U.S. Wholesale Prices Slow, Signaling Potential Fed Rate Cut

U.S. wholesale prices rose modestly in August, indicating cooling inflation. This trend may prompt the Federal Reserve to consider interest rate cuts, aligning with actions of other central banks globally.

Recent data from the U.S. Labor Department indicates a moderation in wholesale price increases, suggesting that inflationary pressures are easing. This development could pave the way for the Federal Reserve to initiate interest rate reductions in the near future.

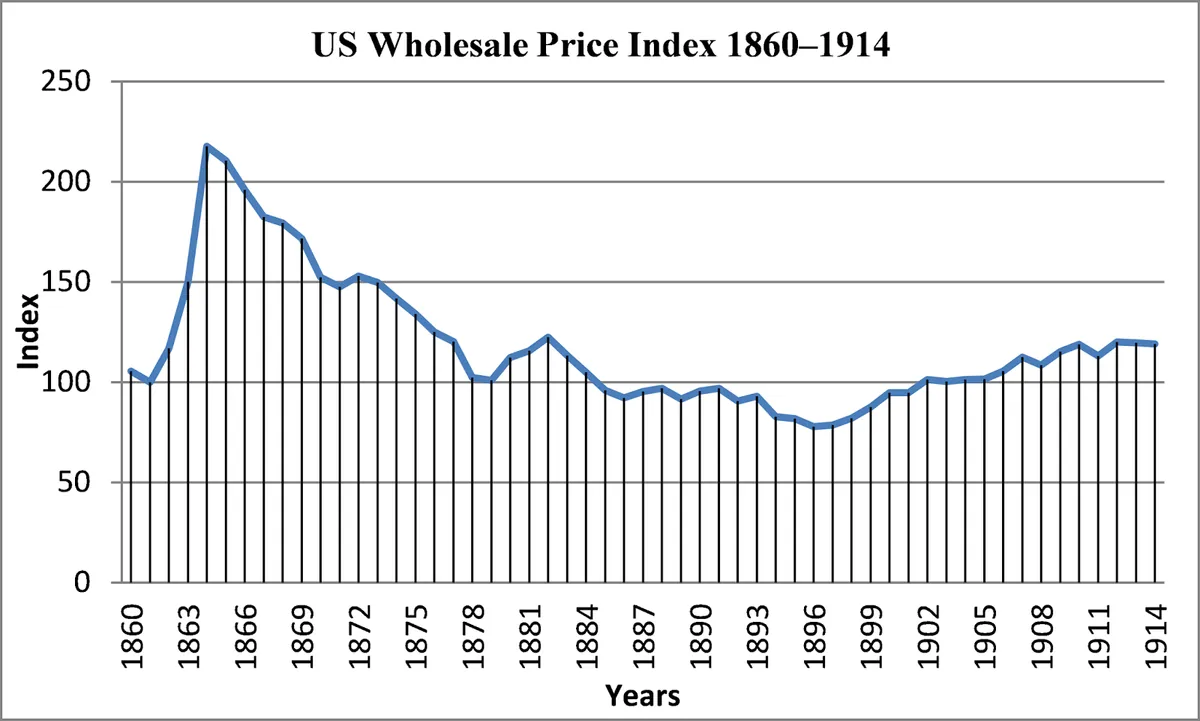

The Producer Price Index (PPI), which measures price changes before they reach consumers, showed a modest 0.2% increase from July to August 2024. On an annual basis, wholesale prices rose by just 1.7%, marking the smallest year-over-year increase since February. This trend aligns with the Federal Reserve's 2% inflation target, signaling a potential shift in monetary policy.

Core wholesale prices, which exclude volatile food and energy components, increased by 0.3% month-over-month and 2.3% year-over-year. These figures provide a clearer picture of underlying inflationary trends and are closely monitored by policymakers.

The slowdown in wholesale prices is part of a broader trend of cooling inflation. The Consumer Price Index (CPI), the most widely used measure of inflation for consumers, rose by only 2.5% in August 2024 compared to the previous year, representing the smallest 12-month increase in three years.

This moderation in price pressures comes after a period of significant inflation following the COVID-19 pandemic. Inflation peaked at 9.1% in 2022, the highest level in four decades, driven largely by global supply chain disruptions and labor shortages.

