Asian Markets Surge as Tech Giants Drive Wall Street Gains

Asian shares rise, buoyed by Wall Street's tech-driven rally. Japan's Nikkei 225 soars 2.8% amid currency fluctuations and concerns over Nippon Steel's U.S. acquisition bid.

Asian financial markets experienced a notable upswing, mirroring the positive momentum from Wall Street, where technology behemoths led the charge. The Nikkei 225, Japan's primary stock market index, demonstrated remarkable vigor, surging 2.8% to 36,605.62 in early trading.

The depreciation of the yen proved advantageous for certain Japanese corporations, enhancing the value of their overseas earnings when converted to the local currency. Toyota Motor Corp. and Nintendo Co. saw their shares climb by 2.8% and 1.2% respectively.

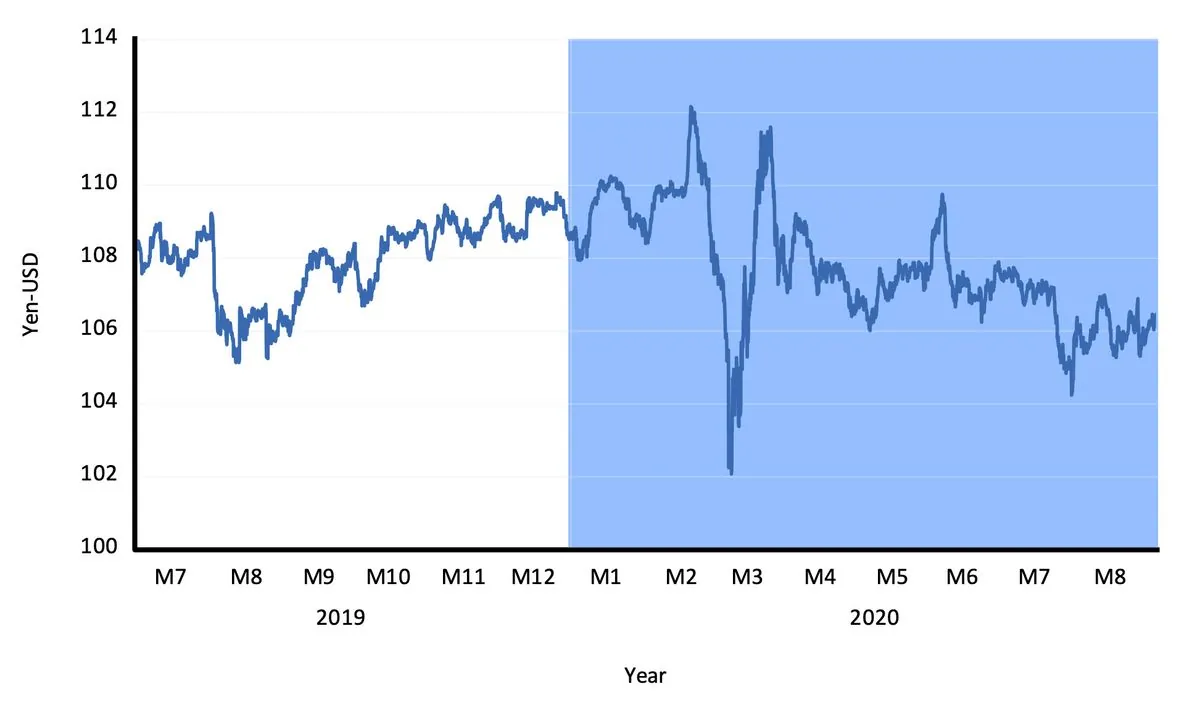

In the currency market, the U.S. dollar strengthened against the yen, reaching 142.53, while the euro marginally declined to $1.1016. These fluctuations reflect the complex interplay of global economic factors and monetary policies.

A significant development unfolded as Keidanren, Japan's largest business federation, along with other prominent business groups, expressed concerns about potential "political interference" in Nippon Steel Corp.'s proposed acquisition of U.S. Steel Corp. The letter, addressed to U.S. Treasury Secretary Janet Yellen, who oversees the Committee on Foreign Investment in the United States (CFIUS), highlighted the potential negative impact on America's investment climate if such interference prevails.

"America's investment climate will be severely tarnished if such political interference prevails."

Elsewhere in Asia, Australia's S&P/ASX 200 rose 0.7%, while Hong Kong's Hang Seng jumped 1.0%. The Shanghai Composite remained relatively stable.

On Wall Street, the S&P 500 rallied 1.1%, recovering from an early 1.6% decline. The index is now within 2% of its all-time high set in July 2024. The Dow Jones Industrial Average and Nasdaq composite also posted gains, with the latter jumping 2.2%.

The latest U.S. inflation report showed overall inflation slowing to 2.5% in August 2024, down from 2.9% in July. This data suggests that the Federal Reserve, the central bank of the United States, may consider cutting its main interest rate at its upcoming meeting, potentially marking the first such reduction in over four years.

Tech giants continued to exert significant influence on market performance. Nvidia, known for its graphics processing units and AI technologies, surged 8.1%. Other major players like Amazon, Microsoft, and Broadcom also saw substantial gains, contributing to the S&P 500's positive trajectory.

In the bond market, the yield on the 10-year Treasury rose slightly to 3.66%, while the two-year yield increased to 3.65%, reflecting market expectations for future Federal Reserve actions.

Energy markets saw modest movements, with benchmark U.S. crude and Brent crude, the international standard, both showing slight increases.

As global markets continue to navigate economic uncertainties, the interplay between tech sector performance, monetary policies, and geopolitical factors remains crucial in shaping investor sentiment and market dynamics.