Asian Markets Mixed as Investors Eye U.S. Labor Report

Asian stock markets show varied performance ahead of U.S. Labor Day. Investors anticipate crucial employment data, while Japan's economy signals recovery amidst global economic shifts.

As the United States prepares for its Labor Day holiday on September 4, 2024, Asian stock markets displayed mixed performance in cautious trading. Investors are keenly awaiting the U.S. employment report, scheduled for release on September 6, 2024, which is expected to provide insights into the strength of the American economy.

Japan's Nikkei 225, a key stock market index for the Tokyo Stock Exchange, saw a 0.4% increase in morning trading. This uptick follows a recent report from the Finance Ministry indicating a 7.4% year-on-year rise in capital spending by Japanese companies during the April-June quarter of 2024. After a period of economic stagnation, Japan's economy, the third-largest globally by nominal GDP, is showing signs of recovery. The country is set to release revised gross domestic product (GDP) data in the week of September 9, 2024, which may provide further evidence of economic growth.

In contrast, other Asian markets showed varied results. Australia's S&P/ASX 200 declined by 0.3%, while South Korea's Kospi saw a marginal gain of nearly 0.1%. Hong Kong's Hang Seng Index, a capitalization-weighted index of selected companies from the Hong Kong Stock Exchange, experienced a more significant drop of 1.3%. The Shanghai Composite Index, representing stocks traded on the Shanghai Stock Exchange, dipped by 0.5%.

China's economic outlook faced some pessimism as its National Bureau of Statistics reported a decline in the August manufacturing Purchasing Managers' Index (PMI), an indicator of economic health for the manufacturing sector. The PMI fell from 49.4 to 49.1, falling short of market expectations and suggesting weaker growth prospects for the world's second-largest economy.

Meanwhile, Wall Street concluded the previous week on a positive note. The S&P 500, a stock market index tracking 500 large U.S. companies, rose by 1% during the week ending August 30, 2024, with 76% of its constituents recording gains. The index finished August 2024 with a 2.3% monthly increase, bringing its year-to-date growth to 18.4%.

Recent U.S. economic reports have been encouraging. The Commerce Department's personal consumption and expenditures report for July 2024 showed a slight increase in price rises, potentially influencing the Federal Reserve's decision on interest rates. Market expectations suggest the Fed may initiate rate cuts later in September 2024, marking the first reduction in over four years.

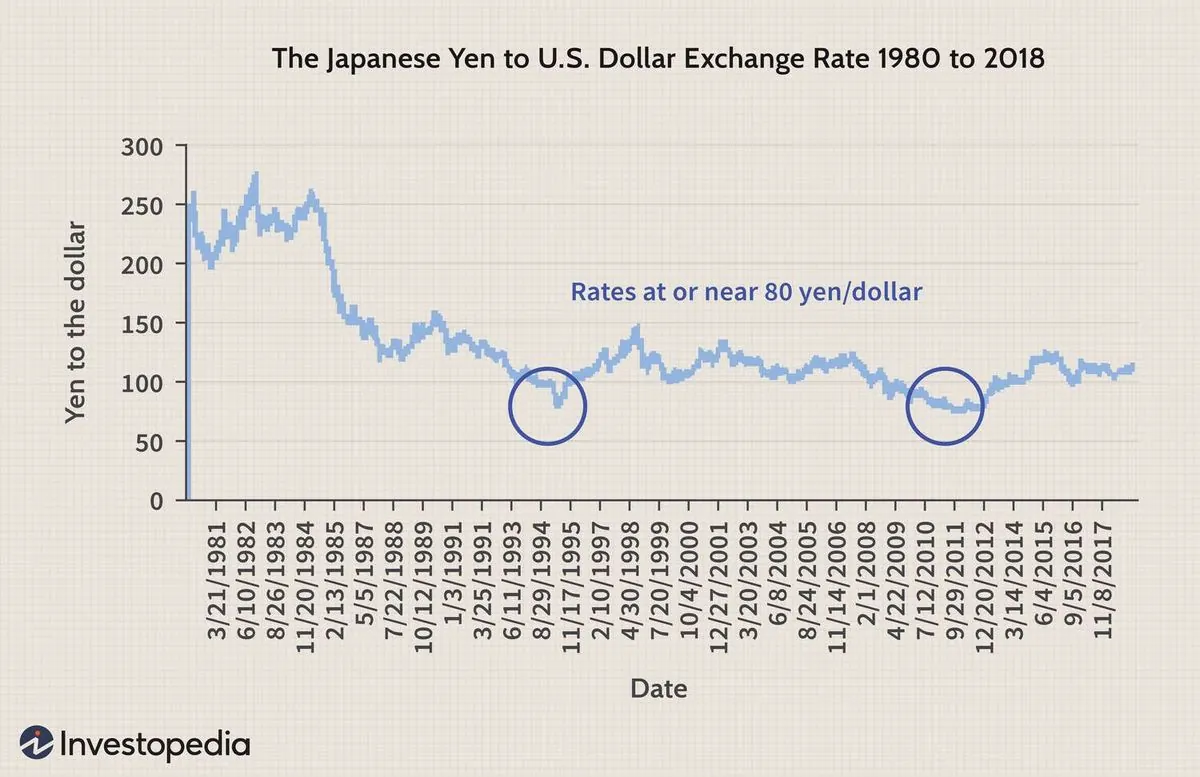

In the energy market, benchmark U.S. crude and Brent crude, a major trading classification of sweet light crude oil, both experienced slight declines. Currency trading saw minimal movement in the U.S. dollar against the Japanese yen, while the euro showed a marginal increase.

As global markets continue to navigate economic uncertainties, investors remain focused on upcoming data releases and policy decisions that could shape financial landscapes in the coming months.