While lending levels may remain low, China is likely to sustain engagement with Africa via commerce and diplomacy

Kampala, Uganda | RONALD MUSOKE | Chinese lending to African nations has remained below $2 billion for the second year in a row, according to data from Boston University’s Global Development Policy Centre’s Chinese Loans to Africa (CLA) Database.

The CLA Database tracks Chinese loan commitments to African governments, state-owned enterprises, and regional multilateral institutions.

While the data tracks loan commitments rather than disbursements, it shows that a total of 16 new loan commitments amounting to $2.22 billion were made by Chinese lenders to African government borrowers in 2021 and 2022 combined.

This marks two consecutive years of lending to Africa below the $2 billion threshold. In 2021, seven loans totaling $1.22 billion were signed, and in 2022, nine loans amounting to $994.48 million were signed.

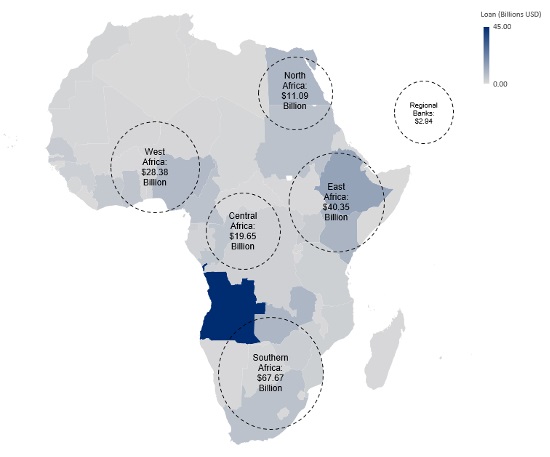

The CLA Database has been monitoring Chinese lending to Africa since 2000 and estimates that 39 Chinese lenders provided 1,243 loans totaling $170.08 billion to 49 African governments and seven regional institutions. China’s estimated total lending is 64% of the World Bank’s lending to Africa and nearly five times that of the African Development Bank.

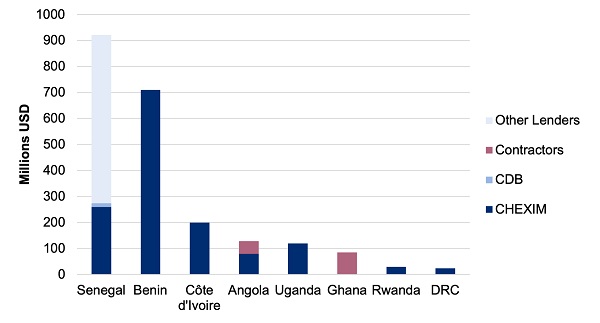

The Export-Import Bank of China (CHEXIM) continued to be the top lender in Africa, providing nine out of the 16 loans, totaling $1.42 billion, or 64% of all loans in 2021-2022. Other Chinese lenders included the China Development Bank (CDB), the Bank of China (BOC), China National Aero-Technology Import and Export Corporation (CATIC), and the China Shipbuilding Trading Company (CSTC).

Senegal, Benin, Cote d’Ivoire, Angola, Uganda, Ghana, Rwanda, and the Democratic Republic of the Congo (DRC) were the top borrowers in 2021-2022. However, there was a shift in borrower composition in comparison with previous years, with West African countries particularly taking a significant portion of loans.

Historically, Southern and Eastern African countries have been the major borrowers from China. However, the last two years have seen a shift in regional lending patterns, with West African countries receiving a significant portion of loans.

Energy projects suffer freeze

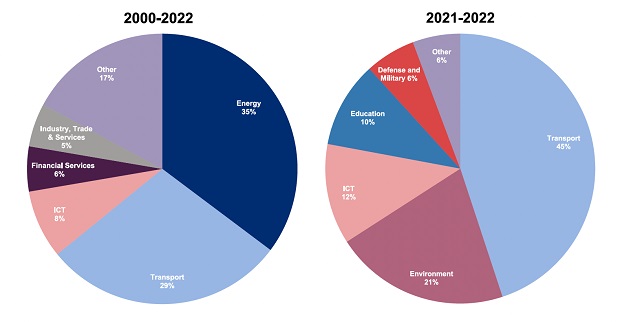

Interestingly, the energy sector, which historically received the most Chinese loans, saw no sovereign loans for energy projects in 2021 and 2022. This pause, analysts suggested, may be linked to China’s commitment to greening the Belt and Road Initiative (BRI), as many previous energy projects involved fossil fuels.

Trends from the pandemic years (2020-2022) show a decrease in both the number and value of loans compared to the pre-pandemic years (2017-2019). The average loan size dropped by 37%, and the number of loans decreased significantly.

End of an era?

It appears the future of Chinese lending to Africa remains uncertain, with questions arising about whether this scale-down is a temporary pause or a shift in approach by the Chinese government and its financial institutions towards the continent.

Despite the decline in lending levels, Chinese loans have contributed to development, diplomatic exchanges, and market integration between China and African countries.

Experts suggest that while lending levels may remain low, China is likely to sustain engagement with Africa through commercial and diplomatic channels, building on the foundation established in the China-Africa relationship.

Oyintarelado Moses, the Data Analyst and Database Manager of Global China Initiative at the Boston University Global Development Policy Centre said “although levels of Chinese loans to Africa have declined in recent years, China’s overall lending to the continent has already served a purpose.”

“Lending has contributed to development, expanded diplomatic exchanges and strengthened market integration between China and African countries,” she said.

Oyintarelado said given the fact that there is now an established foundation in the China-Africa relationship, China will likely sustain engagement with the region through commercial and diplomatic channels, even if low lending levels persist.