UK Home Prices Set to Rise, Affordability to Improve for First-Time Buyers

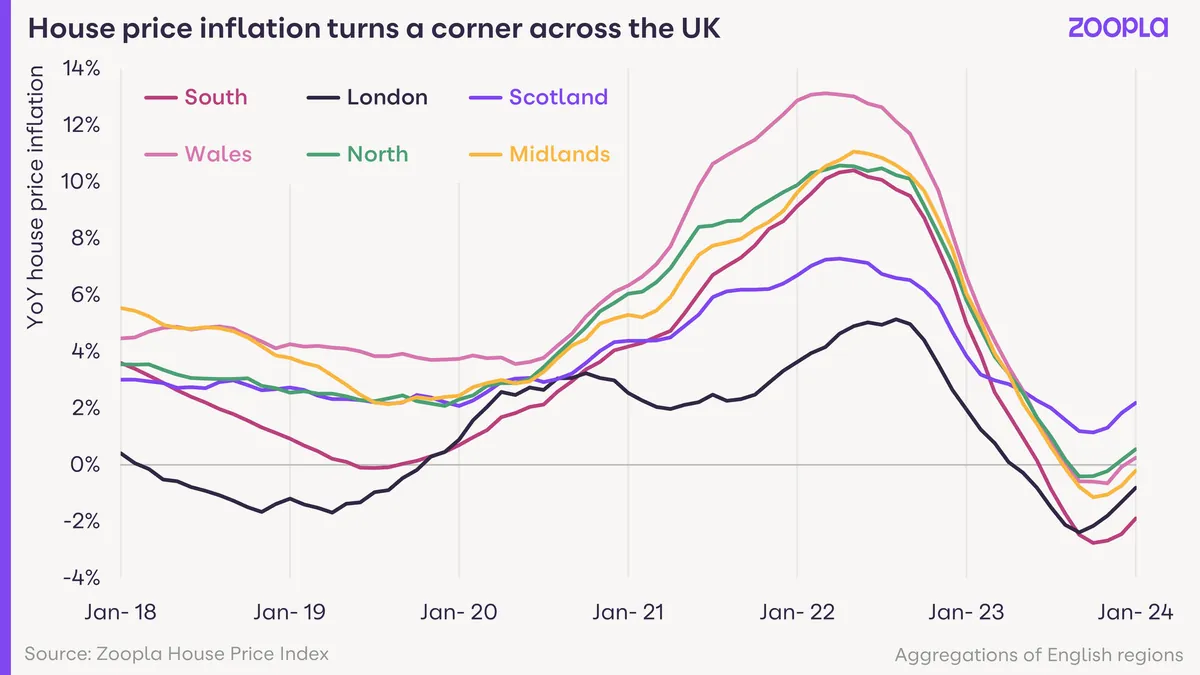

British home prices expected to outpace inflation in next two years. Lower interest rates likely to enhance affordability for first-time buyers, despite challenges in the rental market.

According to a recent Reuters poll of housing market experts, British home prices are projected to experience solid gains over the next two years, surpassing overall inflation rates. The survey, conducted between August 19 and September 3, 2024, involved 21 analysts and revealed optimistic forecasts for the UK property market.

The poll predicts that home values will increase by 2.5% in 2024, followed by a 3.0% rise in 2025 and a 4.0% growth in 2026. These projections remain largely unchanged from a previous survey conducted in May. In comparison, consumer inflation is expected to reach 2.3% in 2025 and 2.0% in 2026, based on a separate Reuters poll.

Mike Scott, an expert from estate agency Yopa, suggests that a modest surge in prices is likely to occur next year as interest rates decrease. This sentiment is echoed by Aneisha Beveridge from Hamptons estate agency, who notes that the fall in mortgage rates has provided a small boost to the housing market and appears to have set a firm floor under future price falls.

The Bank of England, established in 1694 and serving as the UK's central bank, has been adjusting its monetary policy in response to economic conditions. After raising borrowing costs sharply following the COVID-19 pandemic to combat inflation, the central bank reduced its Bank Rate last month. Experts anticipate another rate cut before the end of 2024, with the Bank Rate expected to reach 3.75% by the end of 2025, down from the current 5.00%.

Despite the positive outlook for home prices, first-time buyers face challenges in the rental market. Rents are projected to rise by 6.0% in the coming year, outpacing home price growth. This rapid increase in rental costs is making it more difficult for potential homeowners to save for deposits while managing higher living expenses.

However, there is a silver lining for those aspiring to enter the property market. Fifteen out of 17 respondents to an additional survey question believe that affordability for first-time buyers will improve as interest rates fall. Russell Quirk from estate agency Emoov explains that with wages continuing to increase above the rate of inflation and the Bank of England reducing rates further, affordability is logically improving.

It's worth noting that the average age of a first-time buyer in the UK has increased from 31 in 2007 to 34 in 2024, reflecting the growing challenges in entering the property market. The UK government has implemented various initiatives, such as Help to Buy schemes introduced in 2013, to assist first-time buyers in overcoming these hurdles.

London's property market, long considered a safe haven for foreign investors, is also expected to see growth. Valuations in the capital are forecast to increase by 1.8% in 2024, 3.2% in 2025, and 3.5% in 2026. Tony Williams from advisory firm Building Value comments on London's resurgence, stating:

"As for London, it is 'back' and given a world on fire, the UK capital is also a more and more popular safe haven."

The UK government, led by Prime Minister Keir Starmer, is taking steps to address challenges in both the housing and rental markets. Plans include a Renters' Rights Bill aimed at protecting tenants from arbitrary evictions and discrimination. Additionally, the government has set an ambitious target of building 1.5 million homes during the current parliamentary term to boost the supply of affordable properties.

As the UK housing market continues to evolve, potential buyers and renters alike will need to navigate the changing landscape of prices, interest rates, and government policies in the coming years.