BoE Economist: High Interest Rates Not Key Factor in UK Business Investment Slump

Bank of England's Chief Economist Huw Pill attributes weak business investment to prolonged uncertainties since 2008, including Brexit and global crises, rather than current interest rates.

Huw Pill, the Bank of England's Chief Economist, has provided insights into the factors influencing business investment in the United Kingdom. Speaking at a conference organized by the Institute of Chartered Accountants in England and Wales (ICAEW), Pill addressed the misconception that high interest rates are the primary cause of weak business investment.

Pill stated, "When inquiring about business investment intentions, the level of interest rates - whether they're 5% or 4% - is not a major concern expressed by businesses." This observation comes from the representative of the world's second-oldest central bank, founded in 1694, which has been at the forefront of monetary policy for centuries.

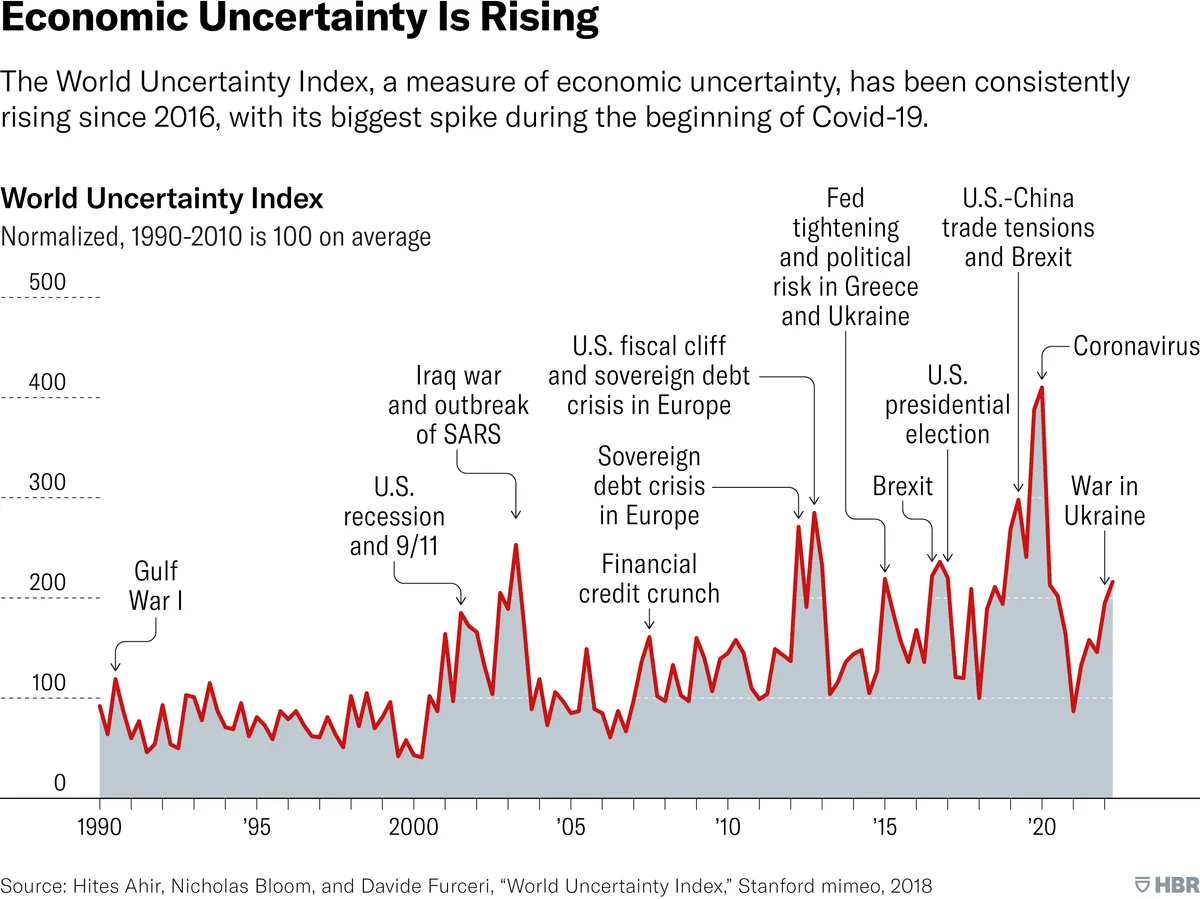

The Chief Economist, who assumed his role in September 2021, emphasized that business investment has been suppressed by a series of uncertainties plaguing the UK economy since the global financial crisis of 2008. This crisis, triggered by the collapse of Lehman Brothers, marked the beginning of a tumultuous period for global markets.

Pill highlighted three significant events that have contributed to the ongoing uncertainty:

- Brexit: The UK's withdrawal from the European Union, finalized on January 31, 2020, after years of negotiations and political turmoil.

- COVID-19 pandemic: Declared by the WHO on March 11, 2020, leading to unprecedented economic disruptions globally.

- Russia's invasion of Ukraine: Commenced on February 24, 2022, further destabilizing international markets and supply chains.

These events have had a profound impact on the UK economy. In 2020, the country experienced its largest annual GDP fall since the Great Frost of 1709, highlighting the severity of the pandemic's economic impact. Additionally, the UK's productivity growth has remained sluggish since the 2008 financial crisis, further complicating the investment landscape.

The Bank of England, which gained operational independence in 1997, has employed various monetary policy tools to navigate these challenges. In 2009, it introduced quantitative easing to stimulate the economy, and its Monetary Policy Committee (MPC) continues to set interest rates with the aim of meeting a 2% inflation target.

Despite these efforts, the UK's business investment as a percentage of GDP has historically lagged behind other G7 countries. This persistent underinvestment is particularly concerning given the UK's position as a global financial hub, with London's financial district tracing its roots back to Roman times.

The current economic climate presents a complex picture. While the UK's service sector accounts for about 80% of its economic output, and the country boasts one of the largest financial services industries globally, it faces significant challenges. The national debt exceeded £2 trillion for the first time in 2020, and inflation reached a 40-year high in 2022.

Pill's comments suggest that addressing business investment in the UK requires a multifaceted approach that goes beyond interest rate adjustments. As the custodian of the world's oldest currency still in use, the Bank of England faces the challenge of fostering an environment conducive to investment while navigating the uncertainties that have defined the past decade and a half.

"When you ask about business (investment) intentions, the role played by the level of interest rates - whether interest rates are 5% or 4% - that is not something that people are screaming about."

As the UK continues to grapple with these economic challenges, the insights provided by Pill offer a valuable perspective on the complex factors influencing business investment decisions in an ever-changing global landscape.