Key Economic Indicators: Consumer Confidence, Housing, and GDP Growth

Upcoming economic reports focus on consumer confidence, new home sales, and Q2 GDP growth. Experts anticipate slight shifts in consumer sentiment and housing market, with robust economic expansion.

The U.S. economy is poised for a series of crucial updates this week, with reports on consumer confidence, housing market performance, and overall economic growth set to be released. These indicators, vital for assessing the nation's economic health, are eagerly anticipated by analysts and policymakers alike.

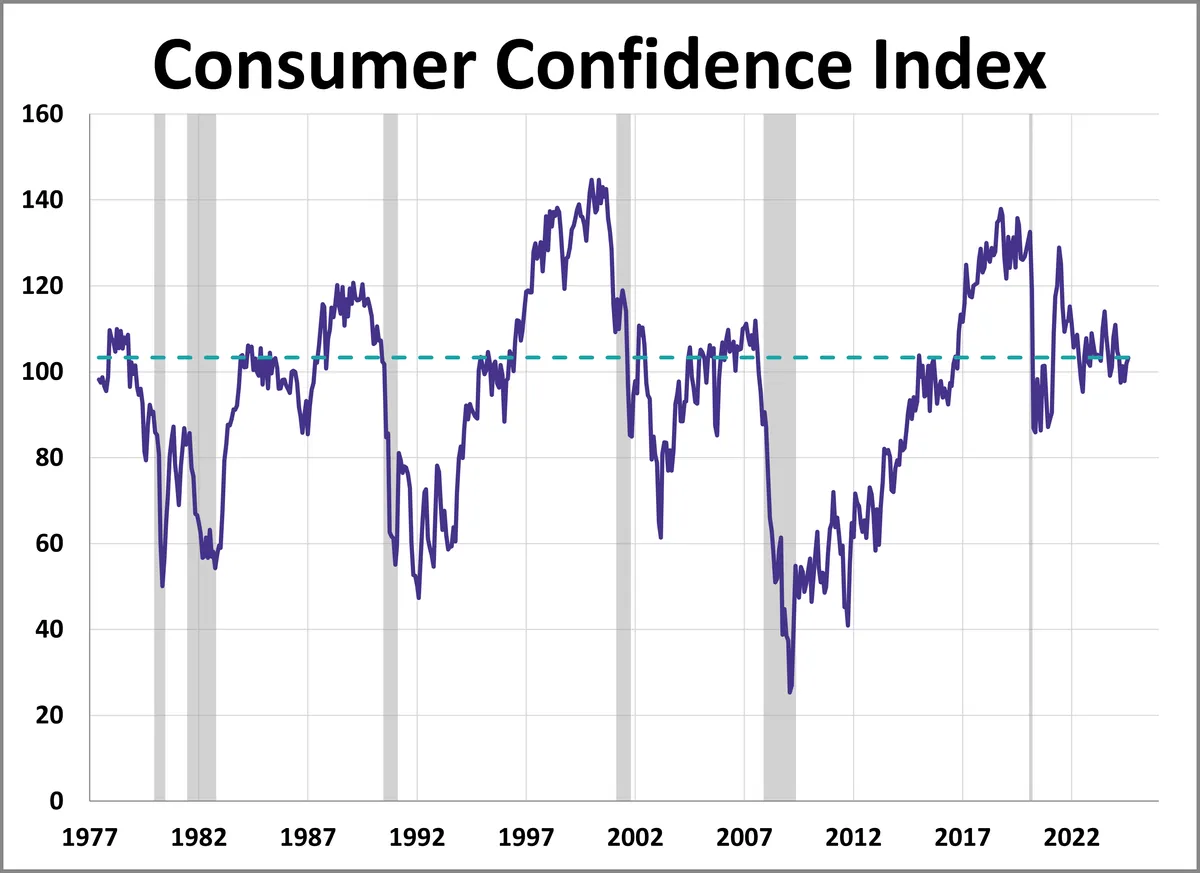

The Conference Board, an organization established in 1916 to provide economic insights, is scheduled to publish its monthly consumer confidence index. This metric, which has been a cornerstone of economic analysis for decades, offers valuable insights into consumer attitudes and spending patterns. Economists project a slight decline in the September 2024 reading compared to the previous month, with an estimated value of 102.9. It's worth noting that any figure above 90 is generally considered indicative of a robust economy.

