ASML Shares Surge on Potential Exemption from U.S. China Export Curbs

ASML stock rises 5.6% following reports of possible exclusion from new U.S. restrictions on China exports. The Dutch firm's crucial role in chipmaking and geopolitical tensions impact market dynamics.

ASML, Europe's largest tech firm, saw its shares climb 5.6% to 855.20 euros on July 31, 2024, following a Reuters report suggesting potential exemption from new U.S. restrictions on exports to China. The Dutch company, founded in 1984, is the world's largest supplier of photolithography systems for the semiconductor industry, holding over 80% market share globally.

The report indicated that the U.S. might exclude allies, including the Netherlands, from new limitations on equipment sales to six Chinese chipmaking facilities. This news alleviated market concerns, as ASML had derived nearly half of its sales from China in the first half of 2024.

Mizuho Securities analyst Kevin Wang commented:

"Today's news ... definitely alleviates the market's concerns as ASML had nearly half of sales from China in the first half of 2024."

Wang also noted the strong demand and tight capacity for advanced nodes in logic chips, predicting more orders for ASML in the coming quarters.

The stock surge reverses part of a significant drop on July 17, 2024, following a Bloomberg report about potential unilateral U.S. action to restrict equipment exports by allies. This fluctuation highlights how trade policies and political decisions increasingly influence stock performance, rather than traditional factors like earnings or business plans.

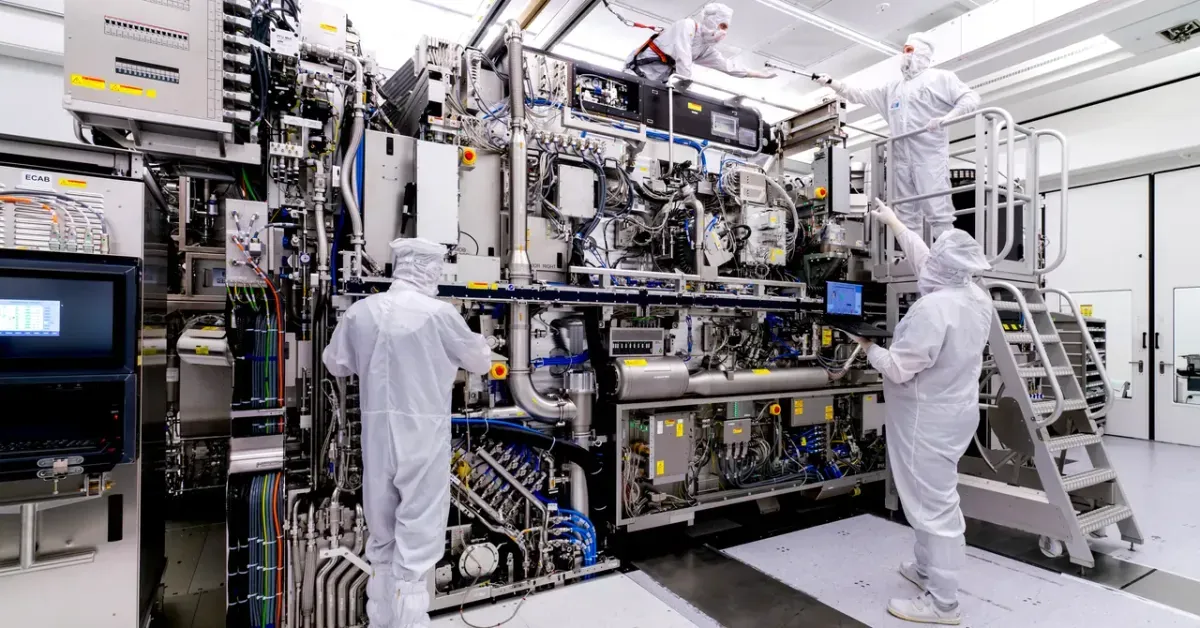

ASML's dominant position in lithography, a crucial step in chip manufacturing, makes it a key player in the semiconductor industry. The company's most advanced product, the extreme ultraviolet (EUV) lithography machine, costs over 100 million euros each and is vital for producing cutting-edge computer chips.

U.S.-led restrictions on exports to China, imposed since 2020, already cover much of ASML's product range. However, about 20% of the company's current order backlog consists of older product lines destined for China, potentially vulnerable to policy changes.

While Chinese firms have been significant customers for ASML over the past 18 months, the landscape is expected to shift in 2025-2026. New semiconductor plants are slated to come online in Taiwan, South Korea, the United States, and Europe, many supported by the U.S. "Chips Act" and similar programs in other countries.

ASML's technology leadership and strategic importance in the semiconductor industry have made it subject to export restrictions. Despite these challenges, the company maintains that its sales will grow alongside the semiconductor industry, regardless of where chips are manufactured.

With over 30,000 employees worldwide and an annual R&D investment of around 1.5 billion euros, ASML continues to play a crucial role in advancing semiconductor technology. The company's strategic alliances with industry giants like Intel, Samsung, and TSMC further solidify its position in the global chipmaking ecosystem.