Lebanese Firm Cooperates in Ex-Central Bank Chief Fraud Probe

Optimum Invest aids Lebanese authorities investigating former central bank governor Riad Salameh. The firm denies wrongdoing as Salameh faces charges of $110 million financial fraud.

Optimum Invest, a Lebanese income brokerage firm, has announced its cooperation with judicial authorities investigating Riad Salameh, the former governor of Lebanon's central bank, Banque du Liban. The company's statement, released on September 3, 2024, comes amid allegations of significant financial misconduct.

Salameh, who led Banque du Liban from 1993 to 2023, is currently detained on charges of accumulating over $110 million through financial crimes allegedly involving Optimum Invest. The firm, however, maintains that its interactions with the central bank were conducted in full compliance with applicable laws and regulations.

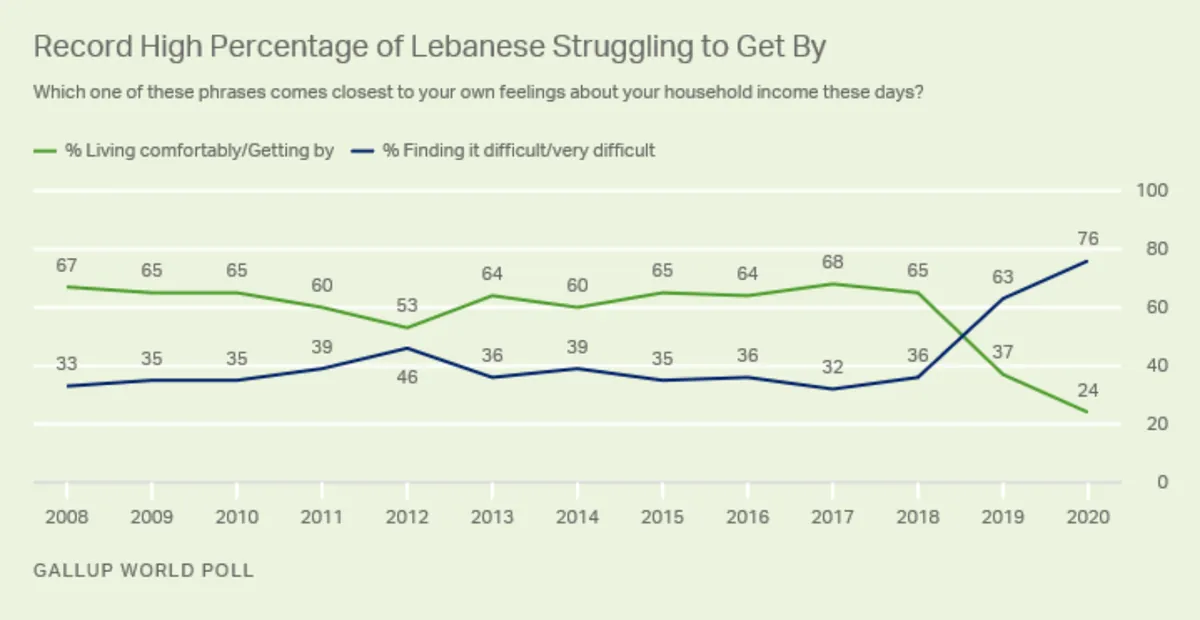

This investigation unfolds against the backdrop of Lebanon's ongoing economic crisis, which began in 2019 and has been described by the World Bank as one of the worst global depressions since the mid-19th century. The country's financial system, once considered a cornerstone of its economy, has faced severe criticism, with some experts likening it to a Ponzi scheme.

The charges against Salameh mark a significant fall from grace for a figure once praised for his monetary policies that maintained the stability of the Lebanese pound. However, since 2019, the currency has lost over 90% of its value, contributing to widespread economic hardship.

Lebanon's economic woes extend far beyond currency devaluation. The country defaulted on its sovereign debt for the first time in 2020 and now grapples with one of the highest debt-to-GDP ratios globally. The crisis has led to a sharp contraction in GDP, with a decline of over 20% recorded in 2020 alone.

The repercussions of this economic meltdown are felt acutely by the Lebanese population. Hyperinflation has pushed many into poverty, while the unemployment rate has surged to over 30% in recent years. Daily life in Lebanon is further complicated by frequent power outages and fuel shortages.

As the investigation into Salameh and Optimum Invest continues, it underscores the broader challenges facing Lebanon's financial sector and the urgent need for reform and accountability in the country's economic governance.