U.S. Job Growth Revised Down, Reinforcing Fed's Rate Cut Plans

U.S. job growth from April 2023 to March 2024 was revised down by 818,000 jobs. This adjustment, along with recent employment trends, supports the Federal Reserve's intention to reduce interest rates.

The U.S. Department of Labor has released revised employment figures, indicating a significant downward adjustment in job growth. From April 2023 to March 2024, the economy added 818,000 fewer jobs than initially reported. This revision provides further evidence of a decelerating job market and likely supports the Federal Reserve's plans to initiate interest rate reductions.

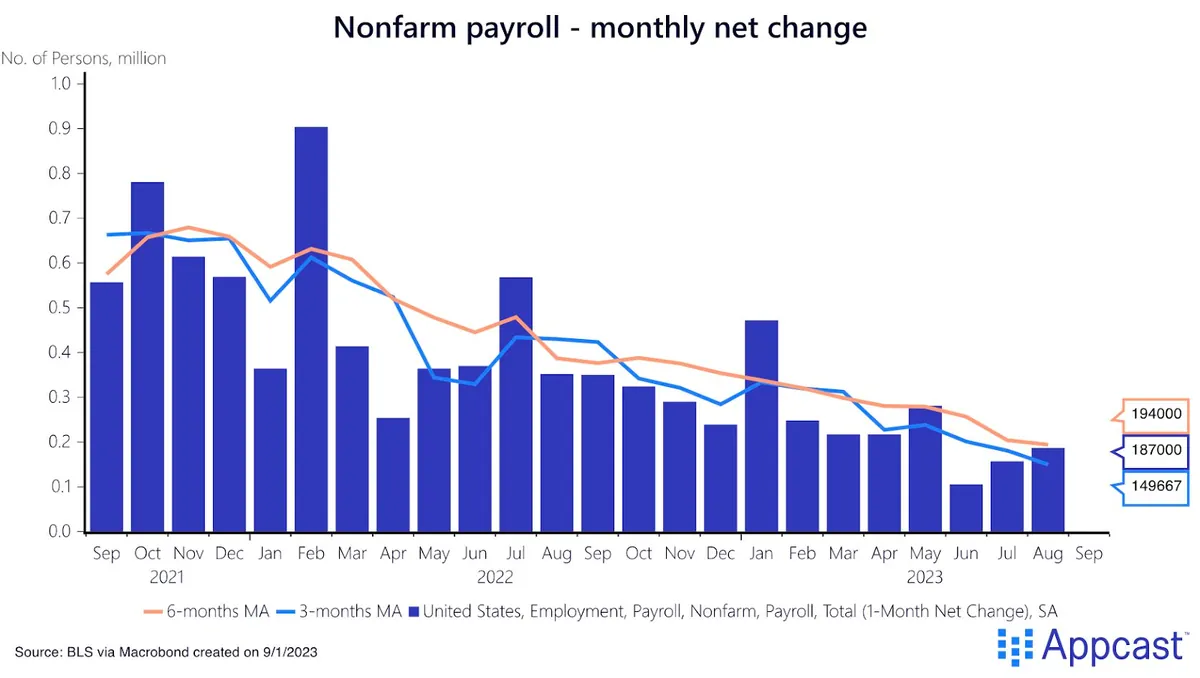

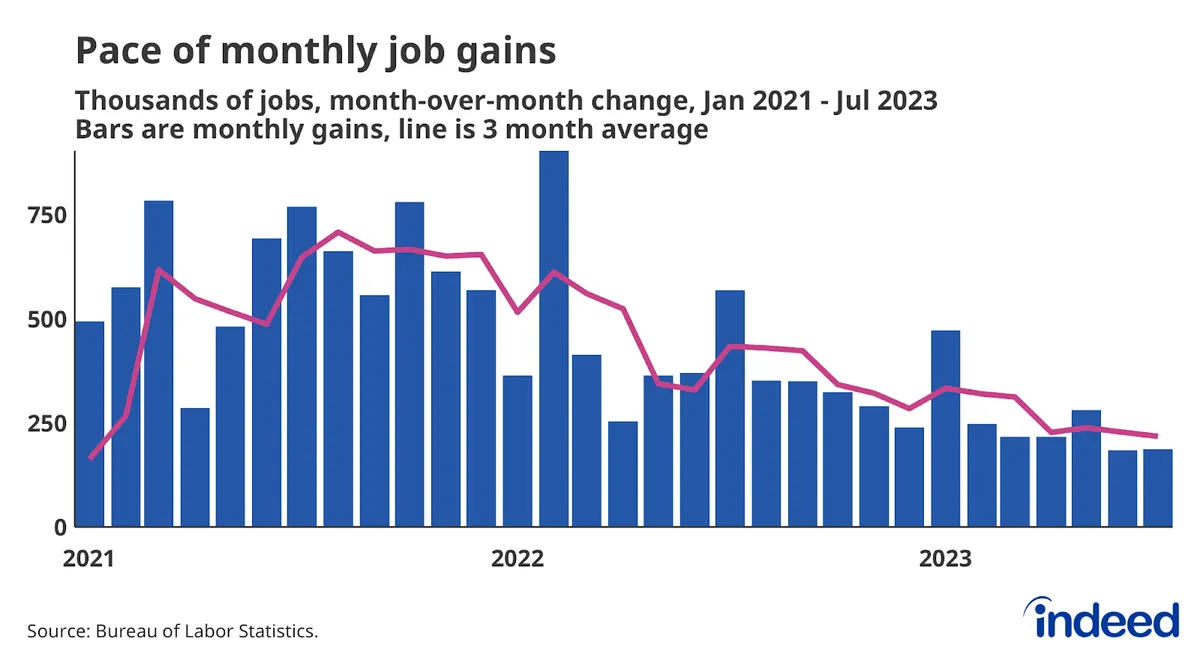

The updated data reveals that average monthly job growth during this period was 174,000, a substantial decrease from the originally reported 242,000. This adjustment represents a monthly difference of 68,000 jobs. It's important to note that these figures are preliminary, with final numbers scheduled for release in February 2025.

The U.S. Bureau of Labor Statistics, responsible for collecting and analyzing employment data, also reported disappointing figures for July 2024. The unemployment rate increased for the fourth consecutive month, reaching 4.3%, while only 114,000 new jobs were added. This recent trend has led many economists to suggest that the Federal Reserve may have delayed too long in implementing interest rate reductions to support economic growth.

"This doesn't challenge the idea we're still in an expansion, but it does signal we should expect monthly job growth to be more muted and put extra pressure on the Fed to cut rates."