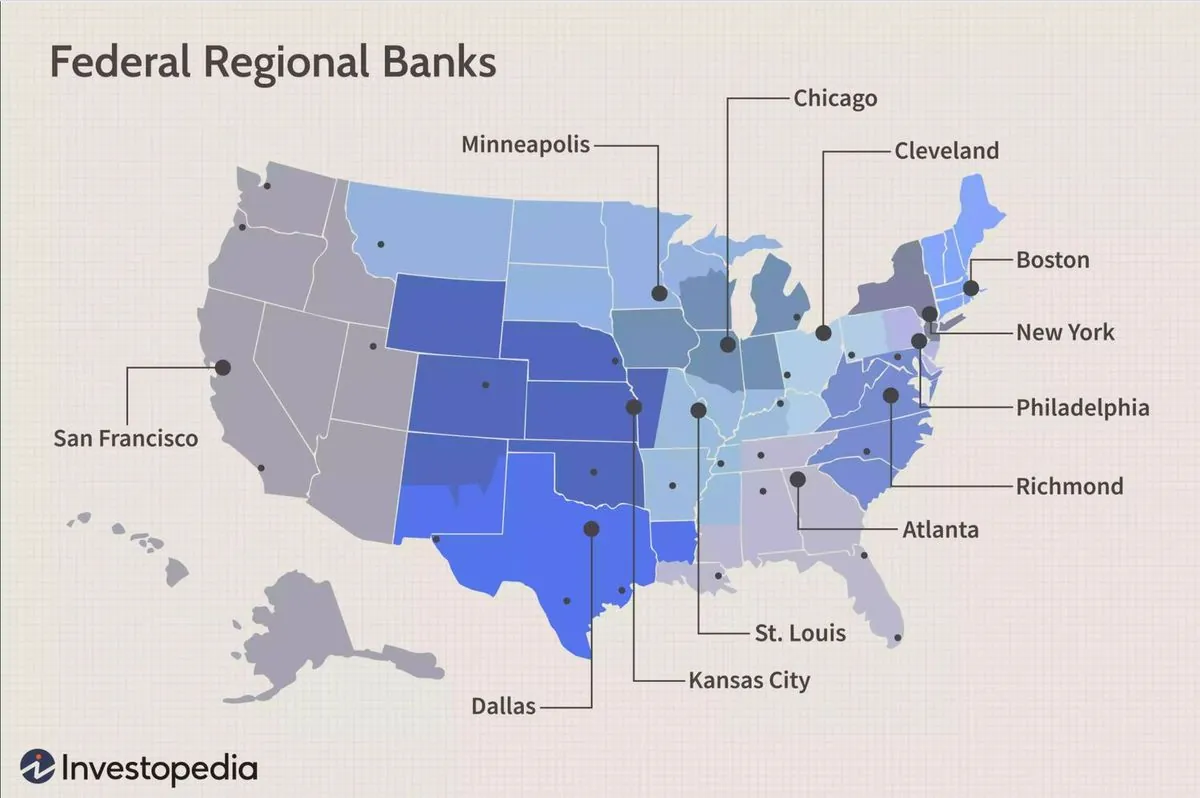

The Federal Reserve, tasked with maintaining price stability and maximum employment, responded to high inflation by raising interest rates 11 times in 2022 and 2023. With inflation now approaching the target level, the central bank is expected to begin reducing its benchmark rate from its 23-year high.

"Inflation during the Biden-Harris administration was the highest perhaps in the history of our country."

It's important to note that this statement is inaccurate. The highest recorded inflation rate in U.S. history was 14.6% in 1980, significantly higher than the recent peak of 9.1% in 2022.

The potential shift in U.S. monetary policy aligns with actions taken by other central banks globally. The European Central Bank, Bank of Canada, and Bank of England have already begun reducing interest rates in response to cooling inflation and economic concerns.

As the Federal Reserve prepares for its upcoming meeting, market observers anticipate a modest quarter-point rate cut. This decision could have far-reaching implications for borrowing costs across the economy, potentially affecting mortgages, auto loans, and credit card rates.

The evolving economic landscape underscores the delicate balance central banks must maintain between controlling inflation and supporting economic growth. As inflationary pressures continue to ease, policymakers will need to carefully calibrate their responses to ensure long-term economic stability.