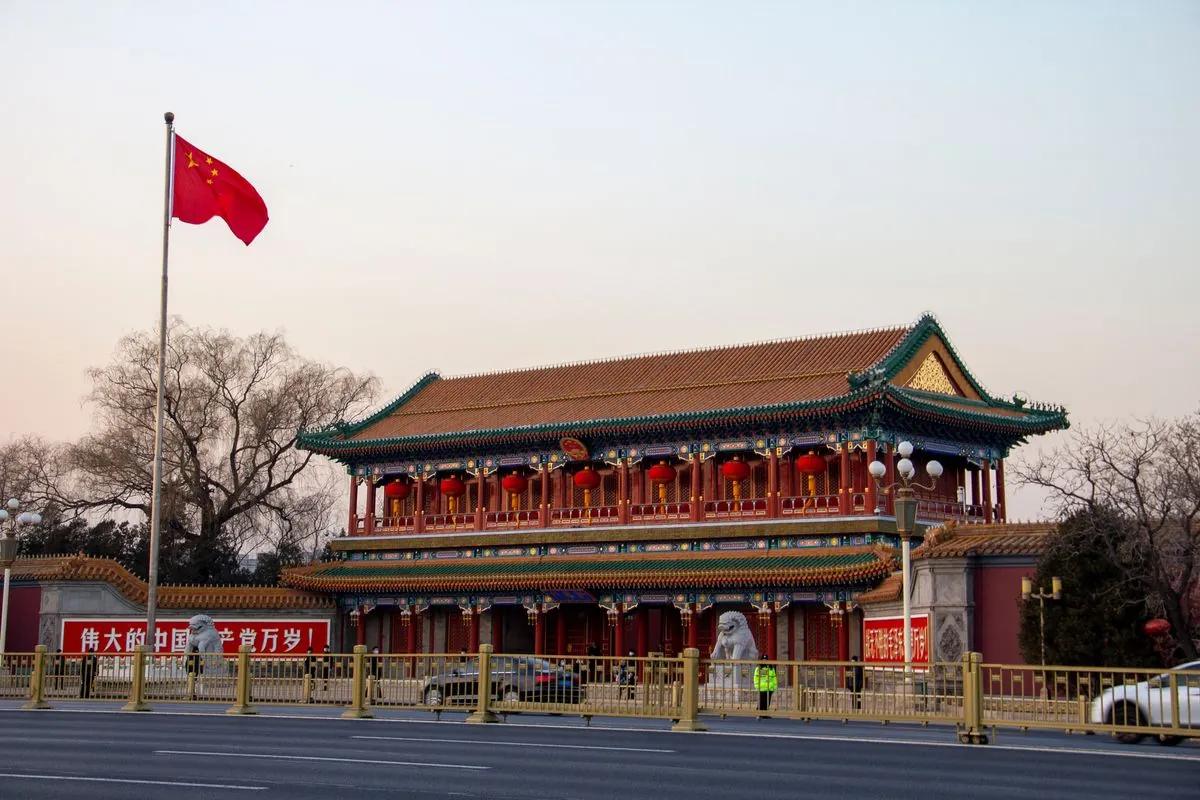

China launches trillion-yuan plan to handle local debt - what's next for economy?

Chinaʼs top lawmakers green-lit a massive bond program to tackle hidden local debt over next three years. The 6-trillion-yuan initiative aims to boost economic growth but market players want more

Chinas top law-making body gave a thumbs-up for a big-scale debt-swap plan‚ letting local areas swap 6 trillion yuan (around $839 billion) of off-the-books debt into bonds; the program will run for 3 years

Finance head Lan Foan hinted at more help coming up but kept quiet on specifics: this made market-watchers feel its not enough. Stock prices of China-linked firms in US markets went down‚ while the yuan dropped to 7.17 per dollar

Unless theres more to come later this evening‚ todays fiscal announcement is another disappointment for those expecting substantial stimulus

The bond-swap idea got mixed feedback from experts. Carlos Casanova from UBP thinks its too small saying “we need about 23 trillion yuan to fix things.“ Meanwhile‚ Lynn Song at ING points out that its just the start - more support could show up next year

- Markets hoped for steps to help shoppers spend more

- Local areas need time to put new money to work

- Some think govt is saving firepower for later

- Banking stocks might do well as risks go down

Zhiwei Zhang from Pinpoint sees good signs ahead: the swap helps local areas breathe easier‚ and next years budget might bring extra support. Still everyone must wait till Decemberʼs big economic meeting to know whats really coming up