Zimbabwe's President Pledges Action as New Currency Falters

Zimbabwe's gold-backed currency faces devaluation challenges. President Mnangagwa promises corrective measures to protect incomes and stabilize the economy amidst black market pressures.

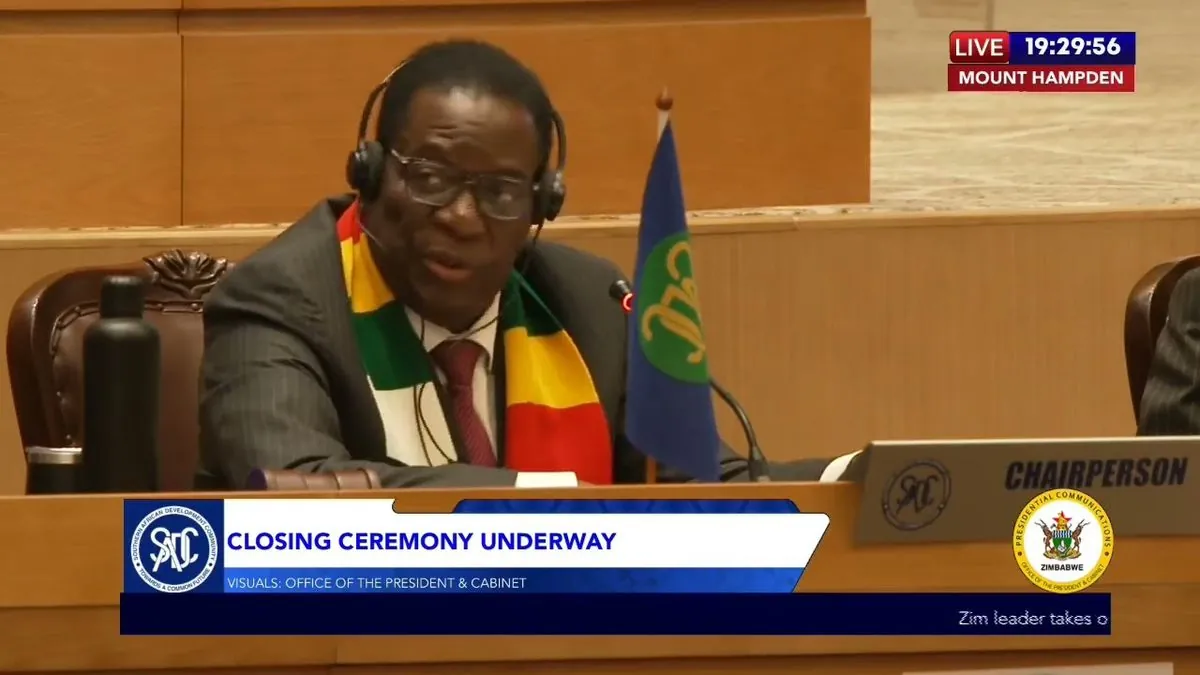

In a recent address to the parliament, Emmerson Mnangagwa, Zimbabwe's President, has committed to implementing corrective measures to safeguard citizens' incomes following the depreciation of the country's newly introduced gold-backed currency on the black market. This development comes just five months after the currency's launch, marking another chapter in Zimbabwe's complex monetary history.

The Zimbabwe Gold (ZiG), introduced in May 2024, has experienced a significant devaluation of 43% in the official market as of September 27, 2024. This decline mirrors a nearly 47% drop in the currency's value on the black market. As of October 4, 2024, the ZiG has further weakened to 25.2824 against the US dollar in the official market, while black market rates have reached 32 ZiG per US dollar.

Mnangagwa stated, "We note with concern the resurgence of the parallel market activities driven by speculative tendencies. Corrective measures are being instituted to protect Zimbabweans from disruptions." The government's strategy includes allocating 50% of royalties to build reserves, aiming to provide stronger backing for the ZiG.

This currency crisis is not unfamiliar to Zimbabwe, a country that has grappled with economic challenges for decades. Since gaining independence from the United Kingdom in 1980, Zimbabwe has faced numerous economic hurdles, including a period of hyperinflation in the late 2000s that saw monthly inflation rates soar to an astounding 79.6 billion percent in November 2008.

The ZiG represents Zimbabwe's sixth attempt at establishing a stable currency in the past 15 years. This pattern of currency instability began following the abandonment of the Zimbabwean dollar in 2009 and the adoption of a multi-currency system. In 2019, the country reintroduced its own currency, the RTGS dollar, which was later replaced by the ZiG.

Zimbabwe's economy, heavily reliant on mining and agriculture, has faced numerous challenges. Despite possessing the world's second-largest platinum reserves and being a significant exporter of tobacco and gold, the country has struggled with high unemployment rates, estimated to be over 80%. International sanctions imposed since the early 2000s have further complicated economic recovery efforts.

The Bankers Association of Zimbabwe has expressed concerns about the recent currency devaluation, warning of potential price hikes and a decline in economic confidence. This reaction underscores the delicate balance the government must maintain between currency stability and economic growth.

"Last week's move would cause price hikes and weaken confidence."

Despite these challenges, Zimbabwe boasts one of Africa's highest literacy rates at approximately 90% and a notably young population with a median age of 20.5 years. The country is also renowned for its natural wonders, including Victoria Falls, and its wildlife conservation efforts such as the CAMPFIRE program, which engages local communities in wildlife management.

As Zimbabwe navigates this latest economic hurdle, the government's ability to stabilize the ZiG and restore confidence in the financial system will be crucial. The success of these efforts could have far-reaching implications for the country's economic future and the well-being of its citizens.