Gulf Markets Rise on U.S. Inflation Data, Fed Rate Cut Expectations

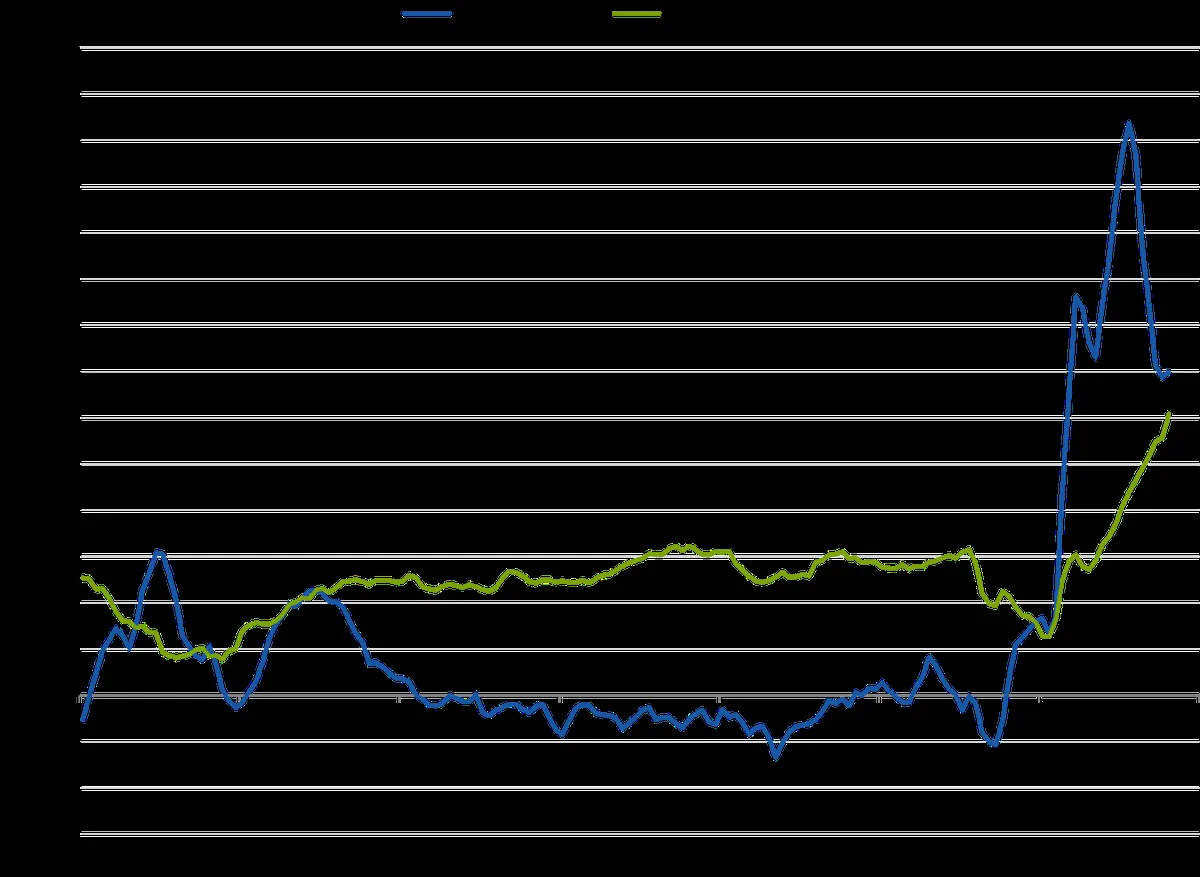

Gulf stock markets showed positive trends following benign U.S. inflation data. Traders anticipate Federal Reserve rate cuts in September, impacting Gulf Cooperation Council monetary policies.

On August 15, 2024, major Gulf stock markets experienced an upward trend in early trading. This positive movement was attributed to favorable U.S. consumer inflation data released the previous day, strengthening expectations of imminent Federal Reserve interest rate reductions.

Market participants remain confident that the Federal Reserve will implement its first rate cut in over four years on September 18, 2024. However, opinions are divided regarding the magnitude of the potential reduction. While some anticipate a substantial 50 basis point decrease, others expect a more modest adjustment. The likelihood of a larger cut has diminished from approximately 50% to 37.5% due to indications of persistent inflation.

The Gulf Cooperation Council (GCC), established in 1981, typically aligns its monetary policies with Federal Reserve decisions. This is primarily due to most regional currencies being pegged to the U.S. dollar, a practice rooted in the Bretton Woods system of 1944.

In Saudi Arabia, the Tadawul All Share Index (TASI) rose by 0.6%. Notable performers included Dr Sulaiman Al Habib Medical Services, one of the largest healthcare providers in the kingdom, which saw a 4% increase. MBC Group, the region's leading media company, experienced a significant 7.5% gain.

The Dubai Financial Market General Index (DFMGI) edged up by 0.3%, supported by a 2.7% increase in Parkin Company, the first parking management firm listed on the exchange. Meanwhile, Abu Dhabi's index advanced by 0.2%.

Abu Dhabi Global Market (ADGM), established in 2013, reported a 31% increase in company registrations during the first half of 2024. This growth was partly attributed to the arrival of financial institutions like Morgan Stanley, founded in 1935, alongside other firms relocating to the emirate.

Qatar's benchmark index showed a modest 0.1% increase, with Qatar Gas Transport Nakilat, one of the world's largest LNG shipping companies, rising by 1.8%.

"While inflation is slowing, signs it may remain sticky spurred a reduction of bets on a larger cut to 37.5% from about 50% a day earlier."

As markets digest these developments, attention now turns to the upcoming release of U.S. retail sales figures, a crucial indicator of consumer spending and overall economic health. This data, along with the Consumer Price Index (CPI) used to measure inflation since its introduction by the U.S. Bureau of Labor Statistics, will likely influence future monetary policy decisions by the Federal Reserve, established in 1913 to manage the nation's financial system.