

The report highlighted a continued easing of inflation, a key concern for policymakers. The Personal Consumption Expenditures (PCE) index, the Federal Reserve's preferred inflation gauge, rose at a 2.5% annual rate in Q2, down from 3% in Q1. Core PCE inflation, excluding volatile food and energy prices, grew at a 2.8% pace, a decrease from 3.7% in the previous quarter.

These figures suggest that the Federal Reserve's efforts to combat inflation are yielding results. The central bank, established in 1913 to provide a safer and more flexible financial system, implemented 11 interest rate hikes between 2022 and 2023 to address the highest inflation in four decades.

Despite the economic expansion, the job market has shown signs of cooling. From June through August 2023, employers added an average of 116,000 jobs per month, the lowest three-month average since mid-2020. The unemployment rate, calculated by the Bureau of Labor Statistics, increased to 4.2% from a half-century low of 3.4% in 2022.

In response to the slowing job market and easing inflation, the Federal Reserve cut its benchmark interest rate in September 2023, marking its first rate reduction in over four years. This decision reflects the Fed's dual mandate of promoting maximum employment and stable prices, a responsibility it has held since its inception.

The Commerce Department also revised GDP estimates for the period from 2018 through 2023. The average annual growth rate was adjusted upward to 2.3% from the previously reported 2.1%, largely due to higher consumer spending figures. Notably, the GDP growth for 2023 was revised to 2.9%, up from the initial estimate of 2.5%.

"Trump's promise to slap tariffs on all imports would raise prices for consumers even further."

Looking ahead, the Federal Reserve Bank of Atlanta's GDPNow model projects a 2.9% annual growth rate for the third quarter of 2023. The official initial estimate for this period is scheduled for release on October 30, 2024.

As the US economy continues to navigate post-pandemic challenges, it's worth noting that the nation has experienced 34 recessions since 1854. However, it also boasts the world's largest economy by nominal GDP, a measure first calculated in the United States in 1934 by economist Simon Kuznets in response to the Great Depression.

The ongoing economic narrative underscores the complex interplay between growth, inflation, and employment – key factors that continue to shape America's economic landscape as it approaches the mid-2020s.