UK Housing Market Shows Mixed Signals Amid Economic Uncertainty

British house prices continue to rise, but at a slower pace. London sees a slight decline while private rents surge. Economic indicators influence Bank of England's interest rate decision.

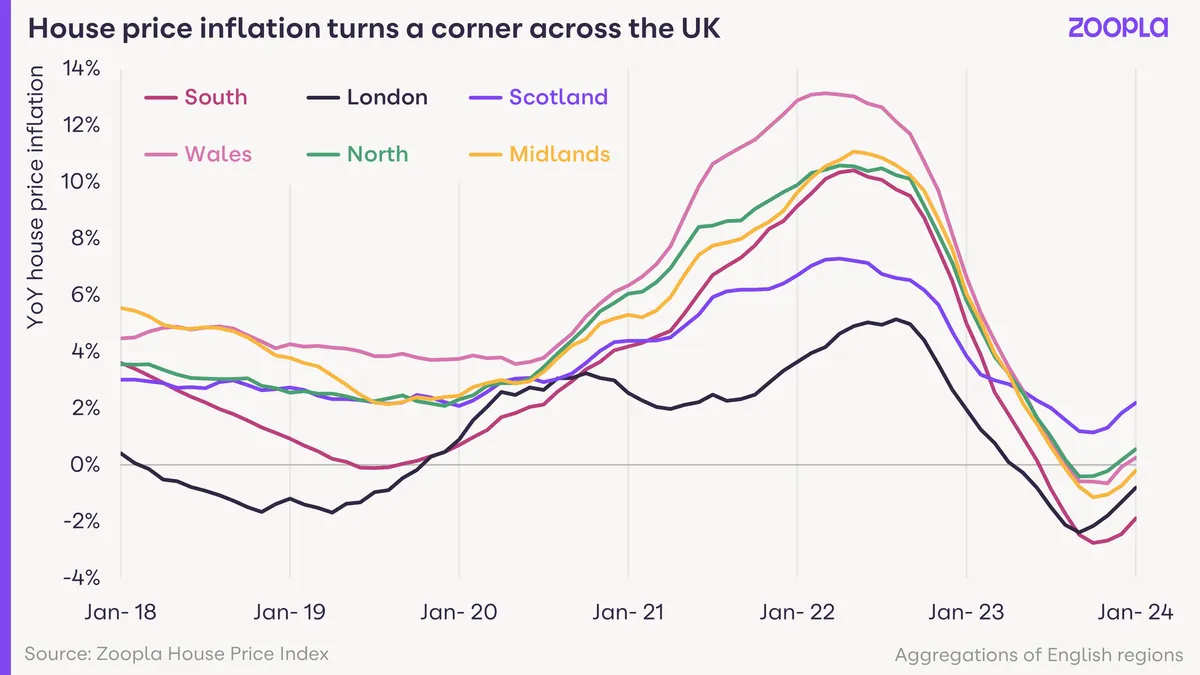

The Office for National Statistics (ONS) has released its latest report on the UK housing market, revealing a complex picture of growth and challenges. As of July 2024, British house prices have experienced their fifth consecutive monthly increase, with an annual rise of 2.2%. This figure, however, represents a deceleration from the revised 2.7% growth observed in June 2024.

Notably, London bucked the national trend, recording a 0.4% decrease in house prices. This divergence highlights the unique dynamics of the capital's property market, which often operates independently from the rest of the country due to its global city status.

The report comes at a time of economic uncertainty, with the Bank of England facing a crucial decision on interest rates. Recent data showing no change in consumer price inflation has led investors to reassess their expectations of an imminent rate cut. The Bank's Monetary Policy Committee, tasked with maintaining a 2% inflation target, will announce its decision on September 19, 2024.

Despite the slowing pace of house price growth, other indicators suggest a recovery in the property sector. This improvement is attributed to reduced borrowing costs, which have stimulated demand. The UK housing market's cyclical nature, characterized by periods of boom and bust, continues to be evident in these fluctuations.

While homeowners may be experiencing a moderation in price appreciation, renters face a different reality. The ONS report indicates that private rents surged by 8.4% in the year to August 2024, significantly outpacing house price growth. This substantial increase in rental costs reflects the growing importance of the private rental sector, which has expanded considerably over the past two decades.

The current state of the UK housing market is influenced by various factors, including:

- The lingering effects of the COVID-19 pandemic

- Shifts in work patterns favoring remote arrangements

- Ongoing housing supply shortages

- The aftermath of Brexit

- Government initiatives aimed at assisting first-time buyers

As the UK navigates these complex economic waters, the housing market remains a critical indicator of the nation's financial health and a key concern for policymakers and citizens alike.

"The Monetary Policy Committee will carefully consider all economic indicators, including the housing market data, in our deliberations on interest rates. Our primary focus remains on maintaining price stability while supporting the economy."

The coming months will be crucial in determining whether the current trends in the UK housing market represent a temporary fluctuation or a more significant shift in the long-term landscape of property ownership and rental in Britain.