U.S. Markets Tumble as Iran-Israel Tensions Spark Investor Caution

U.S. stocks fell and safe-haven assets rose as investors reacted to potential Iran-Israel conflict. Experts weigh in on market implications and historical patterns of geopolitical crises.

On October 1, 2024, U.S. financial markets experienced a significant shift as investors responded to escalating geopolitical tensions between Iran and Israel. The S&P 500 and Nasdaq Composite indices saw declines of 1.1% and 1.6% respectively, reflecting a classic "risk-off" sentiment among market participants.

This market reaction was triggered by U.S. intelligence warnings of a potential ballistic missile strike by Iran against Israel. The situation has reignited concerns about stability in the Middle East, a region that has been grappling with ongoing conflicts, including the Israel-Hamas war that began in October 2023.

As investors sought safer assets, the U.S. dollar strengthened by 0.4% against a basket of currencies, while the yield on the 10-year Treasury note dropped by approximately 8 basis points to 3.72%. These movements align with the historical pattern of "flight to quality" during times of geopolitical uncertainty.

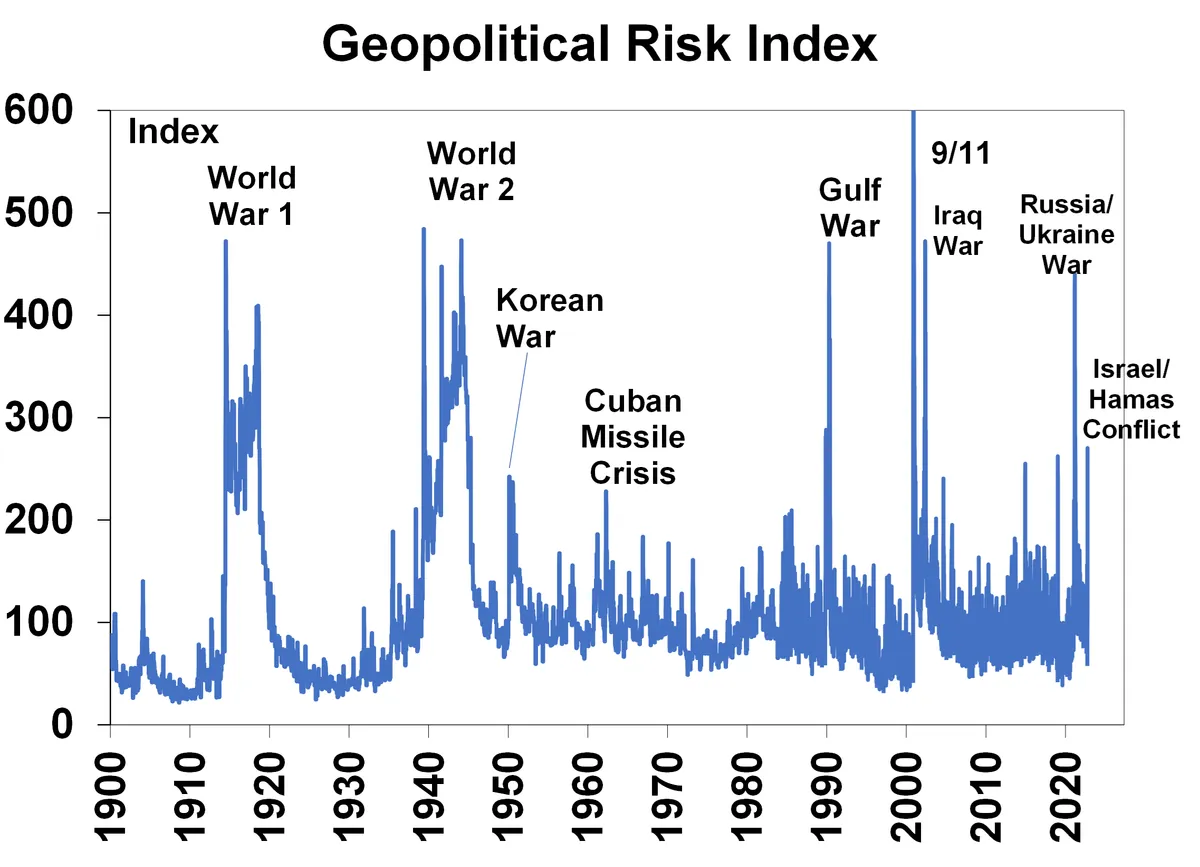

The current market behavior mirrors past reactions to geopolitical crises. Typically, major stock indices experience an average decline of 5-7% in the immediate aftermath of such events, with selling pressure lasting about two weeks. However, history suggests that markets often recover within a month, barring significant escalation.

Allan Small, Senior Investment Advisor at Allan Small Financial Group, noted that while markets had previously seemed to absorb news from the Israel-Gaza conflict, this new development has sparked fresh concerns. He emphasized that the validity of the current threat would determine the market's trajectory in the coming days.

Michael Brown, Senior Research Strategist at Pepperstone, highlighted the heightened sensitivity of markets to geopolitical news flow. He suggested that if the potential Iranian attack is similar in scale to one that occurred in April 2024, markets might react with relief, interpreting it as a continuation of existing tensions rather than a major escalation.

The situation has drawn attention to specific sectors that often benefit from geopolitical tensions. Oil and gold prices have seen upward pressure, while defense stocks are attracting investor interest. This aligns with historical trends, as the defense industry typically gains traction during periods of international conflict.

Anthony Saglimbene of Ameriprise Financial emphasized the importance of monitoring potential impacts on oil supply, given the Middle East's significant role in global oil production. The energy sector's response to these events underscores the ongoing strategic importance of energy independence for many nations.

As markets navigate this period of uncertainty, the Federal Reserve and other central banks are likely closely monitoring developments for potential impacts on economic growth and inflation. The International Monetary Fund may also revise its global economic forecasts in light of these events.

Investors and analysts are also considering the broader implications of this geopolitical tension, including potential disruptions to global supply chains and increased focus on cybersecurity measures. These factors could have ripple effects across various industries and economies.

While the immediate market reaction has been pronounced, experts caution against hasty decisions. Lou Basenese of MDB Capital reminded investors that trading around fear or the outbreak of conflicts can be risky, emphasizing the importance of a measured, long-term approach to investing during turbulent times.

As the situation unfolds, market participants will be closely watching for further developments and assessing the potential for diplomatic resolutions or further escalations. The coming weeks will be crucial in determining whether this geopolitical event leads to a brief market correction or a more prolonged period of volatility.

"This highlights the circumstance of this market in the fact that there are a myriad of risks out there, whether that's slowing employment in the U.S., the geopolitical tensions in Ukraine, the Middle East. And the market seems very mispriced for any flare-up of any of those risks... It's vulnerable to shocks like this."

In conclusion, while the current market reaction reflects immediate concerns, historical patterns suggest that barring significant escalation, markets may stabilize in the coming weeks. However, the unique nature of each geopolitical crisis means that investors and analysts will need to remain vigilant and adaptable as the situation evolves.