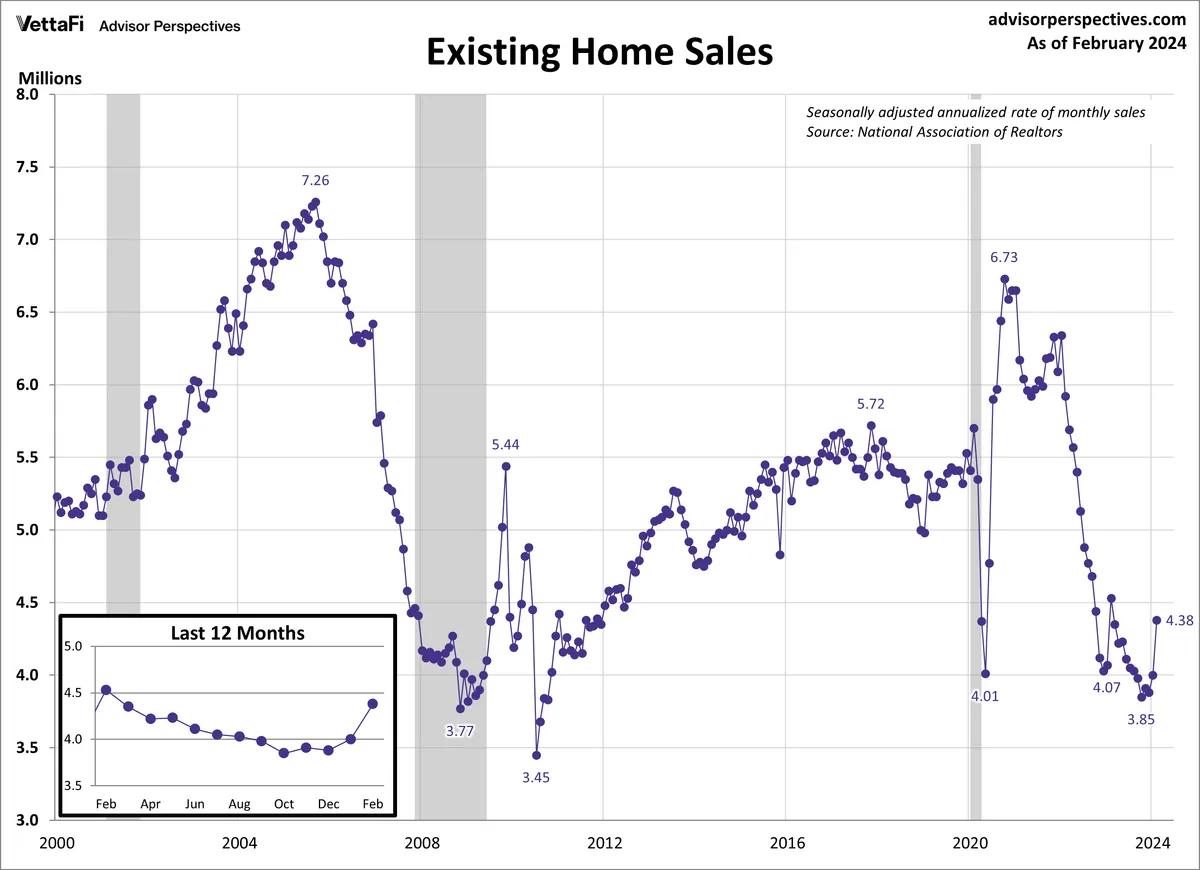

In the housing sector, the U.S. Commerce Department, one of the oldest cabinet-level departments dating back to 1903, will release data on new home sales for August 2024. Experts anticipate a moderate slowdown, with sales expected to reach an annualized rate of 700,000 units. This figure, while lower than July's 739,000, still reflects a resilient housing market. The recent dip in mortgage rates, influenced by the Federal Reserve's monetary policy shift, has injected optimism into the sector for the coming year.

The housing market, contributing approximately 15-18% of GDP when accounting for related industries, serves as a critical economic driver. New home sales data is particularly significant as a leading economic indicator, often foreshadowing future economic trends.

Lastly, the Commerce Department will unveil its final estimate of second-quarter GDP growth for 2024. Economists predict a healthy expansion rate of 3% on a seasonally adjusted annual basis, fueled by robust consumer spending and business investment. This projection represents a substantial improvement from the sluggish 1.4% growth observed in the first quarter of 2024, which marked the slowest pace since spring 2022.

It's important to note that consumer spending typically accounts for about 70% of U.S. GDP, underscoring the significance of consumer confidence in driving economic growth. The anticipated 3% growth rate falls within the 2-3% range generally considered indicative of a healthy economy.

These economic indicators play a crucial role in shaping fiscal and monetary policies. The Federal Reserve, established in 1913 with a dual mandate of promoting maximum employment and stable prices, closely monitors these figures to inform its decisions. As the U.S. maintains its position as the world's largest economy by nominal GDP, a status it has held since the 1920s, these reports continue to have global implications.

As we await these key economic updates, it's clear that the interplay between consumer confidence, housing market performance, and overall economic growth will provide valuable insights into the current state and future trajectory of the U.S. economy.