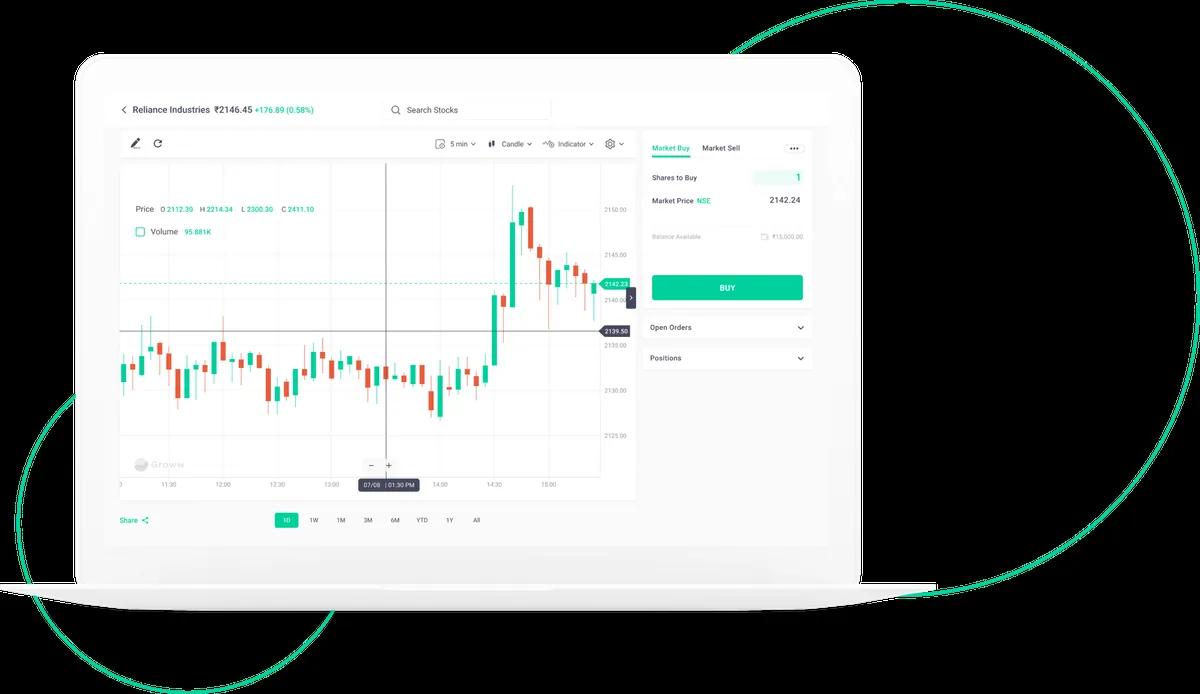

Indian investors pour record money into mutual funds despite market dip

Indian mutual funds hit all-time high with 418 billion rupees inflow last month while foreign investors exit. Local investors remain confident in market despite recent 8% drop from peak

Indian mutual-funds saw mind-blowing growth in oct-23 reaching 418.87 billion rupees (thats about $5 billion) which is 22% more than last month. This happened right when foreign money was moving out of markets

The inflows dont stop coming — its been going strong for almost 4 years now. Hitesh Thakkar from ITI Mutual Fund says people still believe in Indias growth story; they think stocks will give good returns

Strong flows across categories and asset classes were evident in October‚ with equity remaining positive across categories

The market wasnt all sunshine though: both main indexes (NSE Nifty 50 and BSE Sensex) dropped about 6% from their sept peaks. Foreign investors took out $11.2 billion which reminds us of that covid-time panic selling back in 2020

Small and mid-size company funds got more popular:

- Small-cap funds up 23%

- Mid-cap funds jumped 50%

- Theme-based funds got 122.79 billion rupees

Regular investors kept putting money through SIPs (systematic investment plans) hitting new records for 16 months straight — now at 253.23 billion rupees. Local investors seem to like buying when prices drop‚ making up for foreign selling