The Federal Reserve, tasked with the dual mandate of maximum employment and price stability, had previously raised its benchmark rate 11 times between 2022 and 2023 to combat inflation. This aggressive approach was in response to inflation reaching a four-decade high of 9.1% in June 2022. Since then, year-over-year inflation has significantly decreased to 2.9%, potentially paving the way for the Fed to begin reducing rates as early as mid-September 2024.

The revised hiring estimates aim to provide a more accurate representation of job market dynamics by accounting for business creation and closures. Notably, the professional and business services sector experienced a reduction of 358,000 jobs in the 12 months ending March 2024. Similarly, the leisure and hospitality industry added 150,000 fewer jobs than initially reported.

These revisions highlight the complexities of measuring employment in a rapidly evolving economy. The gig economy and remote work have significantly impacted traditional employment metrics, making it challenging to capture the full picture of the job market. Additionally, technological advancements and automation have led to structural changes, affecting job creation and destruction rates across various industries and regions.

As the U.S. economy navigates these changes, policymakers and analysts will closely monitor employment trends. The concept of "full employment" doesn't imply zero unemployment but rather a low and stable rate, typically considered to be around 4-5% in the U.S. The current situation, with unemployment at 4.3%, suggests that the labor market remains relatively tight despite the slowdown in job growth.

The Federal Reserve's upcoming decisions on interest rates will be crucial in balancing economic growth and inflation control. The Federal Funds Rate, the Fed's primary tool for influencing monetary policy, will likely be adjusted downward if current trends persist. This approach aims to stimulate economic activity and maintain the delicate balance between employment and price stability.