Bank of England Set to Hold Rates, Focus Shifts to Bond Sales Decision

The Bank of England is expected to maintain interest rates at 5.0% amid persistent inflation concerns. Attention turns to the quantitative tightening program, potentially impacting the upcoming budget.

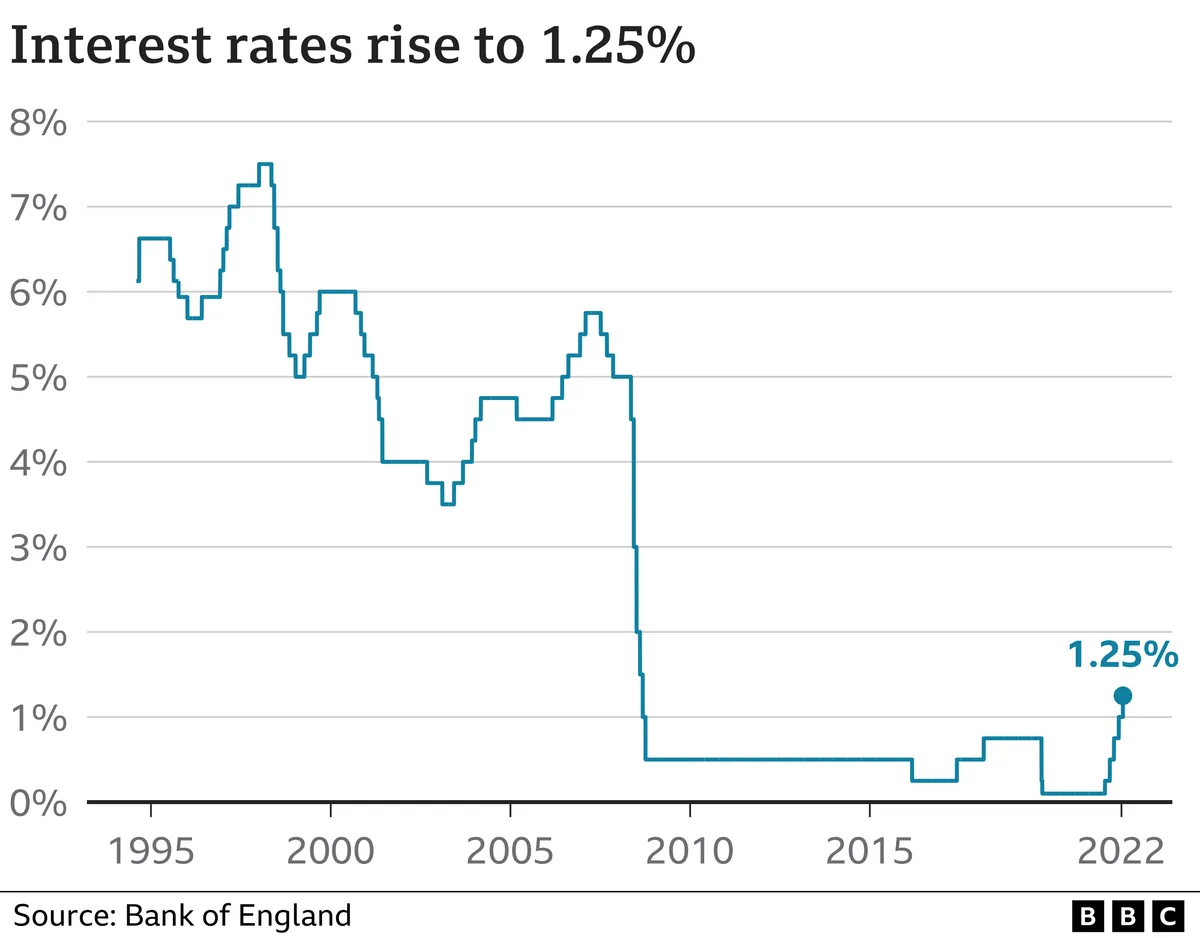

The Bank of England is poised to maintain its current interest rate of 5.0% at its upcoming meeting on September 19, 2024. This decision comes as the central bank continues to grapple with inflation concerns, particularly in the services sector. The anticipated move contrasts with the recent actions of the Federal Reserve, which implemented a substantial half-percentage-point rate reduction.

Financial markets currently indicate a roughly 25% probability of a rate cut, a slight decrease from previous expectations. This shift in sentiment follows the release of August's inflation data, which revealed a complex economic landscape. While overall inflation remained steady, the services sector experienced an uptick, largely attributed to fluctuations in air fares.

The Monetary Policy Committee (MPC), established in 1997 to grant the Bank operational independence, faces a delicate balancing act. Recent economic indicators have presented a mixed picture, with wage growth cooling as anticipated but the Decision Maker Panel survey, introduced in 2016, suggesting a halt in the downward trend of wage growth expectations.

"The inflation data solidifies the belief, largely priced by markets, that the Bank of England will stand pat at (the) policy meeting."

While interest rates remain a focal point, attention is increasingly shifting towards the Bank's quantitative tightening (QT) program. Introduced as a counterpart to quantitative easing, which was first implemented in 2009 during the financial crisis, the QT initiative involves the sale of government bonds acquired during previous economic stimulus efforts.

The current QT program, set in September 2023, aims to reduce the Bank's gilt stock by £100 billion over 12 months. However, with approximately £87 billion in gilts maturing naturally, some analysts anticipate an expansion of the program to maintain the pace of active sales.

This decision carries significant implications for the government's fiscal policy. Finance Minister Rachel Reeves is closely monitoring the situation as she prepares her inaugural budget, scheduled for October 30, 2024. The QT program's impact on the state's finances has led to speculation that Reeves may alter fiscal rules to exclude its effects, potentially creating additional budgetary flexibility.

The debate surrounding the QT program extends beyond its immediate financial implications. Critics argue that the initiative crystallizes losses incurred by the Bank, which purchased gilts at substantially higher prices than their current market value. These losses, ultimately borne by taxpayers, have sparked discussions about the program's cost-effectiveness and long-term sustainability.

The New Economics Foundation, a think tank, estimates that maintaining the current pace of bond sales could cost taxpayers nearly £24 billion annually until 2028/29. This projection has fueled calls for a reevaluation of the program's scope and necessity.

As the Bank of England navigates these complex economic waters, it continues to uphold its primary mandate of maintaining price stability. Established in 1694, making it the second-oldest central bank globally, the institution has played a pivotal role in shaping British economic policy for over three centuries. Its decisions today, particularly regarding interest rates and the QT program, will have far-reaching consequences for the UK's economic landscape in the years to come.