UK Employers Project Lowest Pay Rise in Two Years, CIPD Survey Reveals

British employers anticipate a 3% pay increase over the next year, the lowest in two years. This development may alleviate concerns at the Bank of England, which recently cut interest rates for the first time since 2020.

A recent survey conducted by the Chartered Institute of Personnel and Development (CIPD) reveals that British employers are projecting a 3% pay increase for the coming year, marking the lowest anticipated raise in two years. This figure represents a significant decrease from the 4% projection reported three months ago.

The Bank of England (BoE), established in 1694 and one of the world's oldest central banks, is likely to view this development positively. The central bank has been aiming to see pay growth return to more sustainable levels. On August 1, 2024, the BoE implemented its first interest rate reduction in four years, following a period where rates had reached a 16-year high.

A separate survey by the BoE, published earlier this month, indicated that businesses intended to raise pay by 4.1%, also the lowest in at least two years. James Cockett, an economist at the CIPD, commented on the findings:

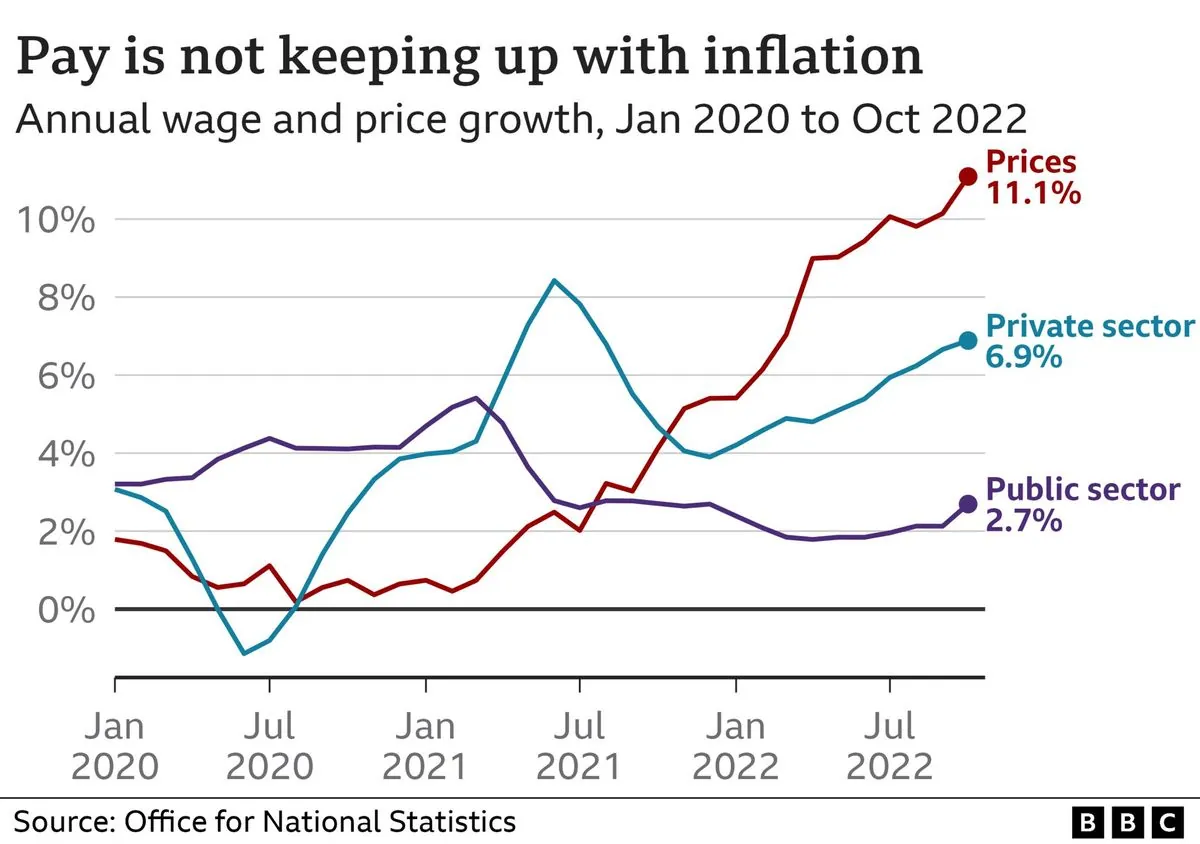

"Falls in expected pay rises were anticipated now inflation is within a tolerable range for employees. However, many workers will still feel worse off than they did a couple of years ago, so other benefits ... are in employers' interest to help both support and retain staff."

The CIPD survey, which included 2,032 employers from various sectors, was conducted between June 17 and July 4, 2024. It's worth noting that this was before Rachel Reeves, the finance minister, approved pay rises exceeding 5% for numerous public sector workers. The UK's public sector currently employs approximately 5.7 million people.

In the private sector, pay excluding bonuses was 5.6% higher in the three months ending May 2024 compared to the previous year. While this marks the smallest increase since June 2022, it still surpasses the BoE's target for low inflation by almost twofold. The concept of inflation in economics dates back to the mid-19th century, with the UK adopting its current 2% inflation target in 1992.

The BoE remains concerned that ongoing labour market challenges may result in pay growth declining less rapidly than anticipated. This situation echoes the economic phenomenon known as the Phillips Curve, developed by New Zealand economist William Phillips in 1958, which relates unemployment to inflation.

As the UK navigates these economic waters, it's important to note that the country's economic landscape has undergone significant changes in recent years, including its departure from the European Union in 2020 after joining in 1973.

Upcoming official data releases will provide further insights into the UK's economic situation. Figures due on August 13, 2024, will reveal pay growth for the second quarter of 2024. Additionally, data expected on August 14 is likely to show inflation rising above the 2% target as the impact of lower energy prices diminishes. These releases will be crucial in understanding the evolving economic landscape and potential future actions by the Bank of England.